Key points:

- Defence job postings in Europe have outpaced overall market trends since 2022.

- France, Germany and the UK are the leading hubs for defence hiring.

- Software and engineering roles dominate defence hiring.

- Jobseeker interest in defence roles has grown in much of Europe but remains flat in the UK.

A collective uptick in European defence spending over the past years has led to a surge in hiring demand across Europe’s largest defence contractors, outpacing the overall European job market. But while jobseekers in Germany, France and other European nations have shown elevated interest in filling these defence-related roles, UK-based jobseekers appear to be reluctant, according to a Hiring Lab analysis of defence-related job postings and jobseeker engagement.

Following the outbreak of war in Ukraine in 2022, EU member states collectively increased defence spending from 1.3 % of GDP in 2023 to 1.5 % in 2024, with projections rising to 1.6 % in both 2025 and 2026. Meanwhile, in the UK, defence expenditure reached 2.3 % of GDP in 2024, and Prime Minister Keir Starmer has pledged to raise this to 2.5 % by 2027, with a long-term goal of approximately 3 %.

Beyond its geopolitical significance, the surge in defence investment has boosted the sector’s economic relevance. Once seen as incompatible with ESG criteria and often excluded from responsible investment portfolios, defence has gained traction among investors. As a result, European defence stocks have seen substantial gains since 2022.

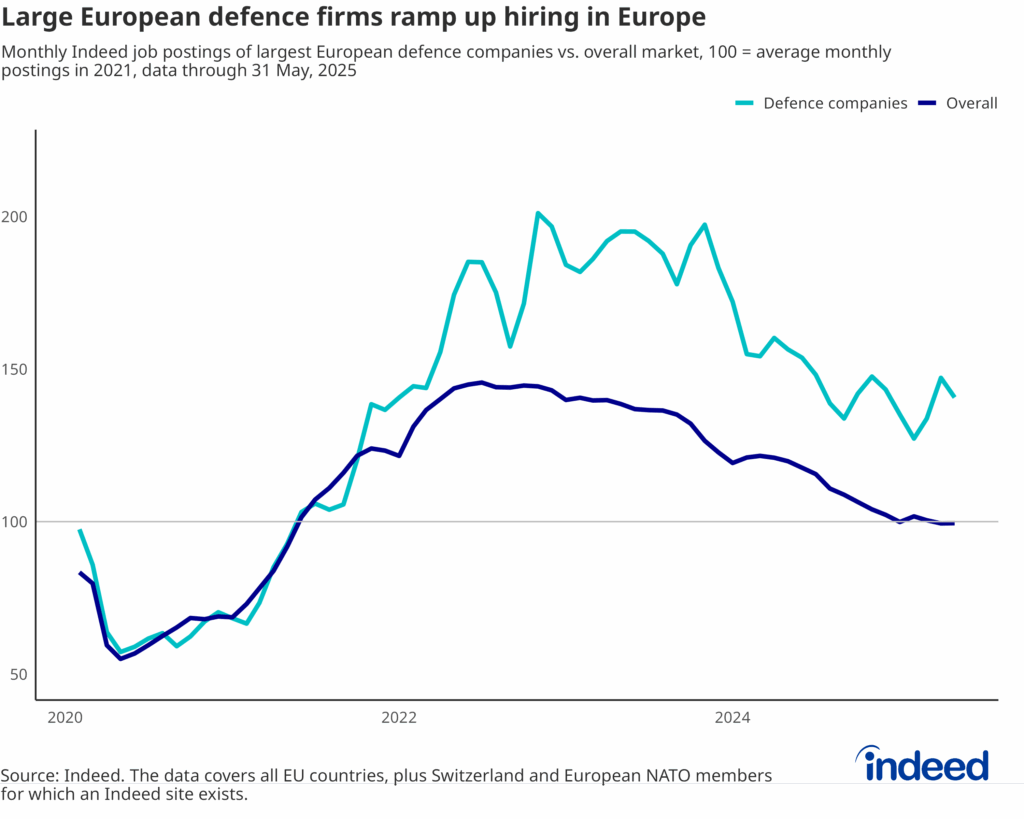

Defence hiring is outpacing the broader market

After a pandemic-related decline in 2020, postings in both the defence industry and the wider market initially recovered at a similar pace. However, the trends diverged sharply beginning in 2022, roughly at the same time as Russia’s February 2022 invasion of Ukraine. Overall job postings peaked in July 2022 (46% above their 2021 average) and have since declined. In contrast, defence postings continued to rise, reaching double their pre-Ukraine-invasion, 2021 average by November 2022. Although defence postings have declined since, they remained 41% above 2021 levels as of May 2025. The overall market has dipped slightly below its 2021 benchmark.

Several major European defence companies operate internationally, reflecting the sector’s increasing integration. Firms including Airbus Defence and Space, MBDA and KNDS lead joint European programmes in aerospace, missile systems and armoured vehicles. These groups align with the EU’s push for technological sovereignty and shared capabilities, while fostering cross-border R&D cooperation and economies of scale.

France, Germany and the UK each host sizable and specialised defence industries. France pursues full-spectrum autonomy through firms like Dassault, Thales and Safran. Germany, home to Rheinmetall and Hensoldt, is central to NATO’s future land systems. The UK holds a strong position in naval and aerospace platforms via BAE Systems. As these companies expand production and innovation, demand for skilled talent across software, engineering and manufacturing continues to rise.

France accounts for the largest share of European job postings from major defence companies, with around 43% as of May 2025, down from 57% in early 2020. Germany and the UK each represent 17% of postings. Meanwhile, the share from other European countries has risen from 7% to 23%, reflecting geographical diversification of defence investment and hiring.

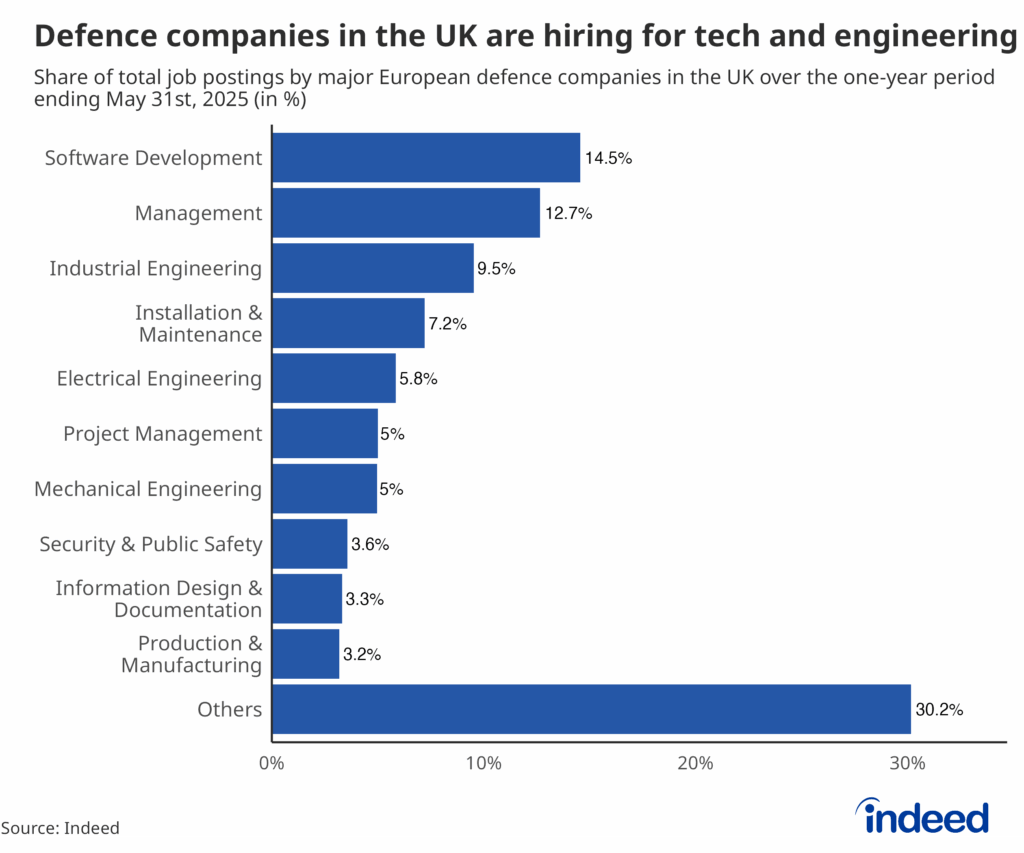

UK defence job postings are tech-heavy

In the UK, defence companies are primarily hiring for technical roles. Software development leads with 14.5% of all defence-related job postings. Industrial, electrical and mechanical engineering make up 9.5%, 5.8% and 5%, respectively. These roles are essential to the UK’s defence capabilities, from aircraft and naval vessels to radar, communications and cyberdefence infrastructure.

Specialised roles, such as principal software engineers and systems integration experts, play a key role in developing embedded systems and secure networks, with applications spanning both military and civilian technologies like GPS and satellite imaging. Additionally, installation & maintenance, which includes vehicle technicians and sheet metal workers, makes up 7.2% of postings, highlighting the demand for the skilled trades in defence manufacturing and support.

In addition to technical hiring, defence firms also seek talent for corporate functions, including management (12.7%) and project management (5%) roles. Many of these roles require sector-specific knowledge, in technical project coordination or supply chain logistics, for example.

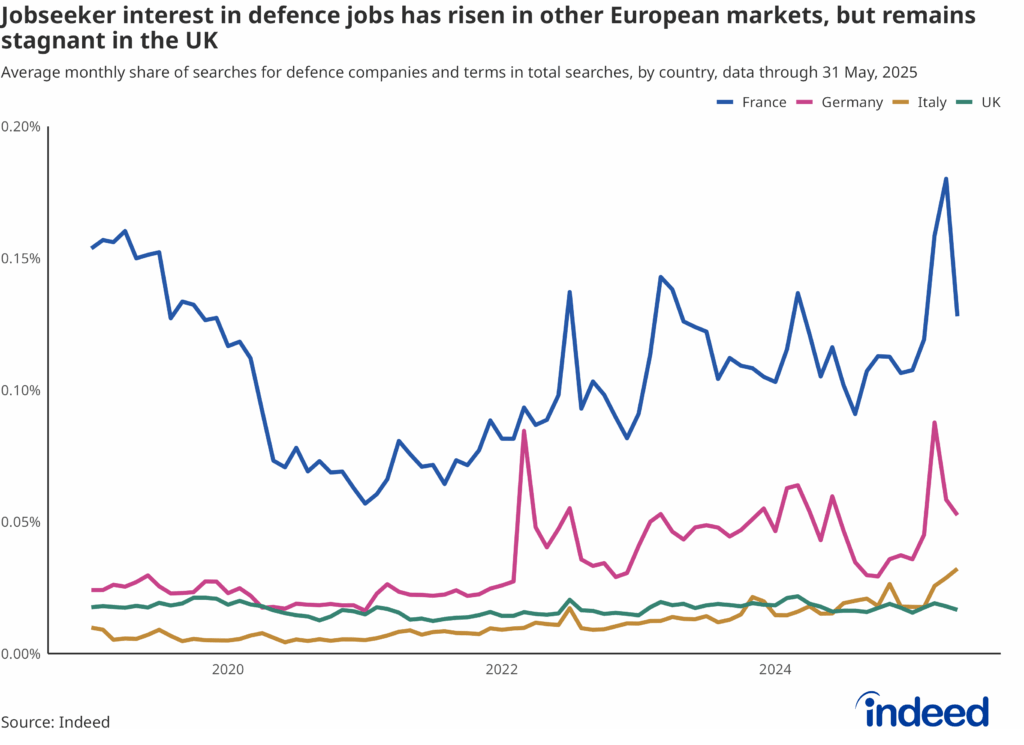

Jobseeker interest has risen across Europe, but remains flat in the UK

As defence companies ramp up hiring, attracting talent will require rethinking employer branding and recruitment strategies. Shifting public perception of the defence sector may boost its appeal to jobseekers, but results, so far, vary widely across European labour markets.

In the UK, jobseeker interest rose slightly after the start of the Ukraine war in 2022 but has remained largely flat since. By contrast, interest has grown in France and Germany. In France, the share of defence-related searches reached 0.18% in April 2025, a marked increase from the pre-war level of 0.08% in 2021. Germany saw the most significant early rise: the share of searches more than tripled from 0.026% in January 2022 to 0.084% in March 2022, and has remained elevated since. In March 2025, searches rose again to 0.088% amid political debate about lifting the country’s debt brake to boost defence spending.

Despite these shifts, defence remains a niche area of jobseeker interest. Even in countries with increased interest, defence-related searches still account for a small share of overall job search.

Differences in jobseeker engagement across countries likely reflect more than economic factors – they also speak to cultural attitudes and social contexts. Defence carries symbolic meaning, attracting individuals motivated by purpose, public service or patriotism. Interest in defence careers is sensitive to broader geopolitical developments such as terrorism, war, global instability or increased military spending. Interest in defence-related roles in the private sector is often less volatile than interest in actual military enlistment, which tends to spike in response to geopolitical or security events, including terrorist attacks.

Public defence spending can be a catalyst for broader technological and economic progress

Beyond the immediate boost to employment, the expansion of Europe’s defence industry could generate powerful positive spillover effects throughout the wider economy. Defence firms invest heavily in R&D and can drive advances in embedded systems, artificial intelligence, cybersecurity, avionics and advanced manufacturing.

Many of these innovations extend beyond military use, with civilian applications that can reinforce Europe’s industrial competitiveness, support high-value manufacturing jobs and improve trade balances through both civil and defence exports. The industry’s demand for STEM talent may also help promote social mobility and foster development in regions with strong defence sector presence. In this context, defence could become a cornerstone of Europe’s economic and technological renewal in an era of heightened security challenges.

Methodology

Job Postings

The analysis includes job postings from 25 of the largest European defence companies listed in SIPRI’s Top 100 ranking (two additional European firms in the Top 100 had no data available: JSC Ukrainian Defence Industry and Czechoslovak Group). We capture postings in all EU and European NATO countries, where an Indeed site exists, including the UK, as well as Switzerland. For most companies, relevant postings were identified using Indeed’s proprietary company taxonomy. For a few subsidiaries of larger conglomerates, whose arms sales account for less than 20% of total revenue (Thyssenkrupp Marine Systems, Safran Defence, Airbus Defence and Space), postings were retrieved via keyword-based extraction so as to only capture job postings at the defence-related business units.

The sample includes the following companies: Airbus, Atomic Weapons Establishment, Babcock International, BAE Systems, CEA, Dassault Aviation, Diehl, Fincantieri, Hensoldt, KNDS, Kongsberg, Leonardo, MBDA, Melrose Industries, Naval Group, Navantia, PGZ, Qinetiq, Rheinmetall, Rolls-Royce, Saab, Safran, Serco Group, Thales, ThyssenKrupp.

Search Queries

To measure jobseeker interest in the defence industry, we calculated the share of searches on Indeed for the companies included in our sample and for variations of the terms defence/arms/weapons industry/sector/company in German, English, French, Italian and Dutch.