Key points:

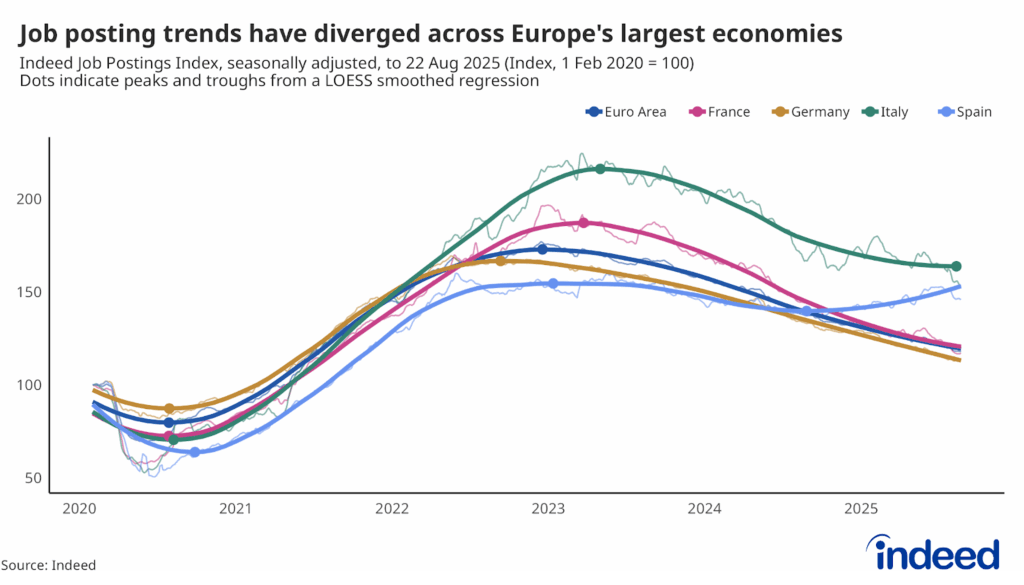

- As of late August, Job postings in Spain and Italy were 46% and 53% above pre-pandemic levels, respectively, indicating overall strong hiring demand, according to the Indeed Job Postings Index.

- Postings in Germany and France have fallen 15% and 19%, respectively, over the past year, pointing to a continued cooling in labour market conditions.

- Germany and France still have tighter labour markets than Italy and Spain, but as postings decline in some countries and grow in others, tightness levels are converging.

- Job posting trends are linked to overall economic growth.

The Eurozone’s largest labour markets are currently telling two different stories. On the one hand, job postings in Spain and Italy are well above pre-pandemic levels, signalling strong hiring conditions. In contrast, postings in Germany and France continue to decline, reflecting a cooling labour market. This divergence in demand for new workers is leading to a gradual convergence between North and South in labour market tightness. With these forces at play, Europe may soon face more uniform hiring challenges, replacing the sharp North-South divide that has long shaped both economic policy and firms’ hiring strategies.

Job postings are high in Italy and Spain, but continue to decline in Germany and France

Job postings in the Eurozone’s four largest economies — France, Germany, Italy and Spain — evolved similarly during the pandemic and the early recovery, but the trends have diverged recently. As of late August, postings in Spain were up 6% over the past year and were 46% higher than pre-pandemic levels. Postings in Italy declined 8% over the same period, but remain 53% higher than before the pandemic. In contrast, Germany and France have experienced sharper slowdowns lately, with year-on-year declines of 15% and 19%, respectively. Postings in these countries are 13% and 17% higher than before the pandemic, respectively, and they continue to decline, mirroring the broader Euro Area Job Postings Index.

Smoothed trends suggest that postings in southern Europe’s largest economies, Spain and Italy, have rebounded, or are set to rebound, from recent, post-pandemic troughs. Postings in Spain reached their latest turning point in 2024 and have been growing since, while Italy’s appear to have just reached an inflexion point this summer. Meanwhile, postings in the largest northern Eurozone economies, France and Germany, remain on a downward trend.

Job postings move with economic growth

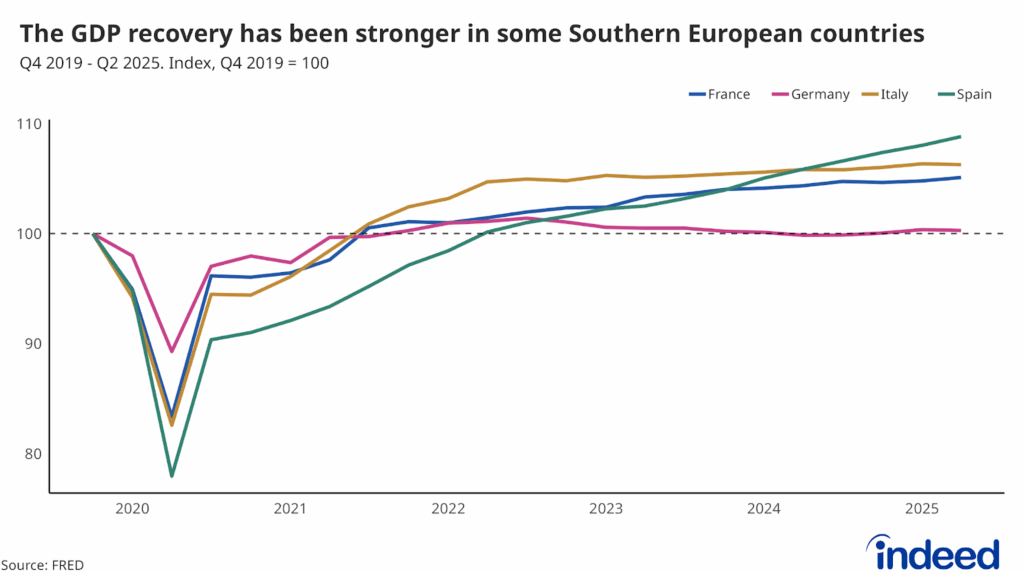

Overall job posting trends largely mirror GDP dynamics, amplified by structural labour market differences. Compared with the period just before the COVID-19 pandemic, Spain and Italy’s GDPs have grown more than France’s and Germany’s, helping explain the differences in job posting performance. In the second quarter of 2025, Spain’s economy was 8.8% larger than in the last quarter of 2019, while Italy expanded by 6.3% and France by 5.0%. Germany’s economy was stagnant (only a 0.3% increase). This ranking is similar to the one observed in job postings, except that Spain and Italy are flipped (the former had the highest GDP growth, while the latter had the highest job posting growth).

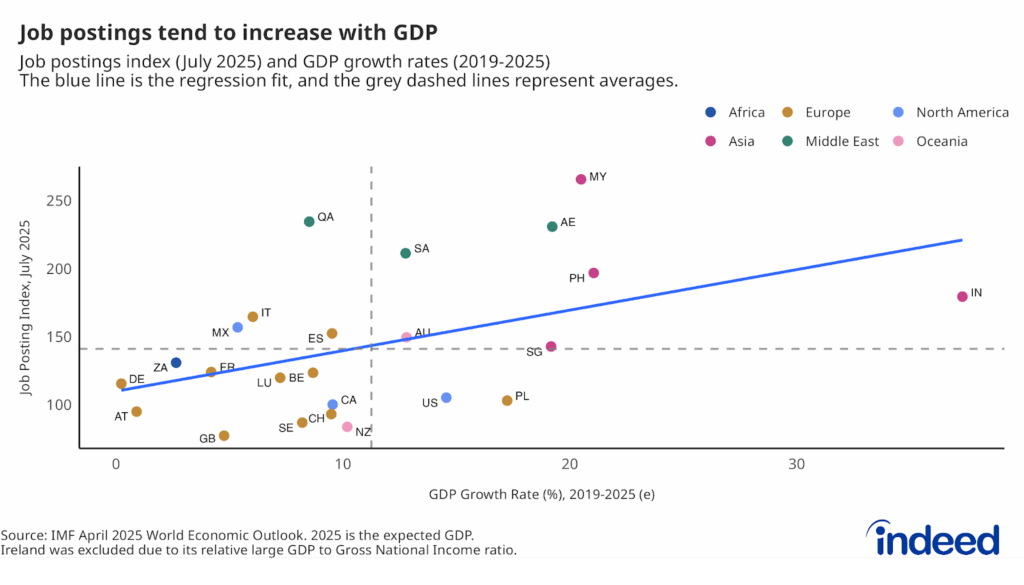

We see a similar positive correlation between job posting growth and real GDP growth across a larger sample of countries. As of July 2025, postings across all countries analyzed were on average 41% higher than pre-pandemic levels, and average GDP growth across all countries since 2019 is expected to be 11%. India’s GDP has expanded the most since the start of the pandemic, and its job postings have increased more than average. Germany is at the other extreme, with the weakest GDP growth rate and below-average posting growth.

This relationship between GDP and job posting growth is statistically significant, but other factors like fiscal policy and labour supply considerations play a role, too. Within Europe, divergent GDP growth patterns (and thus job posting trends) since 2019 reflect factors including the 2022 energy crisis, political uncertainty in Germany and France, and differences in defence spending and the associated present and/or future increases in debt and/or taxation. Italy and Spain have benefitted from Next Generation EU funds and sustained growth in service exports. Spain’s GDP growth has also received an additional boost from population growth through immigration and a vibrant tourism sector.

The South is hot, the North is tight, but they are converging

While Italy and Spain’s job postings are high, indicating robust hiring activity, this does not mean that those labour markets are as tight as those in Northern Europe. Labour market tightness is determined by comparing demand for new workers — measured through job postings or vacancies — with labour supply.

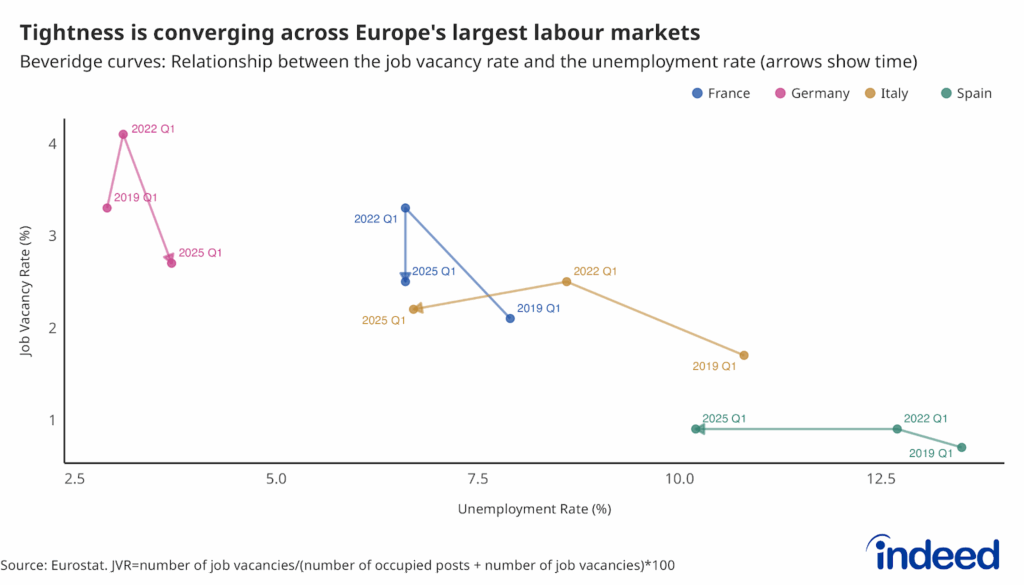

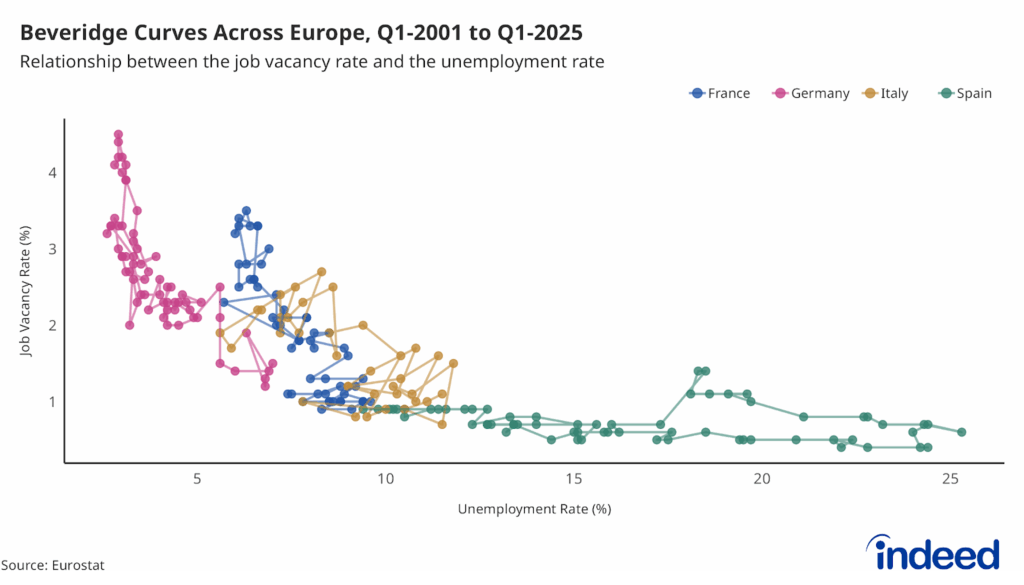

The Beveridge Curve below looks at tightness by comparing the job vacancy rate with the unemployment rate. Germany’s position in the upper-left quadrant (low unemployment, high vacancy rate) indicates a tight labour market where employers are competing for scarce workers. Spain’s position in the lower-right shows the opposite: a higher unemployment rate with a lower vacancy rate, indicating labour market slack. This is despite the fact that Germany’s overall job postings growth has been weaker than Spain’s.

Crucially, tightness in these countries’ labour markets is converging. Between Q1 2019 and Q1 2025, the unemployment rate fell and job vacancy rates rose in France, Italy and Spain, while the opposite occurred in Germany. By Q1 2025, job vacancy rates were broadly aligned in Germany (2.7%), France (2.5%) and Italy (2.2%), with Spain trailing at 0.9%, albeit with a substantially lower unemployment rate than in 2019. As a result, the ratio of vacancies to unemployment — a measure of labour market tightness — has become less dispersed across these economies.

Looking at a longer time period shows the non-linear nature of the continental European Beveridge curve. Different markets are on different sections of the curve, but they have moved closer together.

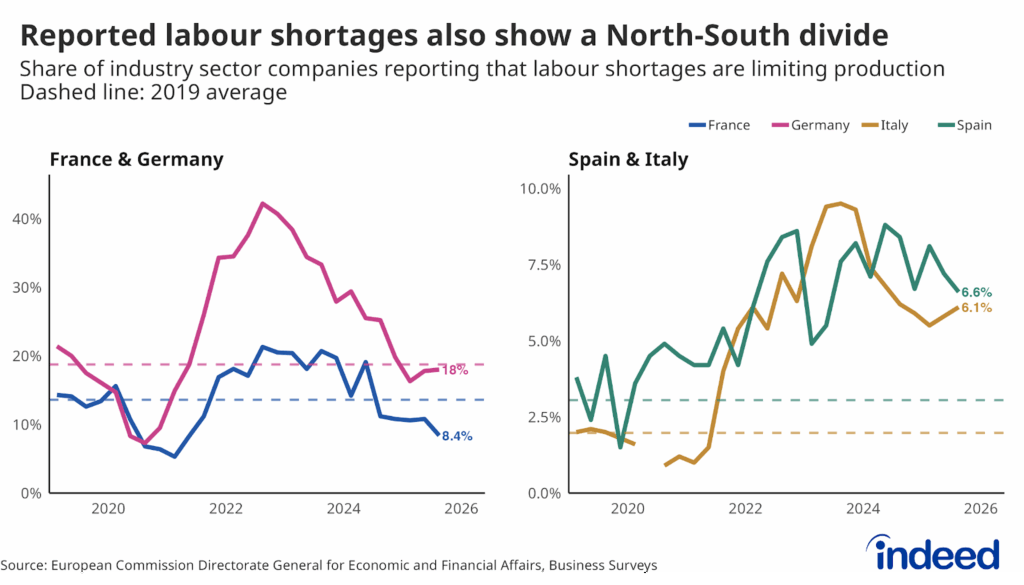

Businesses’ reported labour shortages are converging too

The North-South divide in job posting trends and convergence in tightness correlate closely with labour shortages reported by businesses. Looking at the industrial sector, where data is available for all four countries, employers in Spain and Italy currently report lower shortages than those in Germany and France. However, this gap has narrowed since mid-2022. Reported shortages in Italy and Spain have risen and remain well above 2019 levels, while those in Germany and France have eased below their pre-pandemic levels. This trend aligns with broader patterns in vacancy rates and unemployment, indicating a gradual convergence in hiring challenges across Europe.

Occupational drivers differ across countries

Differences in the occupational mix of postings do not drive the aggregate job posting dynamics analysed throughout this blog post. In other words, the faster rise in postings in Italy and Spain is not simply due to having started with a larger share of occupations that expanded everywhere.

However, there is considerable diversity in the occupational drivers of posting trends across countries. The table below summarises which occupations have made the largest positive and negative contributions to aggregate job posting changes in the six months to 22 August 2025.

In Spain, the country where postings increased overall in the past six months, the occupational categories contributing most significantly to the increase have been sales, retail and software development. Thus, both high- and low-skilled occupations contributed positively to aggregate growth. This was only partially offset by negative contributions from occupations like food preparation & service, driving and production & manufacturing. In Italy as well, high posting levels are supported by growth in selected high-skilled job categories, such as IT.

Conclusion

Europe’s labour markets tell two stories: job vacancy rates are diverging while tightness is converging. This trend reflects both macroeconomic performance and deeper differences in labour market structures. Understanding these nuances will be key for policymakers navigating uneven growth. Germany and France face the prospect of further cooling in their labour markets as job postings continue to decline, while Spain and Italy must prove that their recent turning points are sustainable.

Methodology

Data on seasonally adjusted Indeed job postings are an index of the number of seasonally adjusted job postings on a given day, using a seven-day trailing average. 1 February 2020 is our pre-pandemic baseline, so the index is set to 100 on that day. We seasonally adjust each series based on historical patterns. The Indeed Job Postings Index is available in our Data Portal.

The Euro Area Job Postings Index is calculated by aggregating job postings in Germany, France, Spain, Italy, the Netherlands, and Ireland, and then seasonally adjusting and indexing the aggregated series.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.