Key Points:

- The UK labour market weakened at the tail end of 2025 and looks to remain soft heading into 2026.

- Employers continue to be cautious, with job postings 19% below pre-pandemic levels, though hiring demand has been stable recently.

- Wage growth remains robust but is gradually easing from peaks.

- Salary transparency has dipped in the past few months, partially reversing the growth seen in recent years.

- Employers have started trimming advertised benefits – a possible reflection of the cost pressures they face.

- Hybrid work offerings remain high as flexibility continues to be widely valued, but employers are specifying stricter in-office requirements.

- Foreign interest in UK jobs has softened amid tighter immigration rules; it remains concentrated in high-paid occupations.

- AI adoption continues to rise – the UK leads peer countries with 5.6% of postings nationwide mentioning AI or related tools.

The UK economy had a fast start to 2025, but momentum waned as the year progressed. GDP growth slowed from 0.7% in the first quarter to 0.3% in Q2, and a mere 0.1% in Q3. Over 2025 as a whole, the UK economy is expected to have grown by around 1.5%, with a similar expansion anticipated in 2026.

Hiring headwinds have been considerable, partly reflecting tax changes announced in late 2024, which included a significant rise in employers’ social security contributions and a further large increase in the minimum wage. Uncertainty around provisions in the government’s workers’ rights bill and global factors, including tariff volatility, have tended to reinforce the mood of employer caution. With the Chancellor announcing further tax rises in this year’s Budget and a planned 4.1% rise in the main rate of the minimum wage (with larger increases for younger workers), headwinds look set to continue.

The labour market has been steadily weakening against this backdrop, though job losses have remained modest to date. The unemployment rate has edged higher, reaching 5% in the third quarter, its highest level since early 2021. Vacancies have shown tentative signs of stabilisation, following a sustained decline from post-pandemic peaks over the previous three years.

Meanwhile, data quality issues affecting the Labour Force Survey mean it’s hard to be confident in what’s happening around workforce participation and economic inactivity, which continues to be a tricky blind spot for UK policymakers. At face value, the figures suggest that working-age inactivity has been declining over the past year and a half. However, alternative data sources paint a contrasting picture of rising inactivity.

As the current low-hiring, low-firing market dynamics persist, people in work are tending to hunker down while new entrants and those out of work face a tough labour market. The number of job-to-job moves during the third quarter was reported at 708,000, down almost 30% from the late-2021 post-pandemic peak, though these figures also come with question marks over accuracy.

With the emphasis shifting towards downside risks to the economy and job market, and with inflation easing, there are growing expectations that the Bank of England is set to lower interest rates further in the coming months. Bank Rate has been cut five times from a peak of 5.25% to the current 4%. Further rate reductions could help support growth in the economy and ultimately help boost hiring demand.

If the economy performs at the higher end of expectations in 2026 and employer confidence recovers, that could translate into a stabilisation or even a modest rise in vacancy levels and a moderate dip in unemployment. Conversely, a weaker economic performance coupled with continued employer wariness would likely see further declines in vacancies and rises in unemployment.

Hiring demand remains soft, but has stabilised

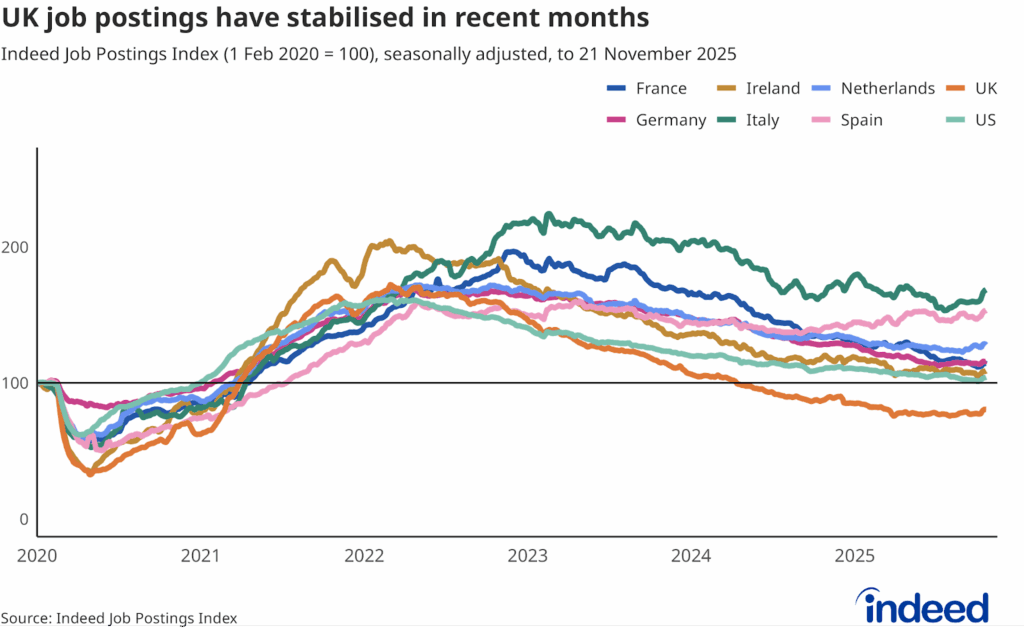

As of 21 November, the number of UK job postings on Indeed was 19% below its 1 February 2020, pre-pandemic baseline, and was down roughly 8% year-on-year. But the decline has stabilised somewhat in the second half of the year. The current level of postings is roughly on par with levels recorded in April. Postings rose 4% over the past month, one of the strongest monthly performances outside of the pandemic, led by strength in logistics-related categories, pharmacy, mechanical engineering, customer service, food preparation & service, personal care & home health and cleaning & sanitation.

The UK remains an outlier compared with peer economies in Europe and the US, where postings generally remain above pre-pandemic baselines.

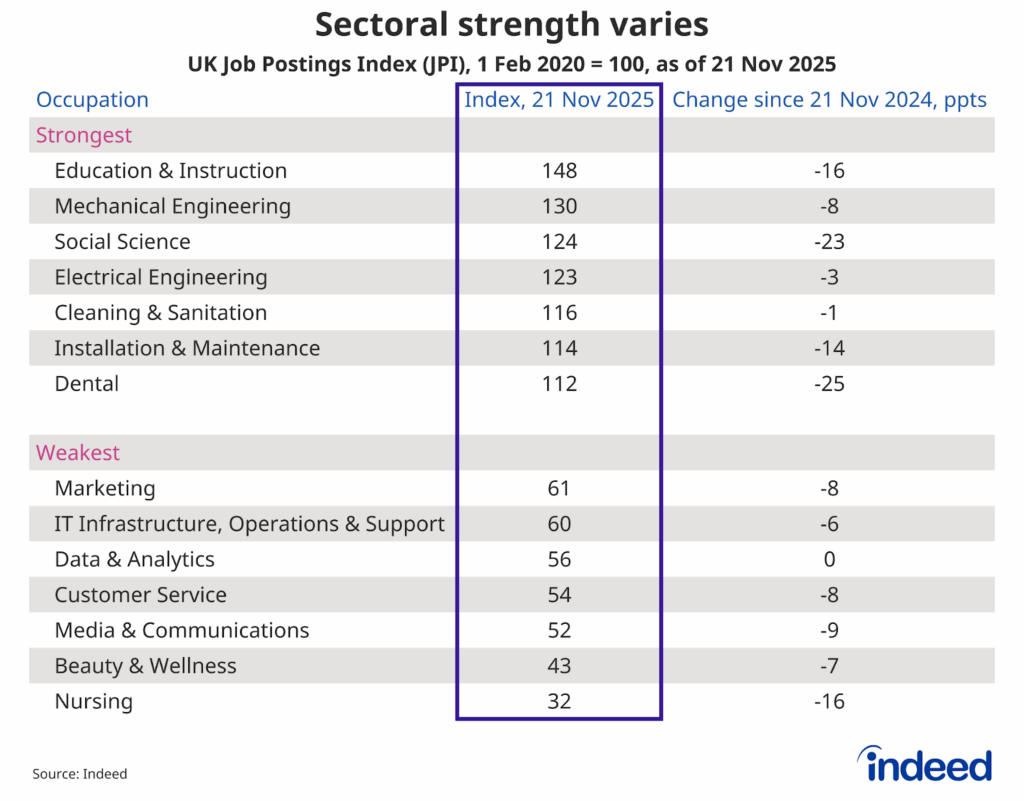

Only a handful of categories have seen growth over the past year. Those which did include loading & stocking (+20ppts), childcare (+15), logistic support (+15), civil engineering (+8), IT systems & solutions (+5), architecture (+5), software development (+5) and food preparation & service (+5).

Conversely, the biggest declines were in veterinary (-39), real estate (-30) and community & social service (-28). Dental (-25) and social science (-23) also saw postings fall, albeit from high levels, and both remain comfortably above baseline.

The occupations where postings remain most elevated compared with pre-pandemic levels are education & instruction, mechanical engineering and social science. Conversely, postings are well below the baseline in nursing, beauty & wellness and media & communications.

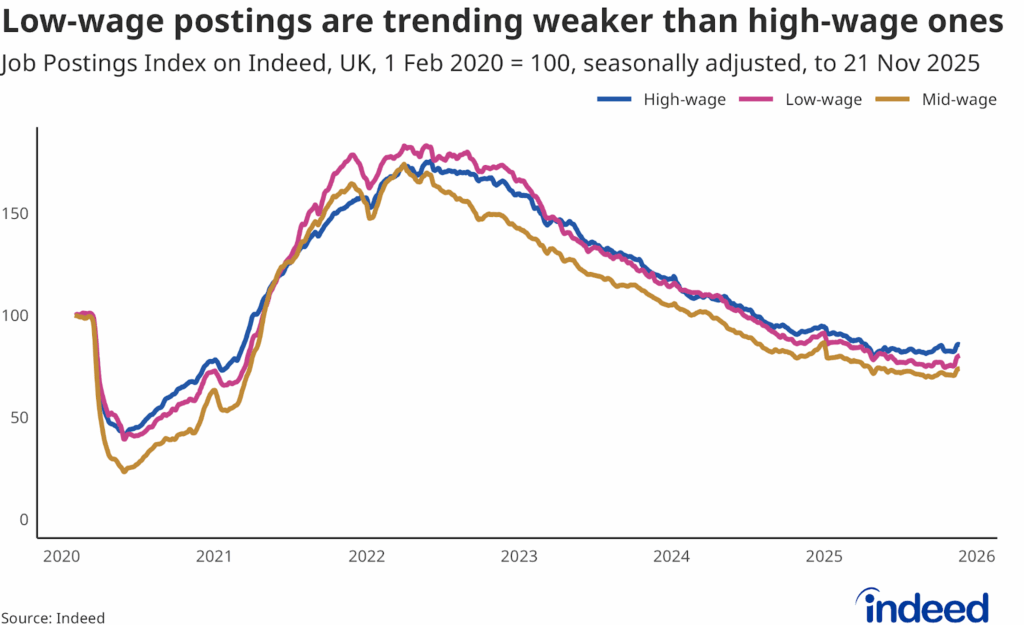

When broken down by wage tiers, job postings for low-wage occupations (-20% below baseline) are trending slightly below high-wage ones (-14%). That’s in contrast to the situation in other European countries, including Germany, France and Italy, where low-wage postings remain considerably stronger than high-wage ones.

This divergence has been partly driven by the slowdown in hiring demand in sectors including retail, hospitality and leisure, which employ large numbers of lower-wage staff and have been hit hardest by increased payroll costs and significant minimum wage increases.

Reflecting their greater exposure to weakness in professional occupations, job postings are furthest below baseline in the South East (-31%) and London (-29%). Northern Ireland (+20%) and the North East (+16%) are the only regions with postings above the baseline. All twelve UK regions saw declines in job postings over the past year.

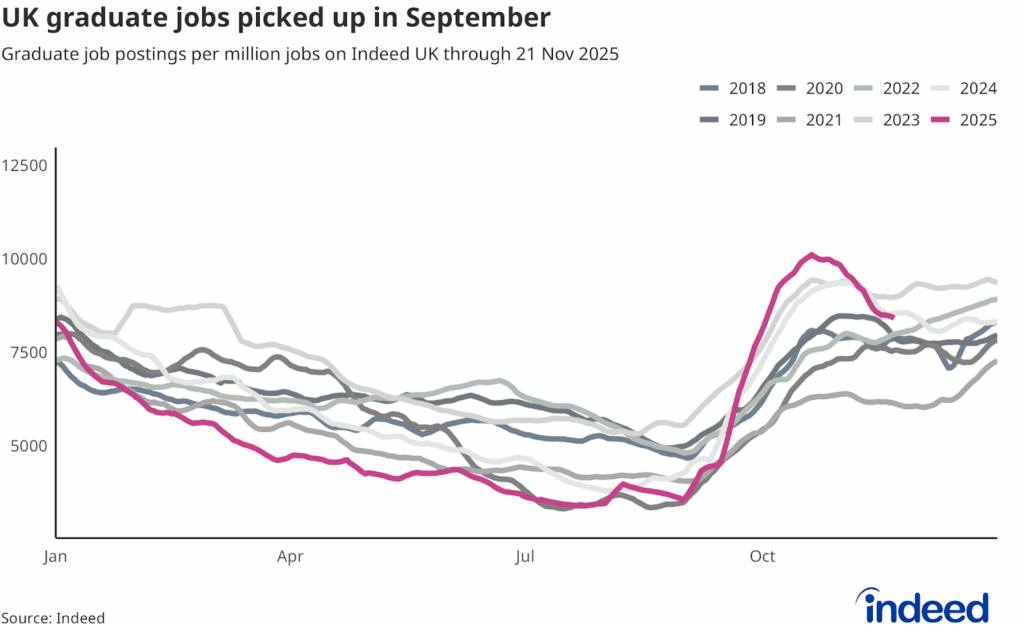

Graduates face a tough market

It remains a challenging landscape for new entrants to the labour market, including graduates, despite a decent seasonal pick-up in graduate job postings during September. As a share of overall postings, as of 21 November, graduate jobs were down 2% from the same period in 2024, though they are pacing at a reasonable level compared with prior years. In absolute terms, graduate job postings are down 13% on last year and are the lowest for this time of year since 2020.

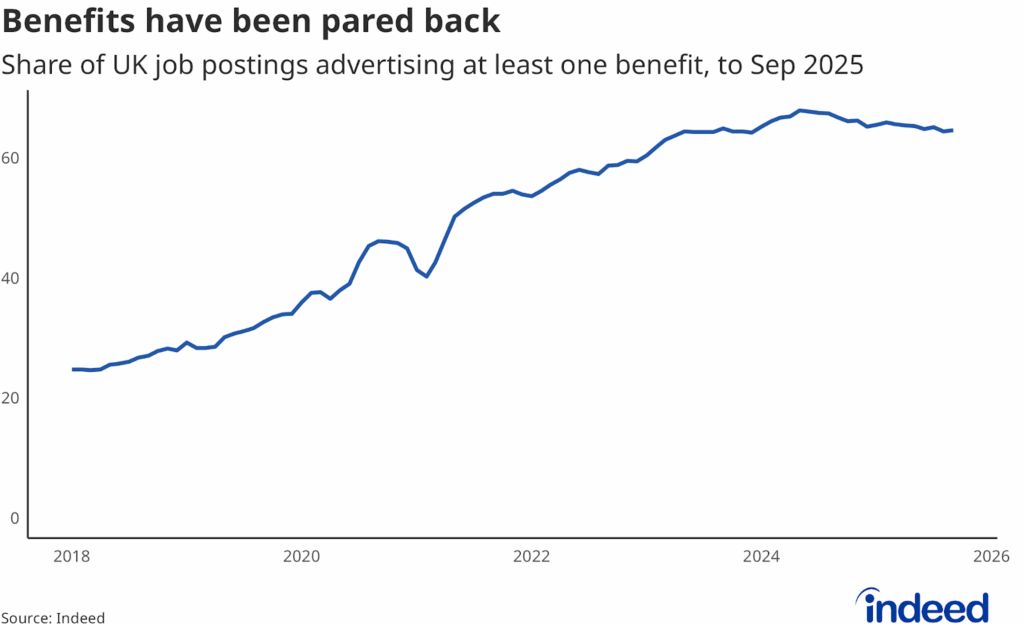

Employers have become less generous around benefits

Employers appear to have become a little less generous in their benefits offered in job postings over the past year. The share of UK job postings mentioning at least one benefit stood at 64.6% in September, down from 66.7% a year ago. That may signal that some combination of easing competition for talent and financial pressures linked to rising employment costs may have prompted some organisations to scale back their offerings. That said, the share has climbed substantially in recent years and remains high overall.

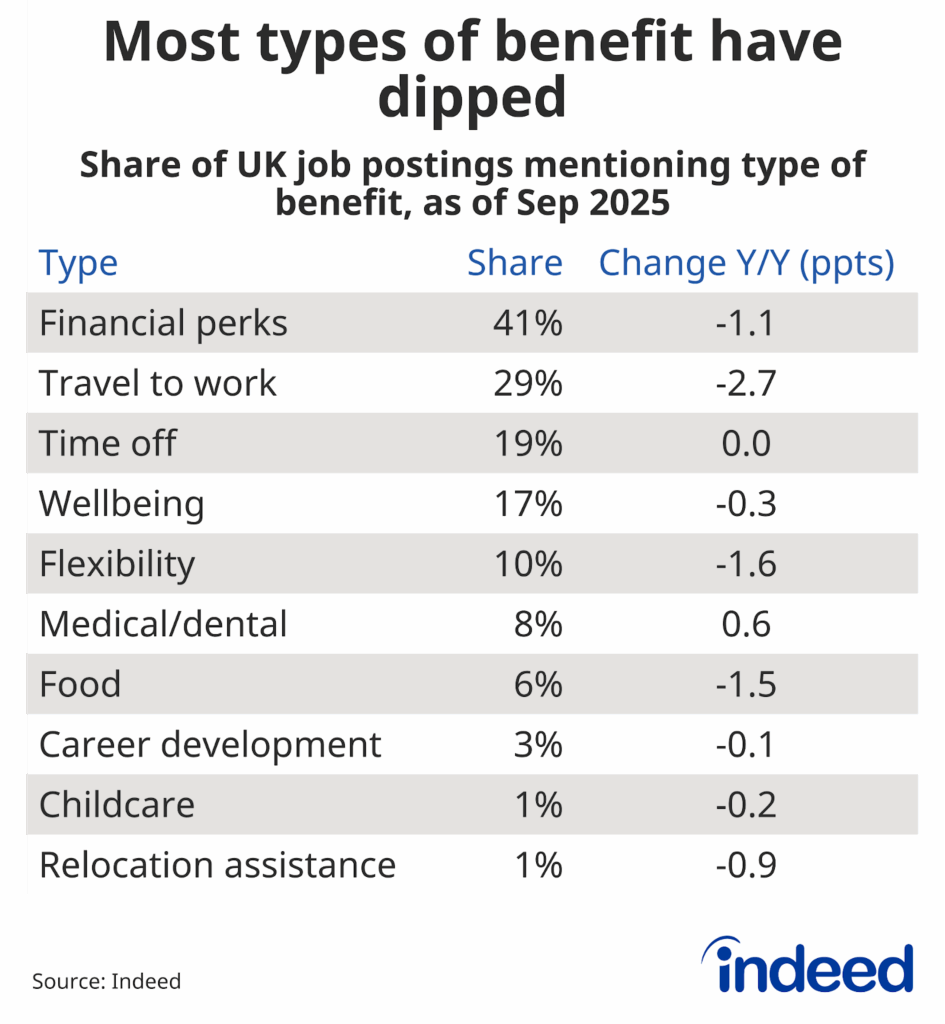

Most types of benefit have seen falls over the last twelve months. Travel to work, flexibility, food and financial perks have seen the largest percentage point declines. The only category to see an increase was medical/dental benefits.

Declines in offered benefits may not all be able to be attributed to firms tightening their belts. For example, prior to 2019, roughly 7% of UK job postings mentioned childcare benefits. That share declined sharply after the implementation of new policies at the end of 2018 ended the previous childcare vouchers scheme.

How benefit offerings evolve in 2026 will likely depend on whether the labour market picks up or remains soft, with employers assessing the pros and cons of various reward packages amid cost constraints.

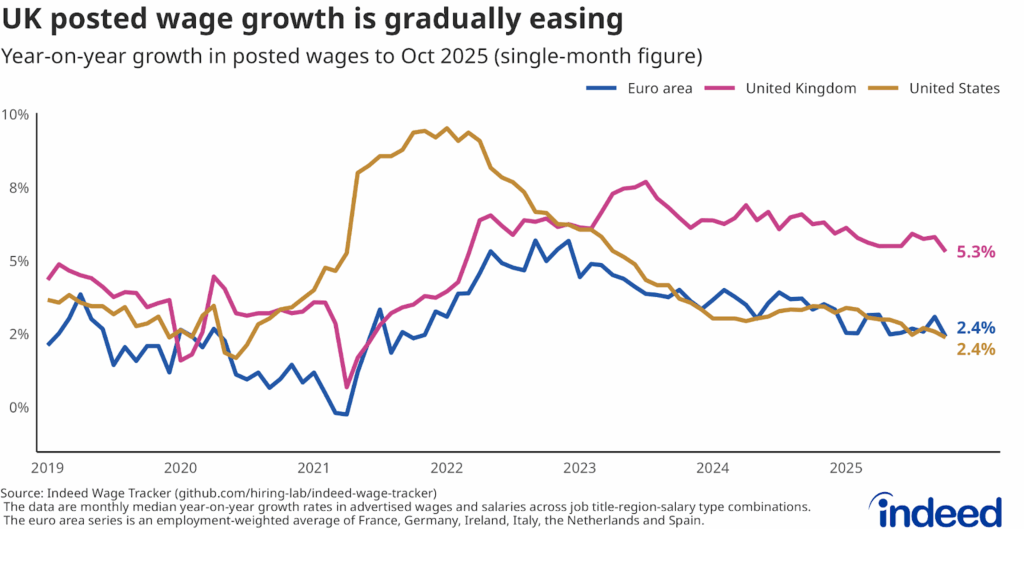

Wage growth continues to gradually cool

Posted wage growth remains robust but is gradually easing. The Indeed Wage Tracker showed that annual wage growth was 5.3% in October on the single-month measure, the lowest since March 2022. But the UK continues to record much stronger annual posted wage growth than the euro area and the US (both at 2.4%). The persistence of wage pressures has been one of the reasons why the Bank of England has remained cautious about loosening monetary policy too fast.

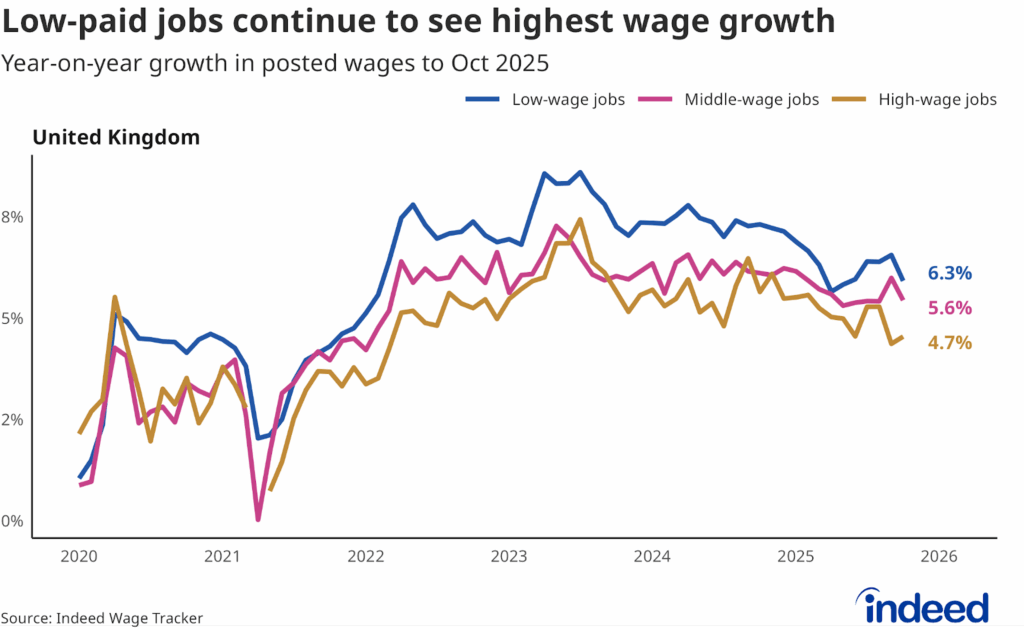

Posted wage growth remains strongest for low-paid jobs. That’s partly a reflection of substantial minimum wage increases (6.7% earlier this year, with next year’s uplift soon to be announced). Annual posted wage growth for lower-paid categories was 6.3% in October, while it was 5.6% for mid-wage occupations and 4.7% for high-wage occupations.

Annual wage growth remains robust in several low-wage categories, led by sports (7.5%), sales (6.7%) and cleaning & sanitation (6.5%). However, higher-wage categories including education & instruction, legal and software development (all 6.3%) are also seeing strong increases.

ONS figures also show easing pay growth. Annual growth of regular pay excluding bonuses was 4.6% in the three months to September. That was the lowest since April 2022, albeit remaining well above the 3% range considered consistent with the Bank of England’s 2% inflation target. The Bank (and most observers) expect wage growth to ease further in coming months, easing risks of inflation persistence and potentially paving the way for further interest rate reductions.

Workers continue to see real-terms pay gains as wage growth exceeds inflation. But that growth is slowing – the annual increase in regular real wages slowed to 0.5% in the three months to September, the slowest in more than two years.

In 2026, wage growth for the lowest-paid workers is expected to stay robust as minimum wage hikes continue – a dynamic that will boost purchasing power for these workers, but could also add to cost pressures on employers. Monetary policymakers, meanwhile, will want to see the overall pace of wage growth cool to a pace closer to the 3% range considered consistent with the 2% inflation target.

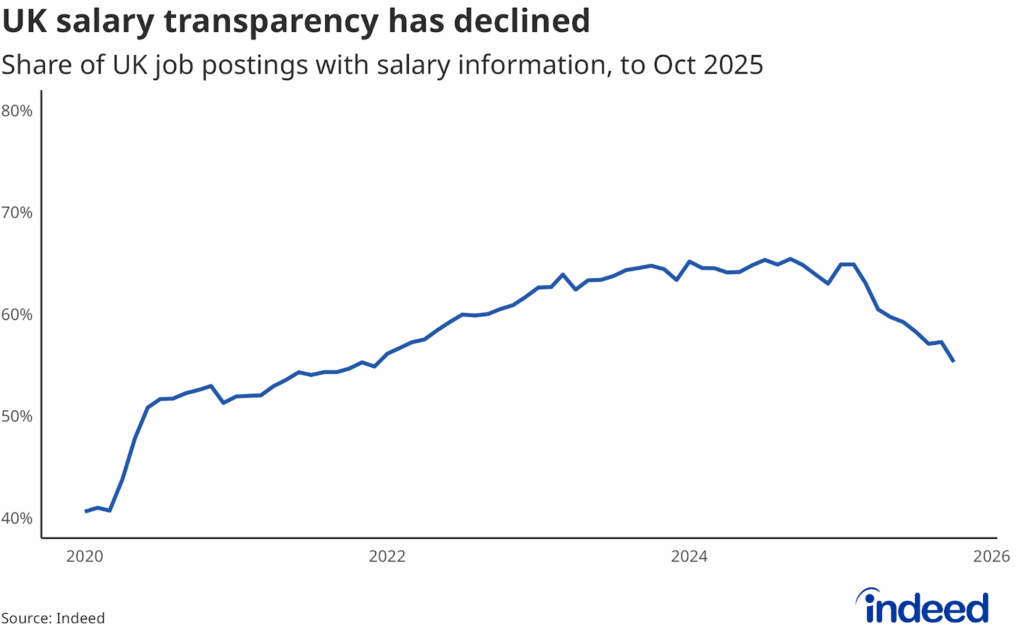

Pay transparency has declined

There has been a notable recent decline in the share of UK job postings that include pay information, which could be a response to weakening market conditions. The share of postings with salary information was 55.3% in October, down from 64.9% back in February and the lowest since December 2021. Employers may feel less need to show salary upfront in a looser labour market, or perceive their bargaining power has strengthened.

Pay transparency declined in the vast majority of occupations over the past year. The sharpest declines were in education & instruction, logistic support, sports, human resources, security & public safety, childcare, administrative assistance, food preparation & service, hospitality & tourism, insurance and IT infrastructure, operations & support.

Only a handful of categories bucked the trend, mostly healthcare-related, including physicians & surgeons, dental, veterinary and therapy.

In 2026, there could be some upward pressure on UK pay transparency as a spillover from incoming EU salary transparency legislation. While there is no corresponding UK legislation (though the government has reportedly been considering certain measures), some employers may choose to adopt a consistent approach across territories and begin incorporating the data into their UK postings.

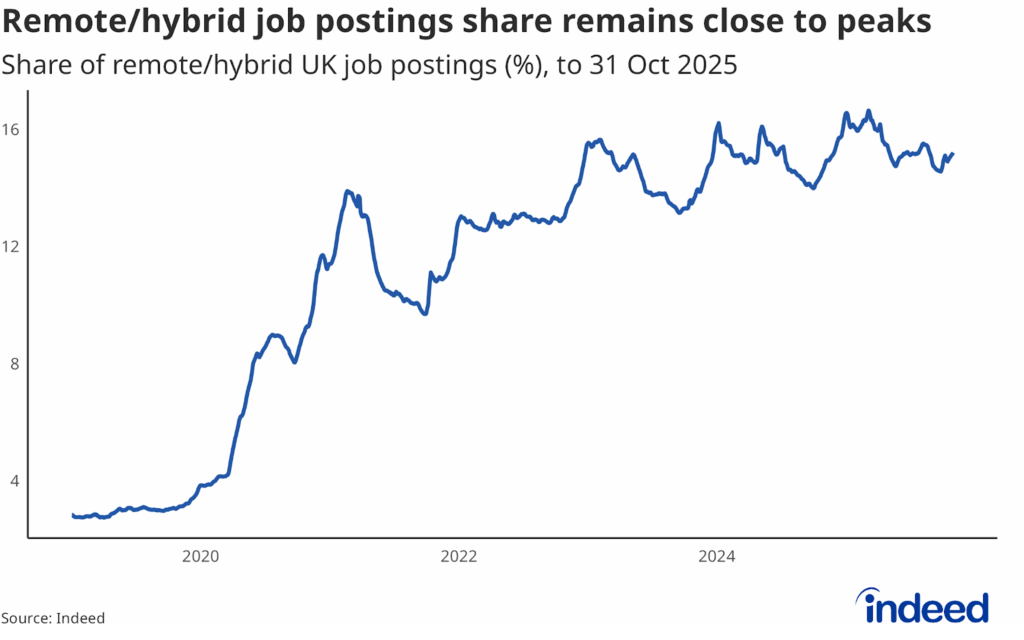

Hybrid work prevalence has held up, though its terms are tightening

The share of UK job postings mentioning remote or hybrid working arrangements was 15.2% at the end of October, close to its recent peak despite several well-publicised return-to-office announcements over the past year.

Offering location flexibility remains a powerful attraction and retention tool for organisations and continues to be highly valued by workers; searches for remote or hybrid work persist close to peaks at around 2.4% of all UK job searches.

Remote/hybrid postings shares remain particularly high in tech categories, including software development (49%). However, even in categories such as legal (44%) and banking & finance (40%), the share of remote opportunities is close to post-pandemic peaks.

While the prevalence of hybrid work looks to have settled in the post-pandemic era to a large extent, its terms have been tightening as bosses have pushed for greater office attendance and in-person collaboration. More than half (56%) of hybrid job postings specify a minimum of at least two or three days a week in the office, up from 43% two years ago. The share requiring only one day a week on-site has dropped from over one-third to just 15% over the same period.

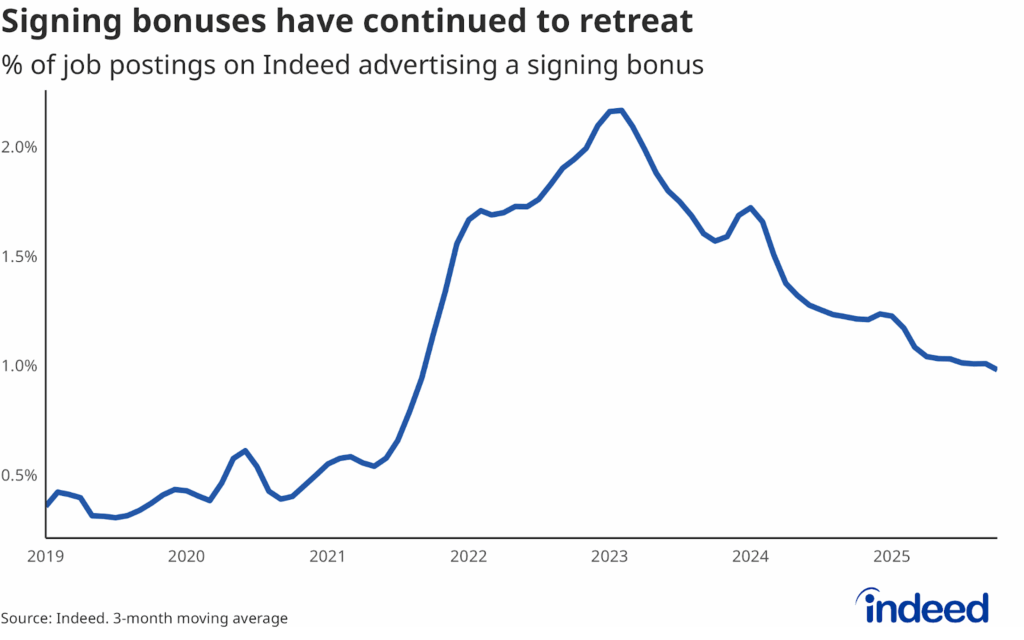

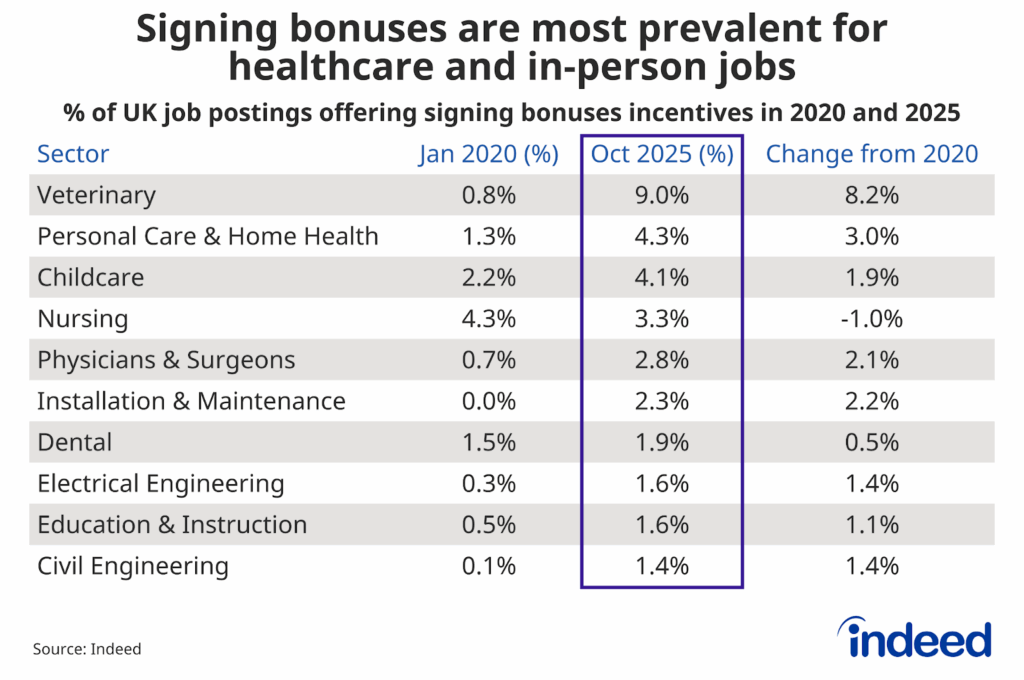

Signing bonuses have continued to become rarer

The prevalence of signing bonuses has continued to fall amid a softening job market. Around 1% of job postings offered a one-off financial incentive in the three months to October, down from a peak of 2.2% in late 2022.

Signing bonuses remain more prevalent in certain occupations, particularly in-person ones, led by veterinary, personal care & home health and childcare. Healthcare categories are also prominent. These occupations tend to be among the ones where roles are trickiest to fill, with employers continuing to use one-off financial incentives to try and tempt candidates to apply.

Foreign jobseeker interest is down from peaks amid falling net migration

Net migration to the UK dropped sharply in the year to June 2025, down 69% on a year ago from 649,000 to 204,000. That followed measures by the previous government to cut the number of work and student visas, while the current government has further tightened rules. Overall population growth continues to be almost entirely driven by net migration, with the UK’s natural population expected to decline from the 2030s.

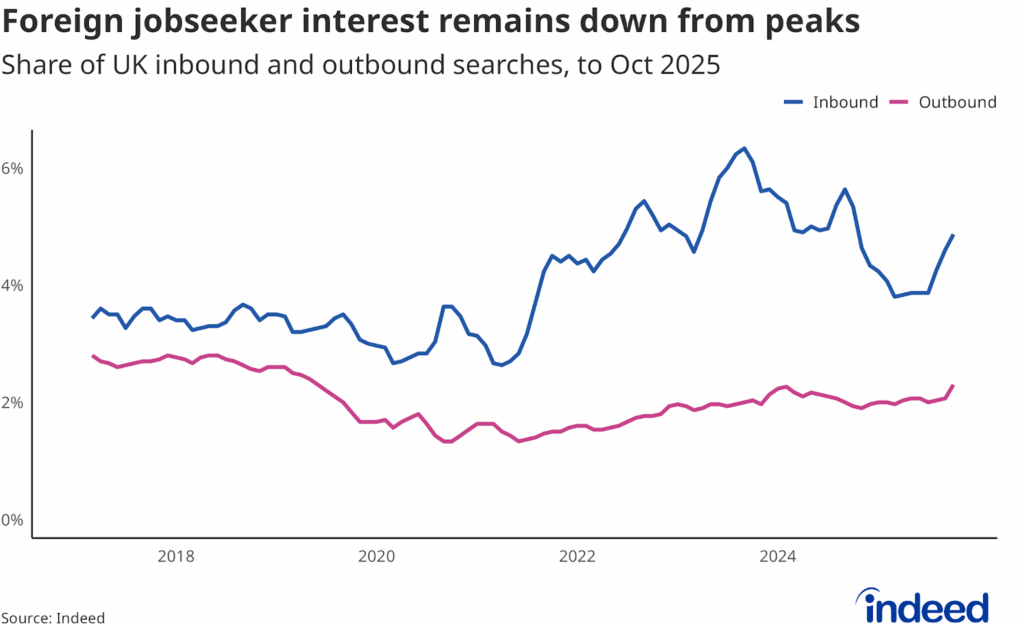

Indeed data shows that foreign interest in UK jobs rose strongly after the pandemic, but peaked in September 2023 and has been falling since. That may reflect the tighter rules around skilled worker visas as well as the cooling UK job market. The share of inbound job searches was 4.9% in the three months to October. That’s up from 3.8% back in April but remains lower than the 6.3% peak recorded in September 2023.

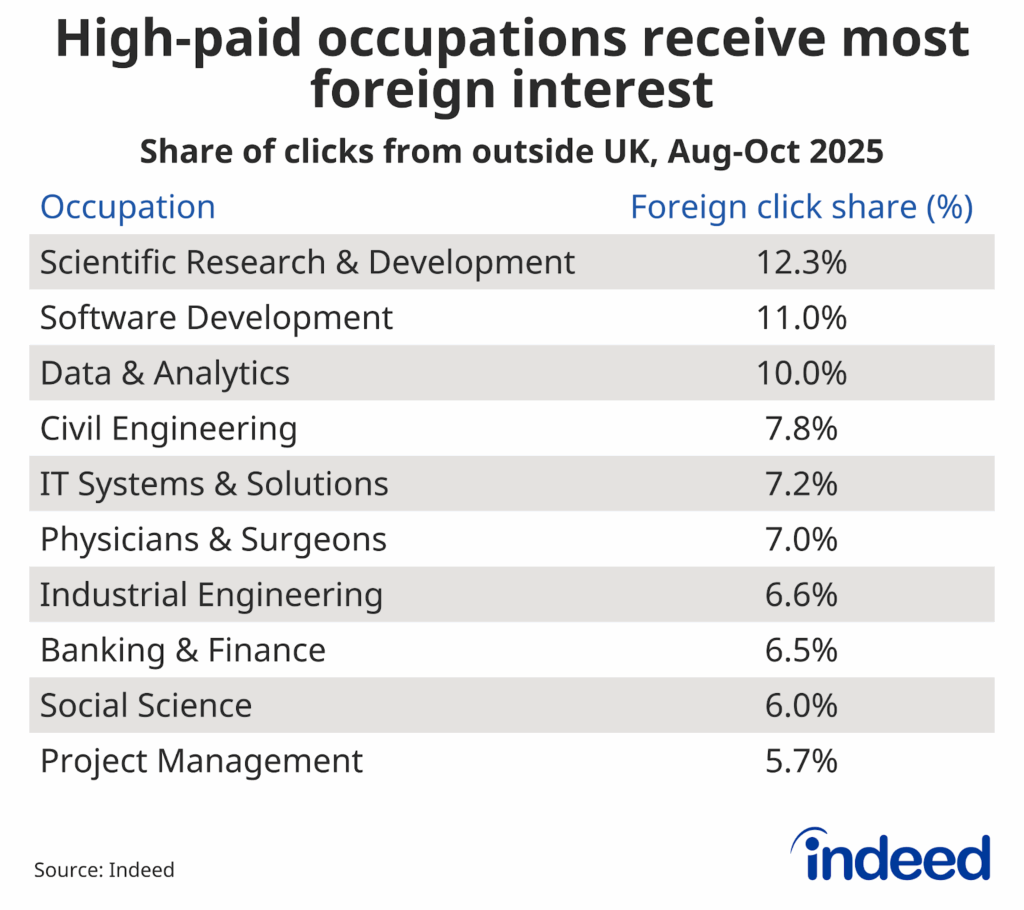

The categories attracting the highest shares of foreign interest in the three months to October were predominantly high-paid, high-skilled categories, including science, tech, engineering and healthcare occupations.

In 2026, as the general salary threshold for a skilled worker visa exceeds £41,000, these higher-paid occupations are likely to continue to represent the majority of feasible job opportunities for workers currently based outside the UK. With immigration remaining a key political focus in Britain, this situation is unlikely to change in the foreseeable future.

UK a leader in job postings mentioning AI

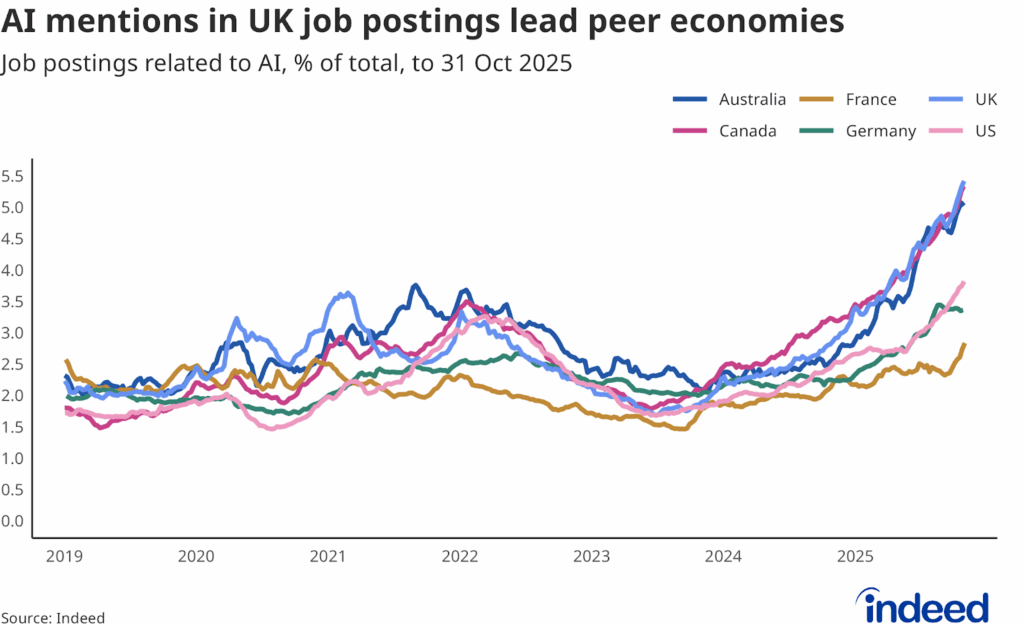

AI mentions in job postings have continued to grow, with 5.6% of UK postings overtly mentioning AI or related tools and programs as of the end of October. That’s the highest share seen to date and above that seen in peer economies including France, Germany, the US, Canada and Australia. We expect to see further strong growth in AI postings in 2026 as more organisations integrate new tools into their workstreams.

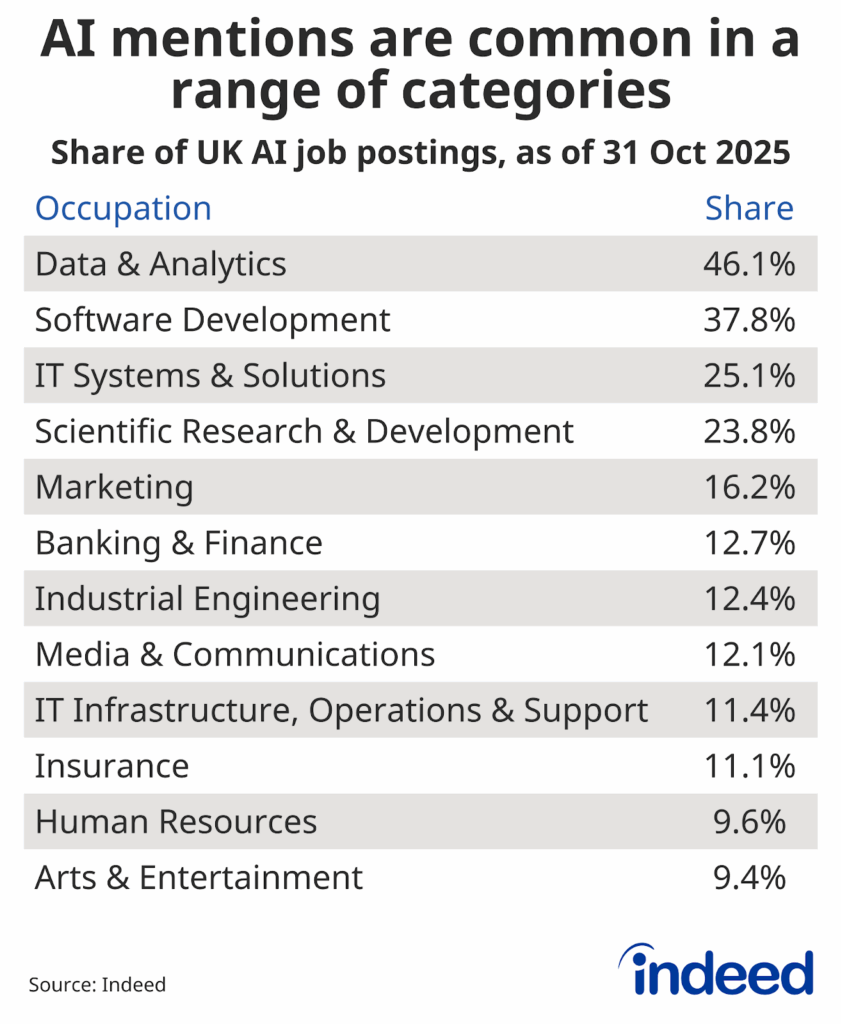

A range of tech and professional occupations have high shares of job postings which mention AI, led by data & analytics, software development and IT systems & solutions.

The rising share of AI mentions is a signal of the increasing deployment of new technologies. That said, our research in the US suggests it’s not always clear in which context employers are referring to AI in job postings, indicating that some may not be entirely clear on the use case.

Meanwhile, AI is reshaping skills requirements across occupations, with routine tasks increasingly automated, while humans retain strategic oversight and responsibility. Currently, 83% of AI-driven skill changes occur in software development and 73% in marketing. Most roles are experiencing a hybrid transformation, where AI handles repetitive work, and employees focus on decision-making, operations management, and strategic responsibilities.

Conclusion

The UK labour market has settled into a steady but subdued pattern in recent months, with hiring demand having remained weak but job losses staying modest to date. Employers continue to grapple with cost pressures and, combined with softer market conditions, that appears to be driving subtle shifts in their approach to benefits and salary transparency.

There remains little sign, though, of the labour market entering a more material downturn. The prevailing mood continues to be one of hesitancy rather than despondency, while there are pockets of the job market which are growing. What’s needed is for employers to gain confidence – perhaps post-Budget clarity will help a little, albeit there are few signs of anything game-changing on the horizon.

Methodology

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. Feb. 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021.

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for each country, month, job title, region and salary type (hourly, monthly or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.