Key points:

- The jobs market continued to soften through August, with payrolls falling for seven consecutive months.

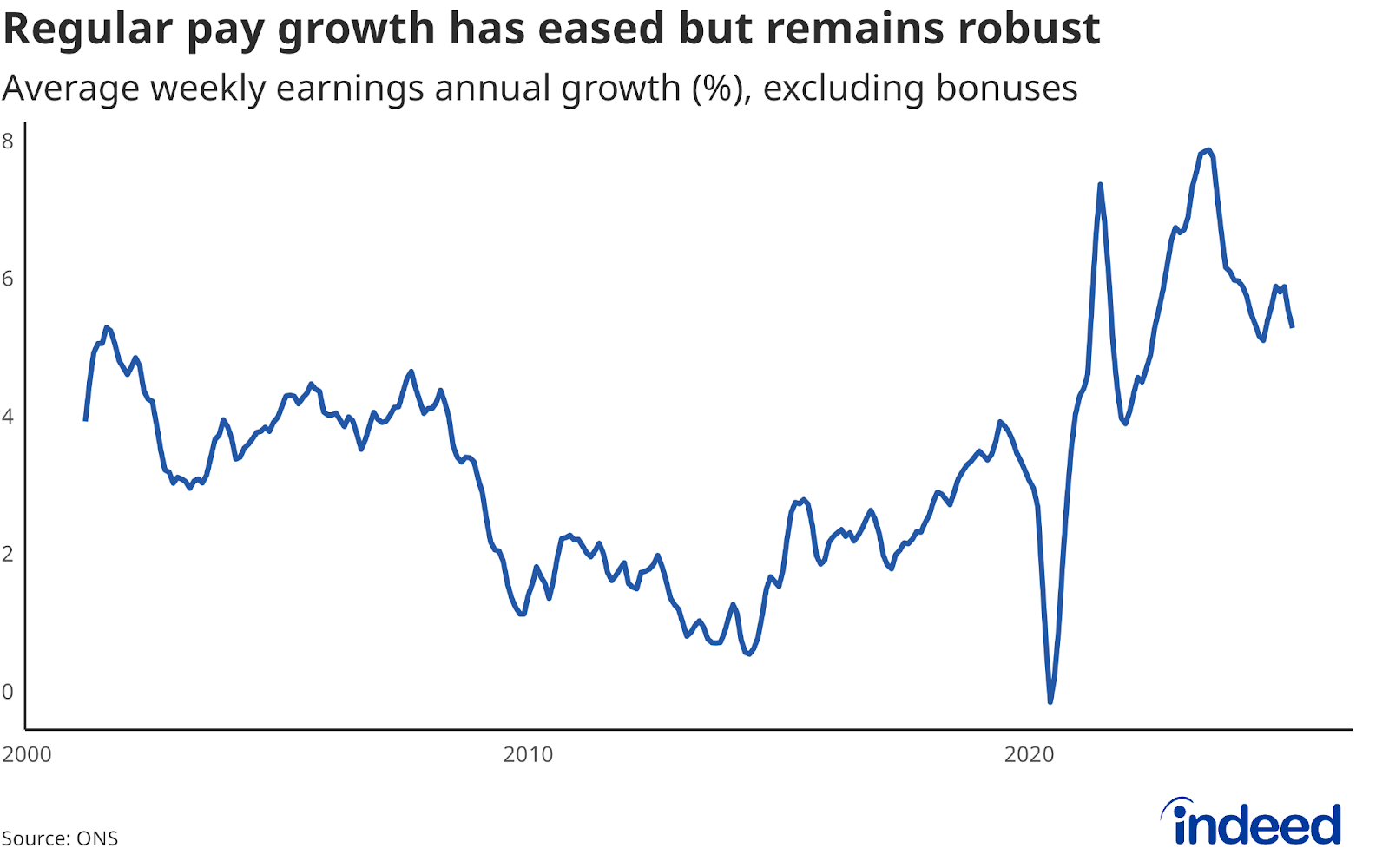

- Wage growth remains robust, with regular pay rising at an annual rate of 4.8% in the three months to July.

There were few surprises in today’s ONS figures, which show a continued cooling of the UK labour market alongside pay growth that’s gradually easing but still running too hot for the Bank of England’s liking.

Payrolled employment declined for a seventh successive month in August, though last month’s decline of 8,000 workers was relatively modest. Annual growth in average earnings excluding bonuses dipped from 5% to 4.8% in the three months to July, but remains well above the 3% level generally regarded as consistent with the Bank’s 2% inflation target.

There’s little in the data that is likely to shift the Monetary Policy Committee’s thinking ahead of Thursday’s interest rates decision, where policy is widely expected to remain on hold. The Bank remains stuck between weak demand and persistent inflation pressures, meaning any rate cuts may be off the table until 2026 unless the labour market begins to show a more material deterioration.