Key Points

- Retail spending remains well above pre-pandemic trends. However, for the first time in 15 years, retail volumes have fallen for three consecutive quarters.

- Retail job postings have fallen 27% from their peak but there are still more than twice as many opportunities as there were before the pandemic.

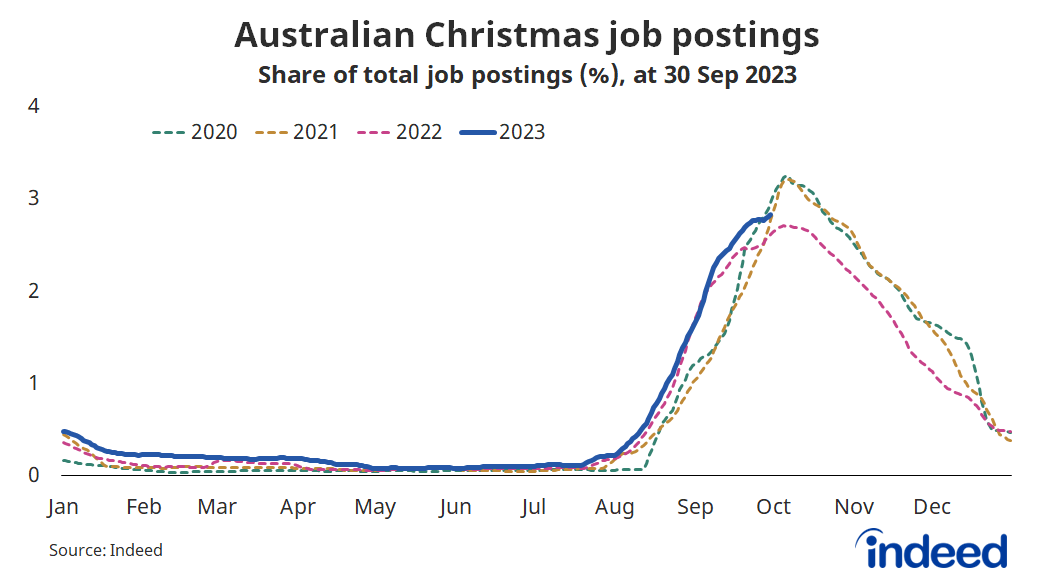

- Retailers are optimistic heading into Christmas, with Christmas-related job opportunities tracking ahead of last year.

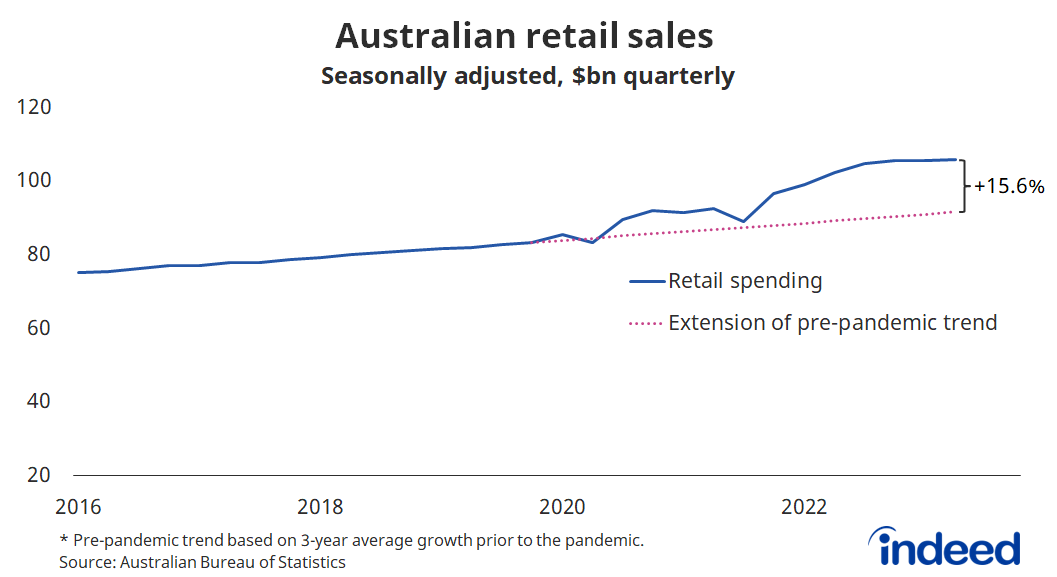

Despite a range of disruptions, the past few years have been pretty good for Australian retailers. Owing to the billions in federal and state government stimulus in response to the pandemic, the value of retail trade has increased by 27% since the December quarter 2019, primarily driven by higher prices, and is 15.6% higher than it would have been had the pandemic never taken place.

However, Australia’s retail boom is coming to an end, with conditions deteriorating somewhat this year. Due to cost-of-living pressures, Australian households have now consumed fewer retail products for three consecutive quarters. That hasn’t happened in 15 years — not since the global financial crisis.

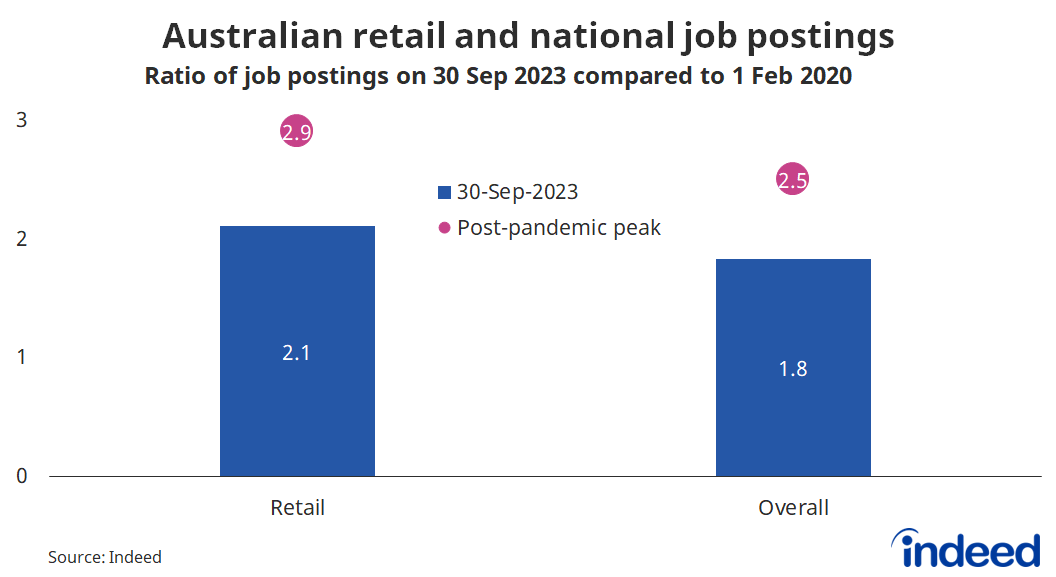

A slowdown in consumer spending has spilled over to retail hiring, with retail job postings falling 27% from their peak last year. Stronger population growth, owing to high immigration, has also helped fill some roles, helping ease the widespread skill shortages that have been so prominent over the past couple of years.

Yet despite a more challenging economic environment, Australian retailers remain optimistic leading into Christmas. Christmas-related job postings are tracking favourably against last year.

Australian retail spending is elevated but cooling

In the June quarter, Australian retail trade was 15.6% higher than it would have been had the pandemic never taken place. Cumulatively, Australian households have spent around $114 billion more on retail than they otherwise would have since the December quarter 2019, including an additional $14.3 billion in the June quarter alone.

The big beneficiaries of Australia’s retail boom have been household goods and food, which accounted for 33% and 32% of the extra spending, respectively, since the December quarter 2019.

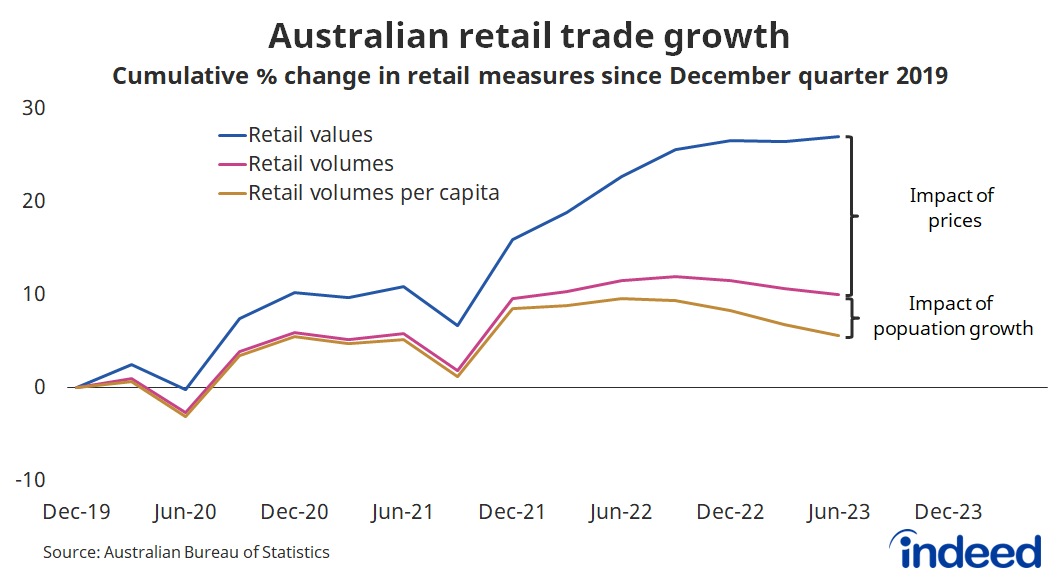

The value of retail spending can be broken down into three factors: the volume of retail goods sold, the price of those goods and population growth. All have contributed to the surge in retail spending since the pandemic began.

While retail spending has increased by 27% since the December quarter 2019, the volume of retail goods & services sold has increased by just 10%. The gap between these two figures represents the impact of rising prices on household spending.

Similarly, the gap in growth between retail volumes (+10%) and retail volumes per capita (+5.6%) reflects the contribution of population growth on overall retail spending.

Consequently, almost two-thirds of the overall increase in retail spending has been driven by rising prices. Rampant inflation has forced Australian households to spend more in order to maintain their consumption habits.

As recently as the December quarter 2021, retail volumes were the driving force behind Australia’s retail boom. Now it accounts for just 21% of overall spending growth, just ahead of a 17% contribution from population growth.

While retail spending continues to rise, retail volumes have now fallen for the past three quarters — the first time in 15 years — as cost-of-living pressures weigh heavily on many Australian households. Population growth is helping to prop those numbers up a little, but there is an expectation that retail conditions will continue to soften over the remainder of the year.

Australian retailers continue to demand workers

But even as the volume of goods sold continues to fall, demand for workers across the retail sector remains elevated. And Christmas hiring is actually tracking ahead of last year.

By the end of September, there were 2.1-times as many retail job postings on Indeed as there were before the pandemic began. Postings have moderated, down 27% from their peak, but remain incredibly high by historical standards.

Hiring trends in the retail industry broadly track hiring trends across the broader economy. The jobs boom in retail last year was a little stronger than the national average, with postings peaking at 2.9-times pre-pandemic levels, but the subsequent decline in postings from its peak have been similar.

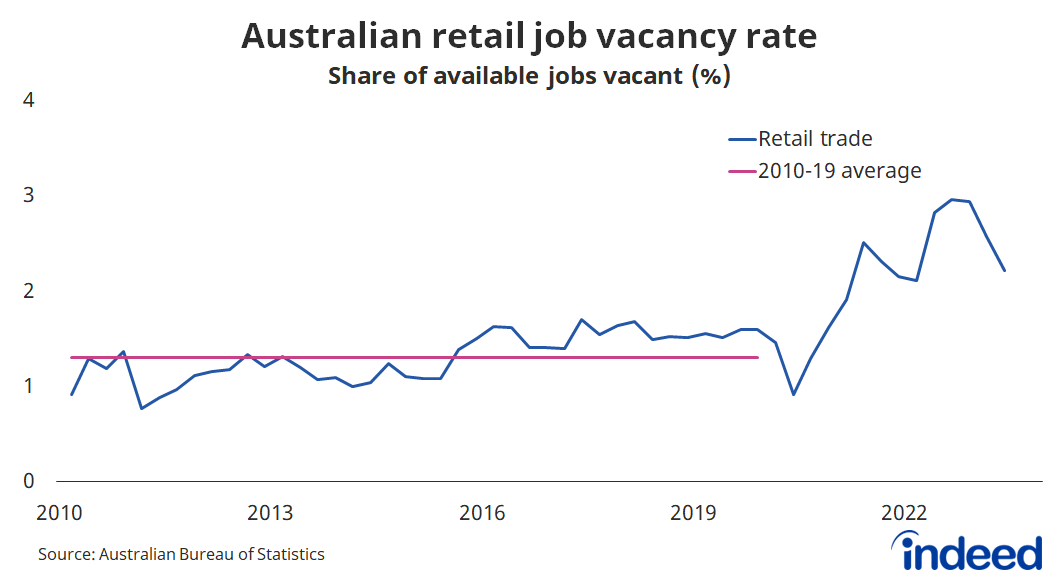

Finding suitable candidates for these job opportunities remains challenging. While the job vacancy rate for the retail industry has recently declined, at 2.2% it is still well above the 2010-2019 average of 1.3%. High population growth is surely helping on that front, but imbalances between labour demand and supply persist.

Demand for Christmas workers strong in 2023

At the end of September, job postings featuring keywords such as ‘Christmas’ in their job title accounted for 2.8% of all job postings on Indeed, higher than the share recorded at the same time last year.

While retail conditions have clearly deteriorated this year, that doesn’t appear to be having any impact on hiring for Christmas jobs, at least not yet.

The good news for retailers is that searches by jobseekers for Christmas/seasonal jobs are tracking well above the past few years. At the end of September, 1.5% of searches on Indeed were for Christmas jobs, up from 1.0% and 1.3% at the same point in 2022 and 2021, respectively.

Normally jobseeker interest in Christmas jobs doesn’t peak until November. But jobseeker interest this year has been so high that it has already exceeded the peak from both 2021 and 2022.

This possibly reflects Australia’s cost-of-living crisis, with these jobs potentially offering some households additional cash during what is often the most expensive time of year.

Methodology

Data on retail trade, retail volumes, population growth and job vacancies is sourced directly from the Australian Bureau of Statistics. The counterfactual for retail spending had the pandemic not occurred was based on a continuation of average quarterly growth in the three years prior to the pandemic.

We define Christmas job postings as those with one or more holiday-themed terms in the job title, including, but not limited to, ‘Christmas,’ ‘Xmas’ and ‘holiday.’ Seasonal job searches are defined as those containing one or more of the same list of holiday-related terms.

Retail and national job postings figures are seasonally adjusted based on historical patterns in 2017, 2018 and 2019. The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.