Key points:

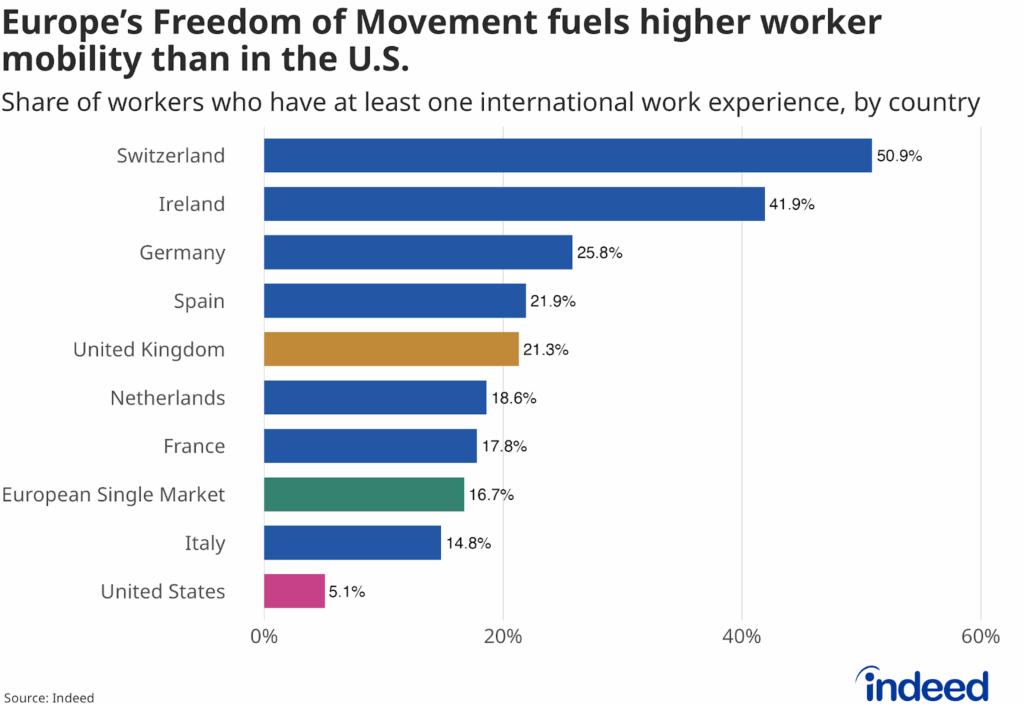

- Countries in the European Single Market consistently have more internationally mobile workers than the US; 16.7% of job seekers in the region have at least one foreign work experience, as opposed to just over 5% of job seekers in the US.

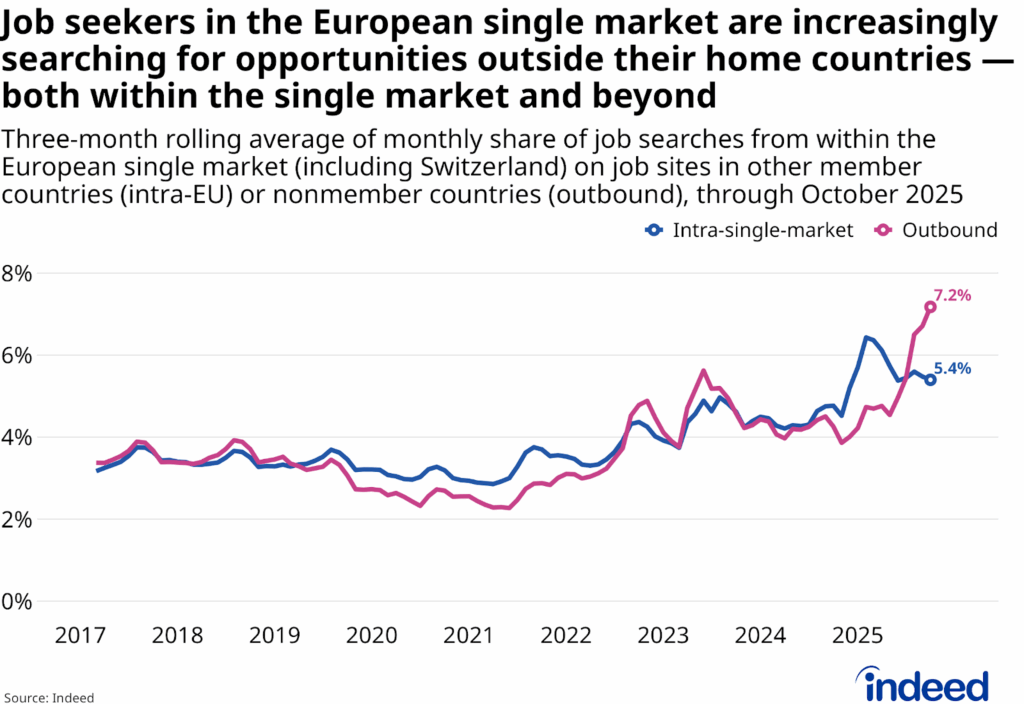

- Outbound interest in foreign jobs among residents of the European Single Market (including Switzerland) has been trending upwards.

- Cross-border mobility — which includes workers who commute to neighboring countries every day for work or telework for a company in another country — has been rising within the European Single Market.

Editor’s Note: This is the fourth installment in our global mobility series, which examines foreign job seekers’ interest globally. Here you can find Part One, Part Two, and Part Three.

Freedom of movement for workers in the European Single Market (including Switzerland) has long been a foundational element of the agreement, allowing citizens to live and work in any member state without the need for special permits or work visas. This policy has created new labor opportunities and helped fill critical shortages in several countries.

Compared to the United States, which doesn’t have similar single market agreements with any countries, workers in the European Single Market are more likely to commute to another country for work or work remotely across borders and have international work experience.

Internationally mobile workers

Workers who have at least one work experience in a country other than their current country of residence — what we call internationally mobile workers — are very prevalent in the European Single Market. While only about 5.1% of job seekers in the US had an international work experience on their resume, 16.7% of workers in the single market were internationally mobile workers as of mid-October 2025, and more than half in Switzerland had international experience.

Internationally mobile workers could include expats or migrants, i.e., workers who may have had work experience in their home countries and then relocated to another country, or local workers who had foreign stints. The high share of internationally mobile workers in Europe reflects both the policies that support mobility and the value placed on cross-border professional experience.

Jobs without borders

Cross-border workers are citizens of the countries within the European Single Market (including Switzerland) who maintain their residence within the region (not necessarily their country of citizenship) but are employed in another. This population reflects a diverse mix:

- Frontier workers who regularly commute across borders from adjacent countries.

- Seasonal or short-term mobile workers who spend part of the year in their country of employment while retaining permanent ties to their home country.

- Workers who telework for employers based in a different country.

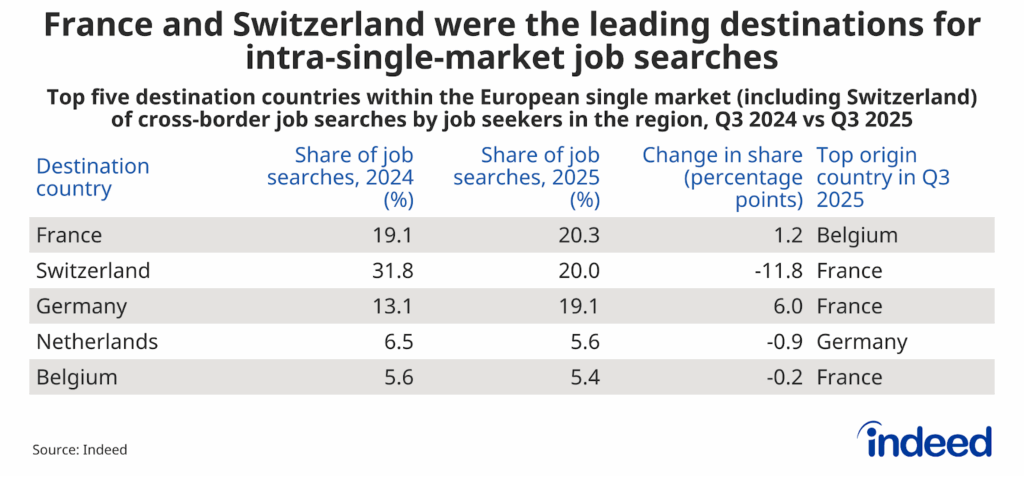

The number of cross-border workers in the European Single Market rose to 1.8 million in 2023, according to official statistics, up 3% from 2022. France, Poland, and Germany continued to be the biggest sources of cross-border workers in 2023, while Germany and Switzerland attracted the highest numbers of incoming workers. Nearly half of all cross-border workers from France head to Switzerland; 9% of Switzerland’s workforce is cross-border workers.

Furthermore, in Luxembourg, cross-border workers make up almost half (47%) of the workforce, predominantly coming from France, Germany, and Belgium. This illustrates just how central cross-border labor is to local economies like Luxembourg’s, and shows how mobility between these key countries shapes regional labor markets. In some cases, cross-border workers can earn up to double in their country of work as opposed to their country of residence.

Foreign interest

Overall, among residents of the European Single Market, job seekers’ interest in foreign jobs can be broken down into two categories:

- Intra-single-market interest: referring to job searches by workers in one member country looking at job opportunities in another member country.

- Outbound interest: which refers to searches by job seekers in member countries looking at jobs in non-member countries.

Since 2019, the two have largely followed similar trajectories. Both saw a noticeable decline during the COVID-19 pandemic — just 2.3% of European job seekers searched outside the single market in June 2021 — and gradually recovered. The two shares largely overlapped until mid-2024, but searches outside the single market dropped during the pandemic years, indicating lowered interest in moving too far from home and reflecting limitations in global mobility as well as work permits.

Since December 2024, however, outbound interest has been rising, and reached its highest share at 7.2% by October 2025.

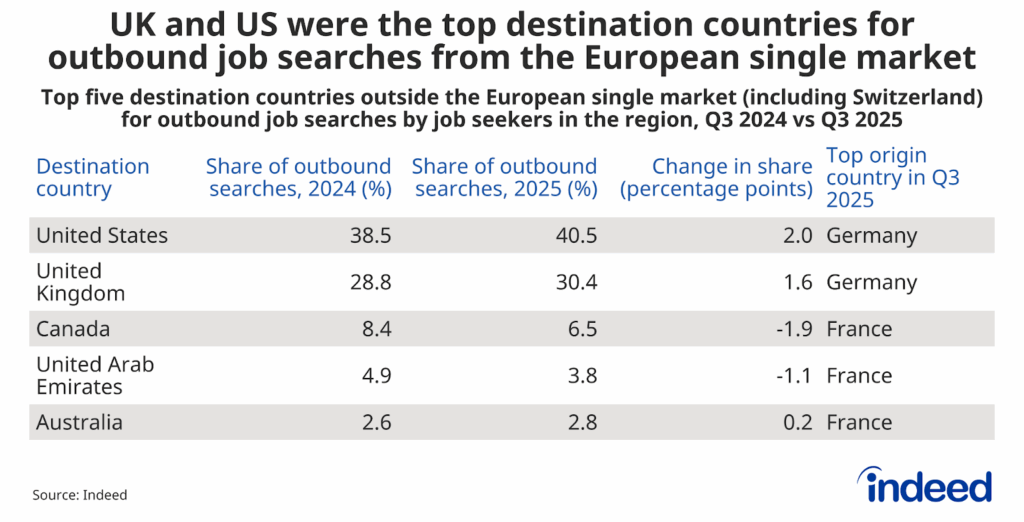

The United Kingdom and the United States were the leading destinations for outbound job searches from the European Single Market in Q3 2025, with Germany being the primary origin country for both routes.

On the other hand, the top intra-single-market job searches typically were among neighbouring countries, highlighting the potential for cross-border commuting or an easier move.

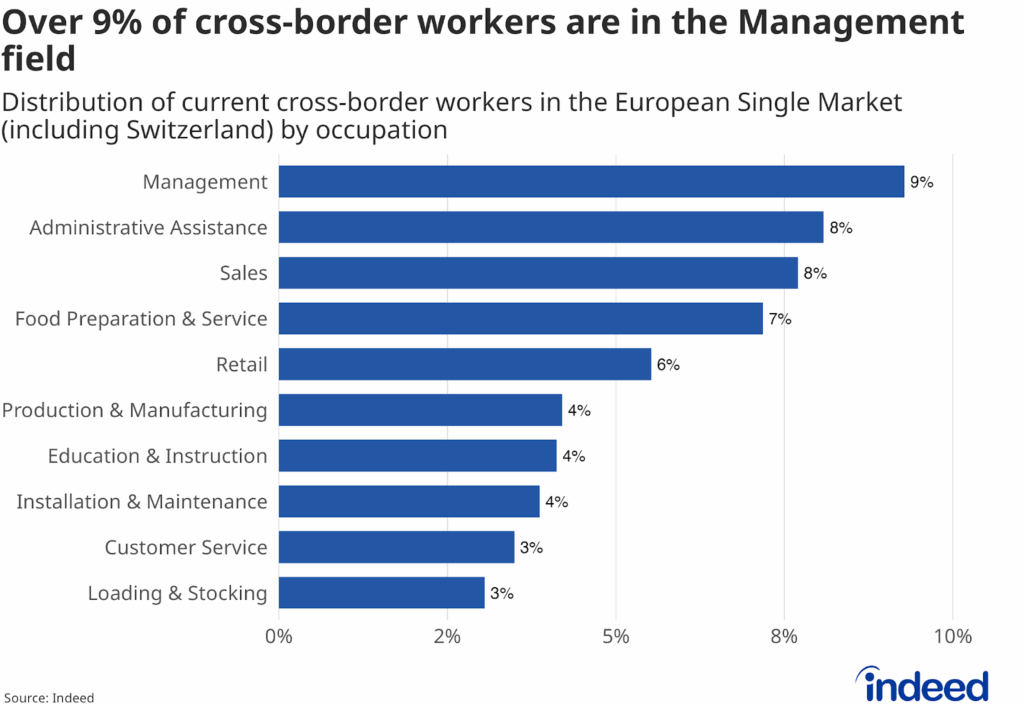

Occupations of cross-border workers

Manufacturing and construction industries comprised 46% of all cross-border workers in 2021, according to a European Union Labour Force Survey. According to Indeed’s data from mid-October 2025, cross-border workers are primarily employed in white-collar sectors.

This could be a testament to the increasing number of cross-border teleworkers in the region over the past four years, which led to more workers working remotely in white-collar roles in one country in the single market while living in another.

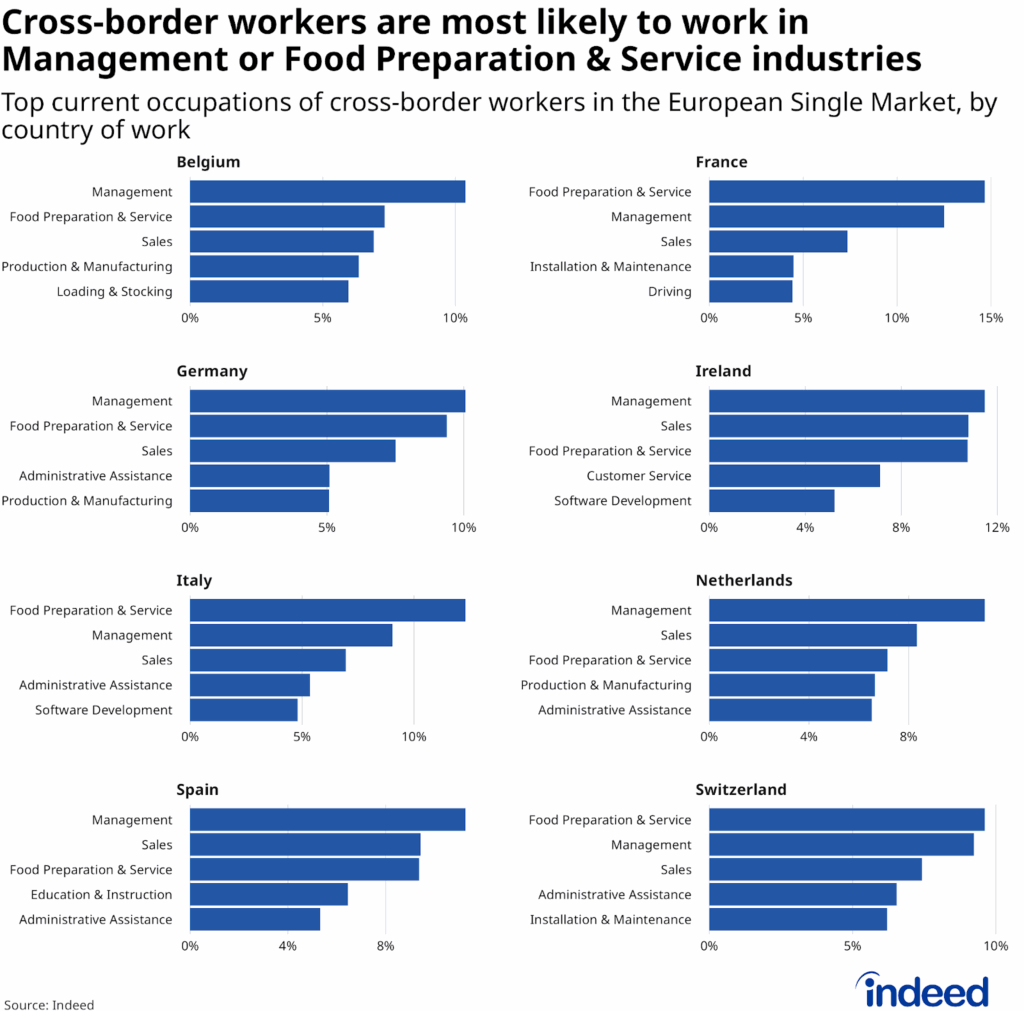

Management and food preparation & service are consistently the leading occupations for cross-border workers in the European Single Market, regardless of country of employment. Sales, administrative assistance, and installation and maintenance roles also feature prominently, reflecting the demand for both managerial expertise and essential support roles.

When examining occupational patterns by country of residence, a similar mix emerges. Management, food preparation & service, and sales rank highly, though there are noticeable differences, such as the inclusion of retail, education, and software development in several countries. This diverse mix highlights the wide array of skills and sectors represented among cross-border workers within the European Single Market.

Cross-border telework

Cross-border telework builds on long-standing principles of the European Single Market agreement, which safeguards equal treatment for workers across member states. While frontier and seasonal workers exemplify traditional cross-border employment, the pandemic accelerated new patterns of remote work that blurred national boundaries. Lockdowns and travel restrictions led many employees to telework across borders – either by necessity or choice – and these temporary arrangements have increasingly become permanent. It is estimated that in 2020, 0.37% of the European Single Market workforce, or almost 400,000 workers, teleworked in another country. The highest shares were observed in Luxembourg (1.51%), Belgium (1.04%), and France (0.57%).

However, this shift has also introduced complex administrative challenges, particularly regarding coordination of social security systems, healthcare coverage, unemployment entitlements, and family benefits.

In 2023, a new Framework Agreement for social security for cross-border telework increased the threshold for remote work in the employee’s home country from 25% to 49.9% of working time, thereby allowing eligible employees to remain covered under their employer’s national social security scheme as long as both countries are signatories. This gives employers and employees more leeway in structuring flexible telework arrangements across borders, but does not resolve certain cross-border tax compliance issues, highlighting how cross-border telework in Europe remains both enabled and constrained by policy. As of the summer of 2024, 18 countries in the European Single Market had enacted the agreement.

Conclusion

Europe’s freedom of movement offers clear economic advantages, but it has mixed results on the labor market. On one hand, in a region as large as the European Single Market, cross-border work helps fill shortages, supports local economies, and allows workers to live in countries with a lower cost of living. At the same time, it underscores how dependent some economies have become on inflows of foreign labor. Furthermore, differences in wages, regulations, and social protections mean that “borderless work” isn’t without its challenges. So while mobility remains crucial in the European Single Market, it reflects some structural imbalances as well.

Methodology

On data privacy: To protect workers’ personal information, all datasets are stripped of identifying information, including names and addresses. Results are only reported in an aggregated format. Analysis and data review are also performed to ensure that data points cannot be tied back to individuals.

The European Single Market consists of the following countries and territories: Austria, Aland Islands, Belgium, Bulgaria, Cyprus, Czech Republic, Croatia, Denmark, Estonia, Finland, France, French Guiana, Germany, Greece, Guadeloupe, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Martinique, Mayotte, Netherlands, Norway, Poland, Portugal, Reunion, Romania, Saint Bartelemey, Saint Martin, Slovakia, Slovenia, Spain, Sweden, Switzerland.

For this analysis, we utilized Indeed’s pool of hundreds of millions of job seeker profiles to identify workers currently residing in the European Single Market, United Kingdom, and United States with at least one work experience outside the current country of residency (based on the most recent resume) as “mobile.” Workers who had listed all their work experiences as being in the current country of residence were identified as “non-mobile.” A smaller but meaningful share of workers had some local work experience alongside other roles where the location was not specified. Because it was not possible to determine whether these unspecified experiences occurred domestically or abroad, these workers were categorized as “unknown” in the dataset. Profiles were excluded if they lacked a first or last name or if their number of work experiences exceeded the 99th percentile threshold.

“Cross-border” workers were identified as workers whose current work experience is in a country different from their country of residence, with both countries located within the European Single Market. These workers’ current occupations were then analysed by country of residency and country of work. The 2024 Annual Report on Intra-EU Labour Mobility was used for reference.

We assess foreign job seeker interest by tracking the share of total clicks on Indeed job postings in a given country by job seekers with IP addresses outside of that country. Data from job seekers in 254 countries and overseas territories was included in this analysis. Job seekers whose location could not be determined were removed from the analysis. All data in the post are summarized by month, unless noted otherwise. Figures may differ slightly from previously published data due to changes in filters used for this analysis, which expanded the sample size compared to prior work.