Key points:

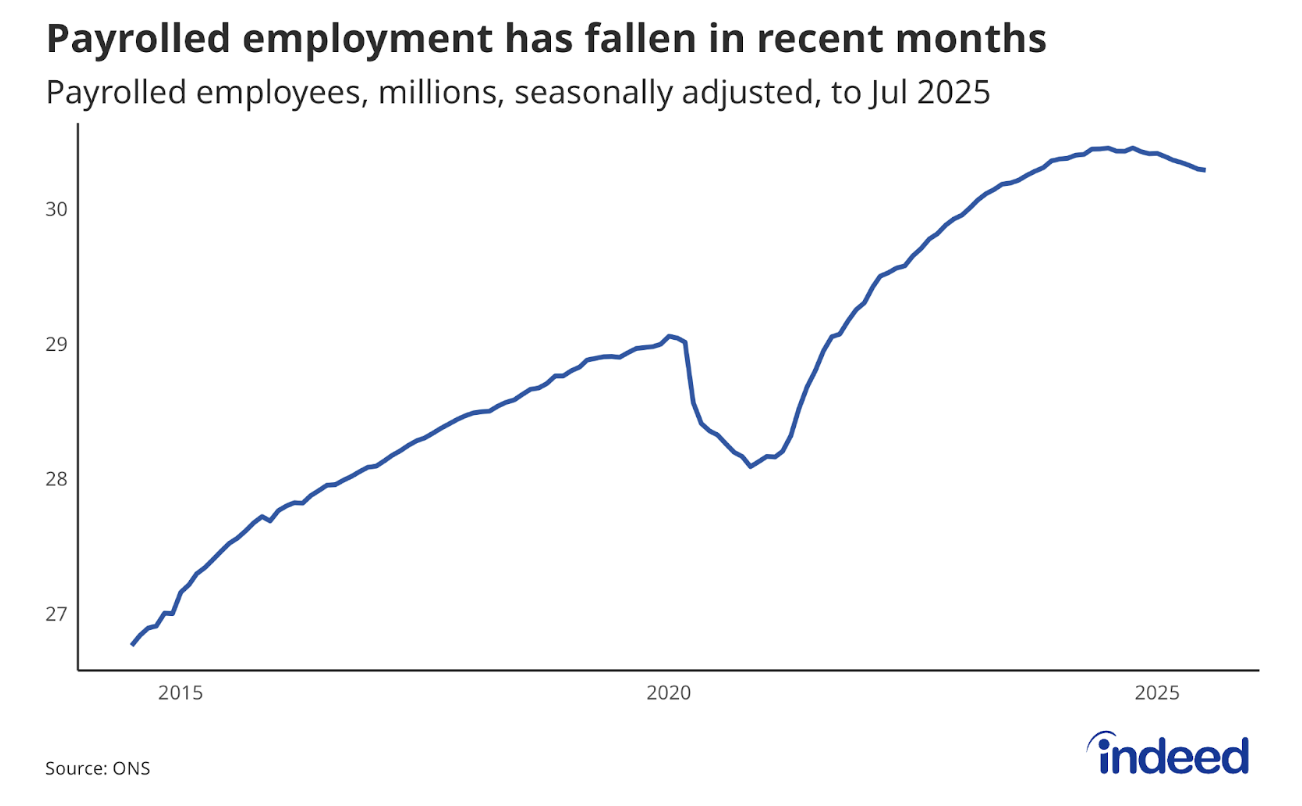

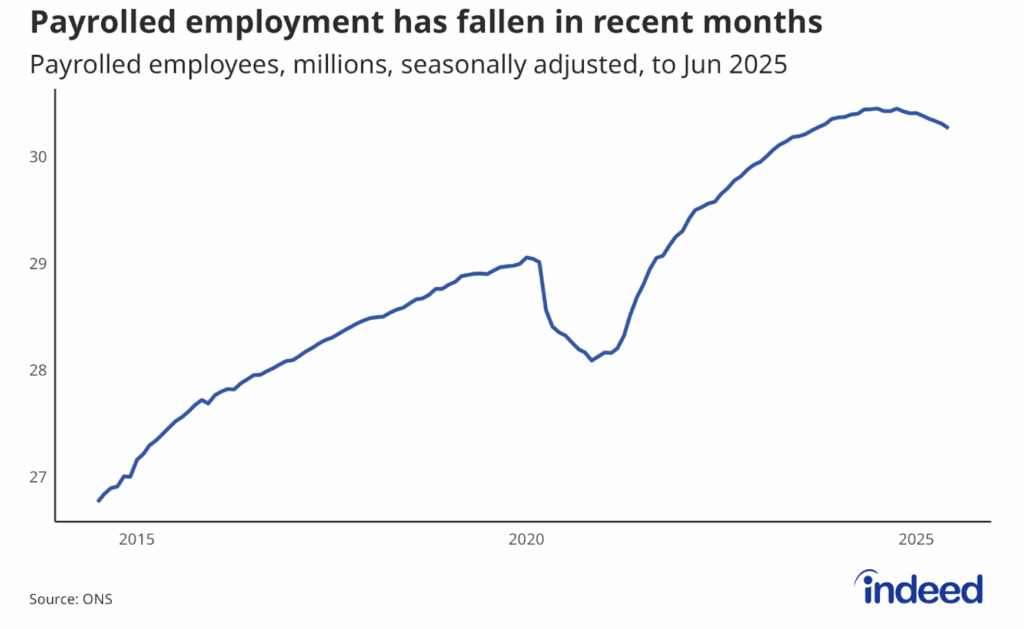

- Payrolls have fallen for the past six months, but the pace of decline has eased off.

- Wage growth remains robust, with regular pay rising at an annual rate of 5.0%.

Today’s labour market figures underline the stagflation quandary facing the Bank of England. The payrolled employees figures indicate a jobs market that’s struggling but not collapsing. Payrolls have declined for six consecutive months, but July’s initial estimate points to a smaller-than-expected fall of 8,000, while June’s revised figure showed less of a drop than previously thought (-26,000 vs -41,000). Vacancies continue to fall, with reductions across almost all sectors.

While the jobs market continues to face significant headwinds from higher employment costs and global uncertainty, the Bank of England’s Monetary Policy Committee continues to operate in a heavy fog. August’s knife-edge vote on the level of key interest rates reflected the tricky balancing act between downside labour market risks and upside inflation risks. Meanwhile, its navigation tools remain impaired by ONS data quality issues. While a further rate cut in November remains on the cards, it’s not a done deal, with wage growth remaining elevated amid concerns over inflation persistence.