Key points:

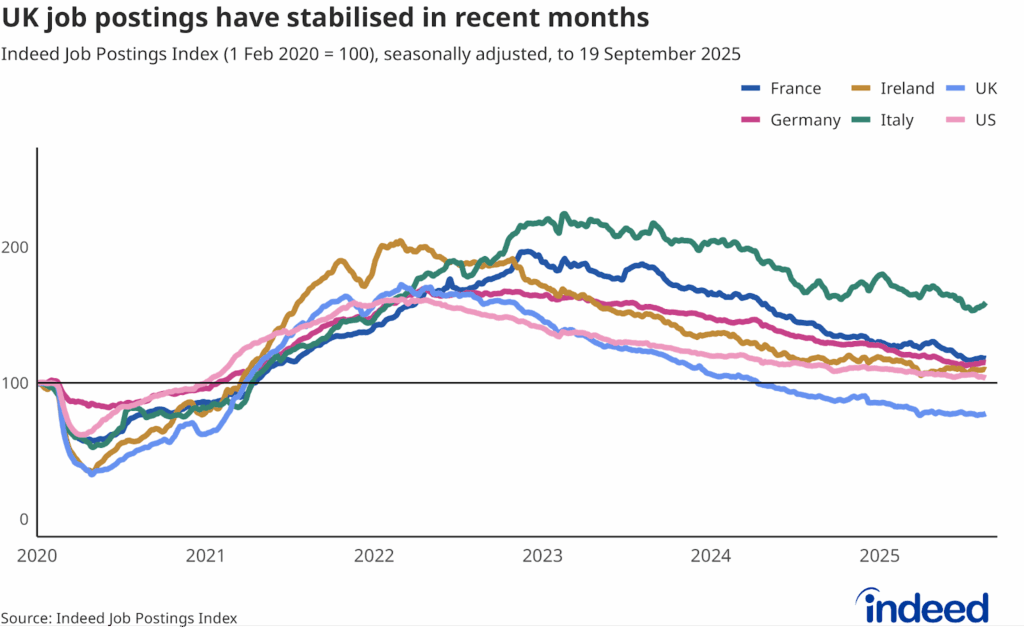

- UK job postings remain subdued at 22.5% below pre-pandemic levels, but have stabilised in recent months.

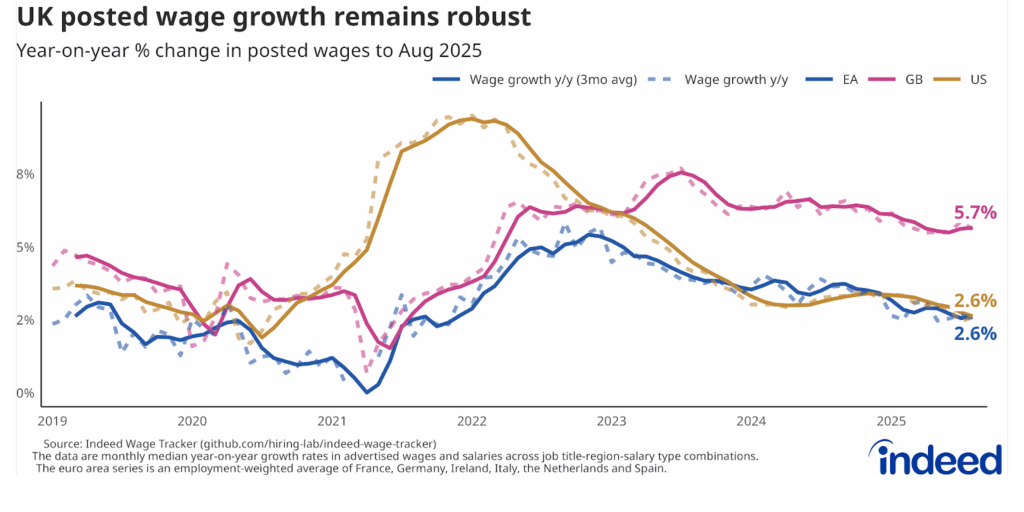

- Soft hiring demand still isn’t translating into weaker pay growth, with posted wages rising by a robust 5.7% year-on-year.

- The UK labour market continued to gradually cool but is showing few signs of crumbling, with job losses having remained modest.

Our Labour Market Updates examine important trends using Indeed and other labour market data. Our European Labour Market Chartbook provides a more comprehensive view of the European labour market. Other data, including the Indeed Wage Tracker, are regularly updated and can be accessed on our data portal.

The UK labour market has continued to gradually soften, but is still generating strong wage growth. That remains a quandary for the Bank of England, with rate setters cautious about loosening monetary policy amid concerns over inflation persistence. Hiring appetite remains subdued but has stabilised recently, with the UK economy having maintained modest growth momentum ahead of expected further tax rises in November.

UK job postings remain subdued but stable

UK hiring demand remains muted, though hasn’t deteriorated materially in recent months. UK job postings stand 22.5% below their 1 February 2020, pre-pandemic baseline, as of 19 September 2025. Postings are down around 14% on an annual basis, though are only 0.4% below their level three months ago.

Wage pressures persist

Despite soft hiring demand, posted wage growth continues to run hot. The Indeed Wage Tracker showed that year-on-year growth of UK advertised wages climbed to 5.7% in the three months to August. The latest official figures point to gradually easing but still-robust wage growth across the UK workforce, meaning the Bank of England continues to face considerable challenges in containing inflation pressures. UK posted wage growth continues to run at more than double the levels seen in the euro area and the US.

Several lower-paid categories continue to see strong year-on-year posted wage growth, including beauty & wellness (7.9%), administrative assistance (6.7%), loading & stocking (6.6%), retail (6.4%), customer service (6.3%) and hospitality & tourism (6.2%). That’s partly reflective of the 6.7% increase in the minimum wage, which came into effect in April. Physicians & surgeons and dental (7.0% and 6.5% respectively) also saw strong wage growth in August.

Line chart titled “UK posted wage growth remains robust” shows annual growth in posted wages in the UK, US and euro area. UK posted wage growth ticked up to 5.7% year-on-year in August, remaining well above that seen in the euro area and the US (both 2.6%).

The UK labour market has continued to gradually cool

The latest Office for National Statistics figures point to an ongoing gradual softening of the UK labour market. Payrolled employment fell for a seventh consecutive month in August, though the latest monthly decline was again modest at just under 8,000.

Line chart titled “Payrolled employment has fallen in recent months” shows the number of payrolled employees from 2014 to 2025. Payrolled employment fell for the seventh month running in August.

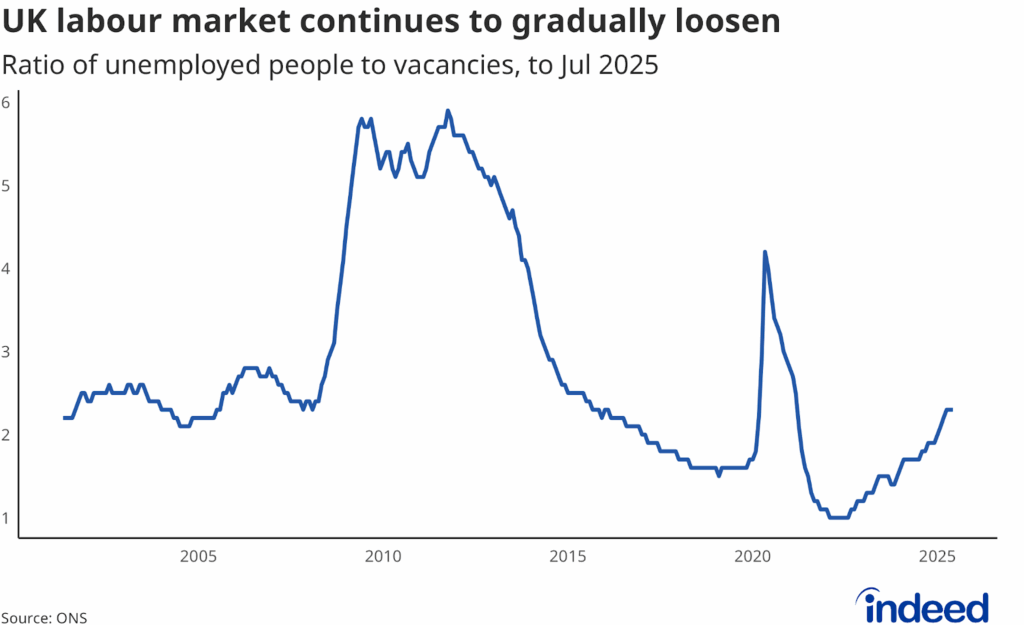

The unemployment rate has continued to inch higher in recent months but remains fairly low at 4.7%, while there was a modest 10,000 decline in job vacancies during the three months to August. The ratio of unemployed people to vacancies (a metric of labour market tightness) now stands at 2.3, slightly above where it was just prior to the pandemic, but still lower than the historical average since 2001.

Line chart titled “UK labour market continues to gradually loosen” shows the ratio of unemployed people to vacancies from 2001 to 2025. The ratio has risen recently to 2.3.

Meanwhile, redundancy notifications have remained fairly modest in recent months, suggesting that unemployment isn’t likely to spike anytime soon.

Conclusion

A key question remains: how long can workers keep bargaining for higher pay against a backdrop of a softer labour market? Concerns that pay pressures may not abate swiftly — with workers having got used to high inflation and holding out for bigger pay awards — are one reason why the Bank of England remains cautious about further interest rate reductions in coming months. Conversely, any signs of the labour market beginning to show a more material weakening would likely shift the dial towards a faster pace of rate cuts.

Hiring Lab Data

Job postings data is available on our Data Portal. We also host the underlying job-postings chart data on GitHub as downloadable CSV files. Typically, it will be updated with the latest data one day after this blog post is published.

Methodology

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. Feb. 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. We adopted this methodology in January 2021.

To calculate the average rate of wage growth, we follow an approach similar to the Atlanta Fed US Wage Growth Tracker, but we track jobs, not individuals. We begin by calculating the median posted wage for each country, month, job title, region and salary type (hourly, monthly or annual). Within each country, we then calculate year-on-year wage growth for each job title-region-salary type combination, generating a monthly distribution. Our monthly measure of wage growth for the country is the median of that distribution.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.