Key points:

- The unemployment rate rose to 5.1% in the three months to October, its highest since the height of the pandemic, while wage growth eased further.

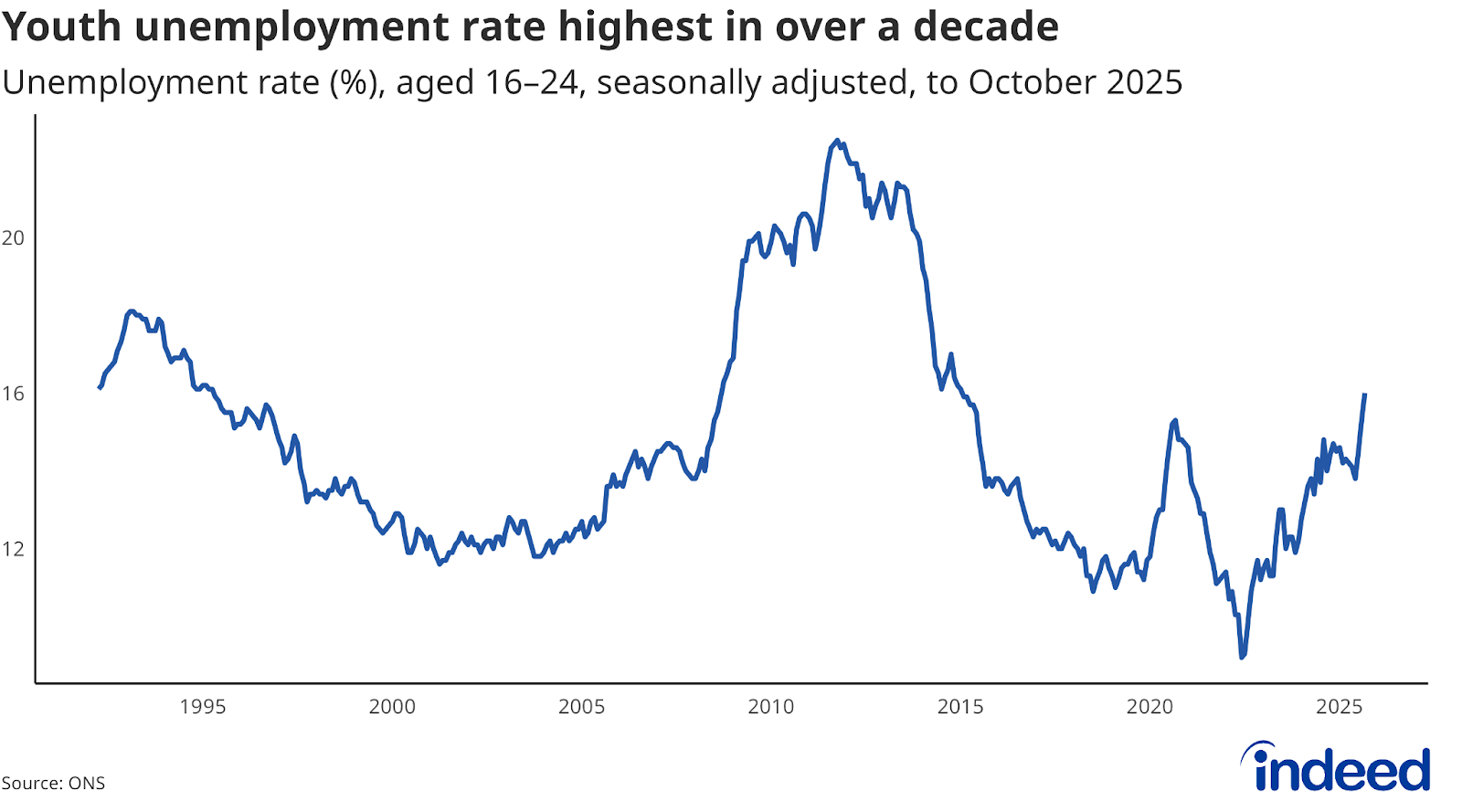

- Youth unemployment has climbed to its highest level in more than a decade, a growing concern.

The further softening in the UK labour market bolsters the case for an interest rate cut by the Bank of England on Thursday. Rising unemployment alongside weak GDP growth could tip the balance on the Bank’s Monetary Policy Committee (MPC) in favour of looser policy to support the economy. If tomorrow’s data show a further easing in inflation, as expected, the final potential stumbling block to lower rates should be cleared.

The latest ONS figures showed the unemployment rate ticking up to 5.1% in the three months to October, its highest since January 2021. Vacancies remained relatively stable, but payrolled employment continued to fall while regular wage growth eased further to 4.6% year-on-year. Regular pay growth in the private sector slowed to 3.9% year-on-year, while annual public sector pay growth rose to 7.6%, but the latter was affected by base effects as some public sector pay rises were paid earlier in 2025 than in 2024.

While some of the recent softness in hiring may reflect pre-Budget uncertainty, the stagnant growth data suggests that a more fundamental loss of momentum in the economy is weighing on employment. Looking ahead, planned increases in the minimum wage and the expansion of workers’ rights are set to be further headwinds to labour demand in 2026, particularly in lower-paid sectors where job postings are already down 9% year-on-year and trending weaker than higher-paid occupations.

Hospitality and retail, already disproportionately affected by last year’s rise in employer National Insurance contributions, have seen hiring capacity eroded. These sectors traditionally provide key entry points for younger workers, and their weakening outlook raises growing concerns about rising youth unemployment. The rate of unemployment among 16-24-year-olds was 16% in the three months to October, its highest level since January 2015.