This post is updated as of 10th April 2020. We will continue to update these trends regularly as we track how coronavirus impacts the global labour market.

Job postings data on Indeed is among the most timely indicators of how the labour market is faring in what are still the early stages of a global economic crisis. While official labour market statistics are backward-looking and will take time to fully reflect the new reality, we can already see a marked slowdown in the Indeed data.

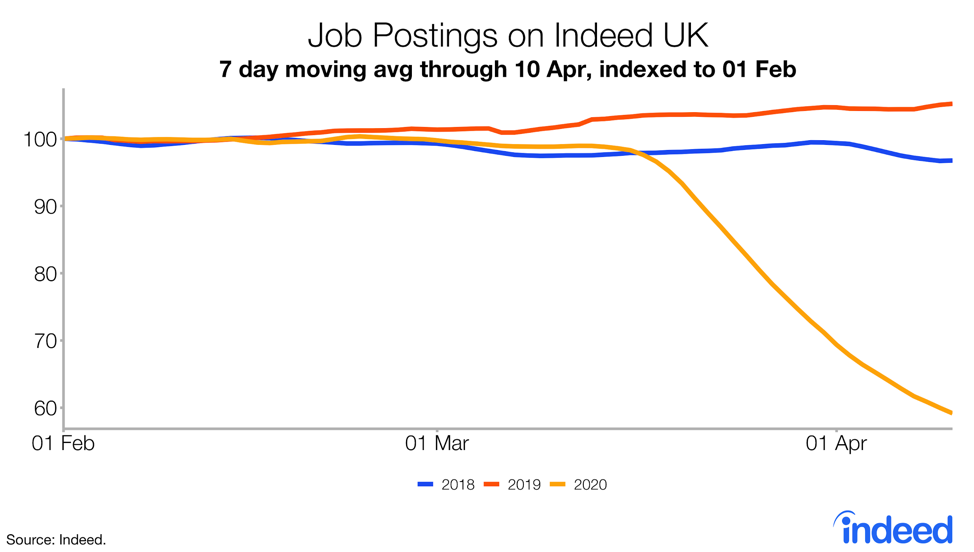

The job postings trend turned sharply downwards in mid-March as social distancing measures were ramped up. The downturn deepened further last week, with the volume of job postings down 44% versus a year ago as of 10th April.

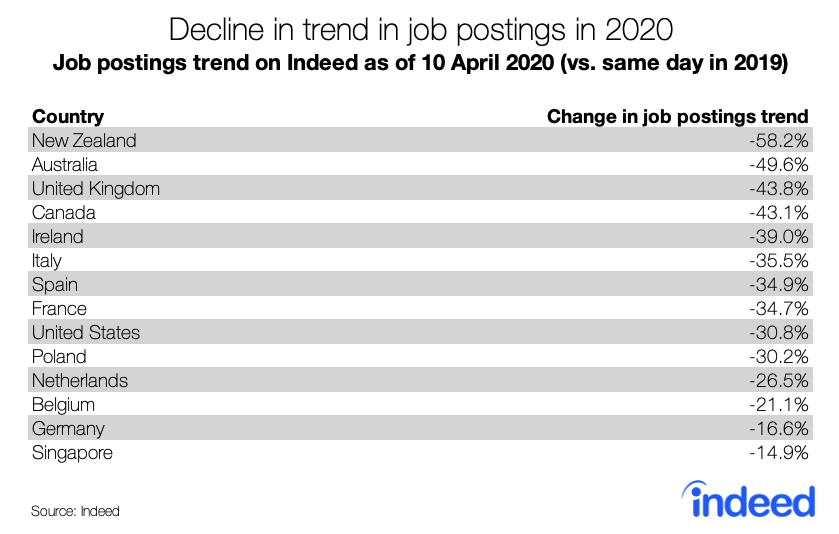

International comparisons show the UK has so far been among the worst-affected countries we have looked at in terms of job postings.

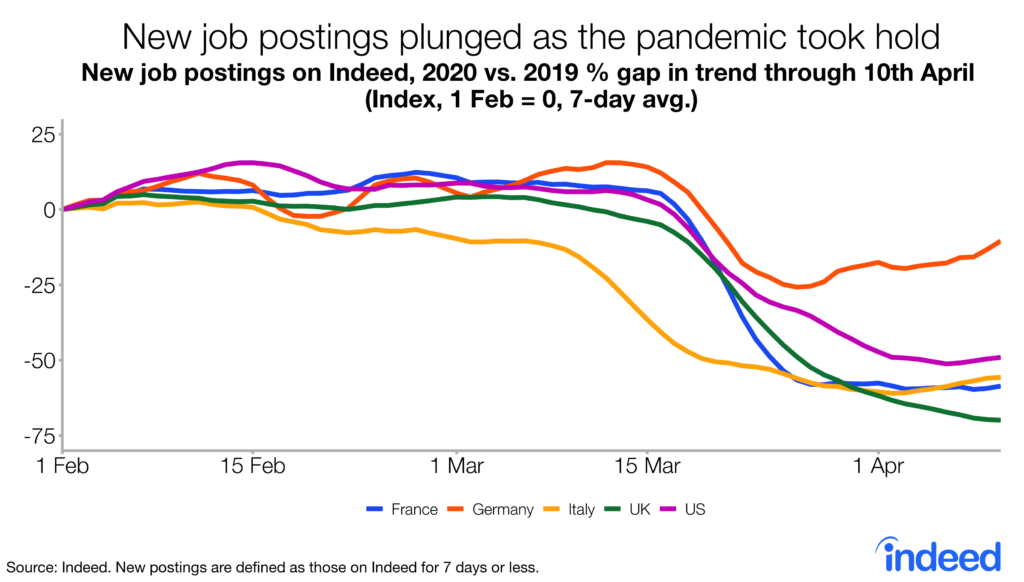

Data on new job postings (those that have been on Indeed for seven days or less) show an even steeper drop, down 70% on a year ago as of 10th April. This is a larger fall than in countries such as Italy, France, Germany and the US. However, the pace of decline appears to have eased over the past week (new job postings were down 64% on the previous year as of 3rd April), mirroring similar signs of bottoming out in the aforementioned countries.

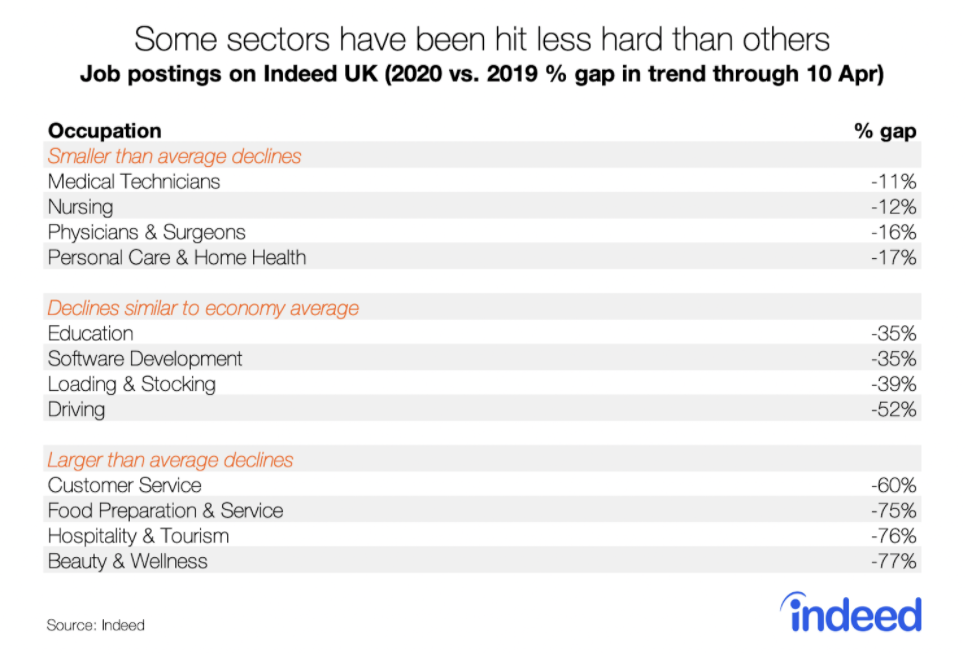

Sectoral impacts vary markedly

Some sectors have been much more affected than others. Healthcare occupations such as medical technicians (down 11% on last year’s trend) and nursing (down 12%) have seen the smallest declines.

Those sectors that have been most directly impacted by shutdowns unsurprisingly have seen the largest declines. Beauty & wellness job postings are down 77%, closely followed by hospitality & tourism (down 76%) and food preparation & service (down 75%).

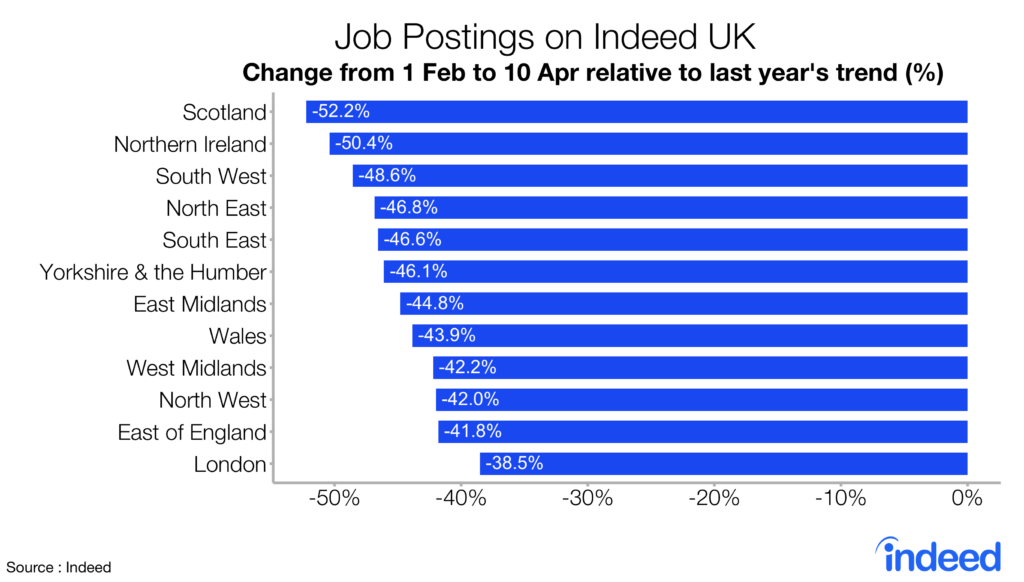

Scotland and Northern Ireland have seen the biggest falls, London the shallowest

Scotland and Northern Ireland have seen the biggest declines in job postings (down 52% and 50% respectively). At the other end of the scale, London has recorded the least marked drop (down 39%).

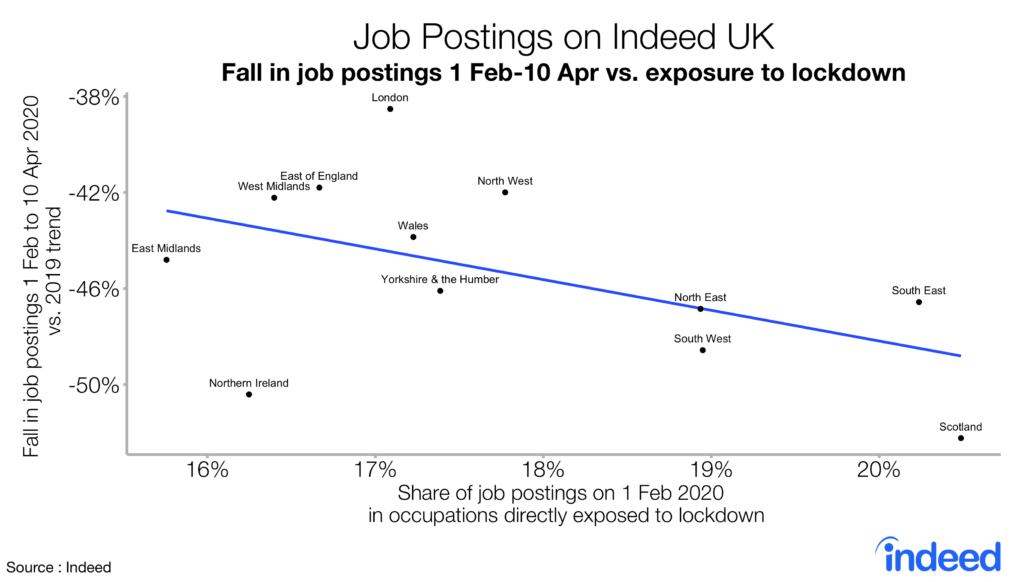

There appears to be some evidence that those regions with greater direct exposure to mostly shut down sectors have tended to see the largest falls in job postings (albeit Northern Ireland looks like an outlier here). These sectors are: retail, hospitality & tourism, aviation, food preparation & service, customer service, beauty & wellness and sports.

We will provide regular updates on these trends as the situation evolves.

Methodology

To measure the trends in total job postings, we calculated the 7-day moving average of the number of UK job postings on Indeed. We indexed each day’s 7-day moving average to the start of that year (1 February 2020 = 100 for 2020 data, and so on), or another date if specified on the chart.

For each country we report how the trend in total job postings this year differs from last year, in order to focus on the recent changes in labour market conditions due to COVID-19. For example: if job postings for a country increased 30% from 1 February 2019 to 10 April 2019, but only 20% from 1 February 2020 to 10 April 2020, then the index would have risen from 100 to 130 in 2019 and 100 to 120 in 2020. The year-to-date trend in job postings would therefore be down 7.7% on 10 April (120 is 7.7% below 130) in 2020 relative to 2019.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.