We regularly update this report to track the pandemic’s effects on the labour market. Our methodology changed at the start of 2021, as explained in the methodology note at the end of the post.

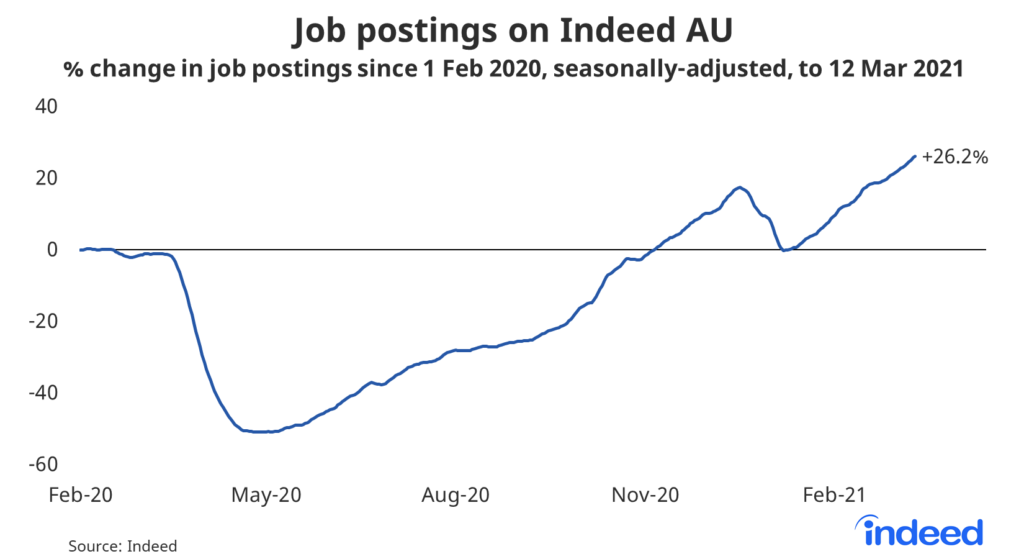

Job postings on Indeed are a real-time measure of labour market activity. On March 12 they were tracking 26.2% ahead of their level on February 1 last year, our pre-pandemic baseline, after adjusting for seasonal trends.

Postings are up from +19.2% a fortnight ago and +9.2% at the end of January.

In 2020, job postings plunged from mid-March until late April, falling by half, and then gradually improved over the remainder of the year. Victoria’s lengthy second lockdown slowed the recovery, creating a temporary divergence between Victoria and the rest of Australia. Thankfully, there appears to be no lasting impact on Victorian recruitment and short-term lockdowns in New South Wales, Western Australia and Victoria have had minimal hiring impact.

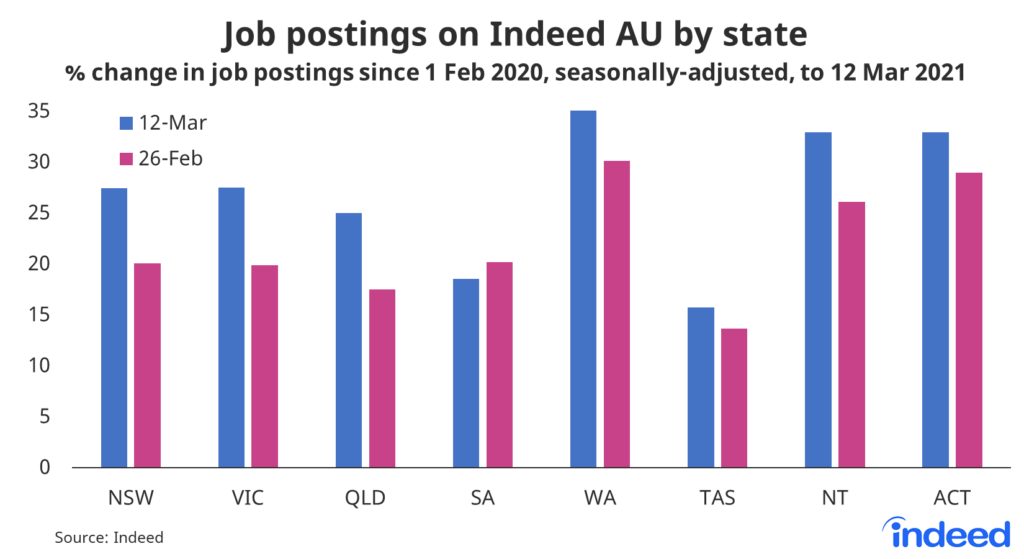

In the past two-weeks, job postings have continued to improve across every state and territory, except for South Australia. Posting numbers are healthy across the country.

Compared with last year’s baseline, postings are up 35% in Western Australia, a booming jobs market perhaps one small factor in the recent lopsided election, while postings are up by 27.5% in both New South Wales and Victoria. Queensland is not far behind, up 25%.

Tasmania (+15.7%) and South Australia (+18.5%) are beginning to lag behind other states and territories.

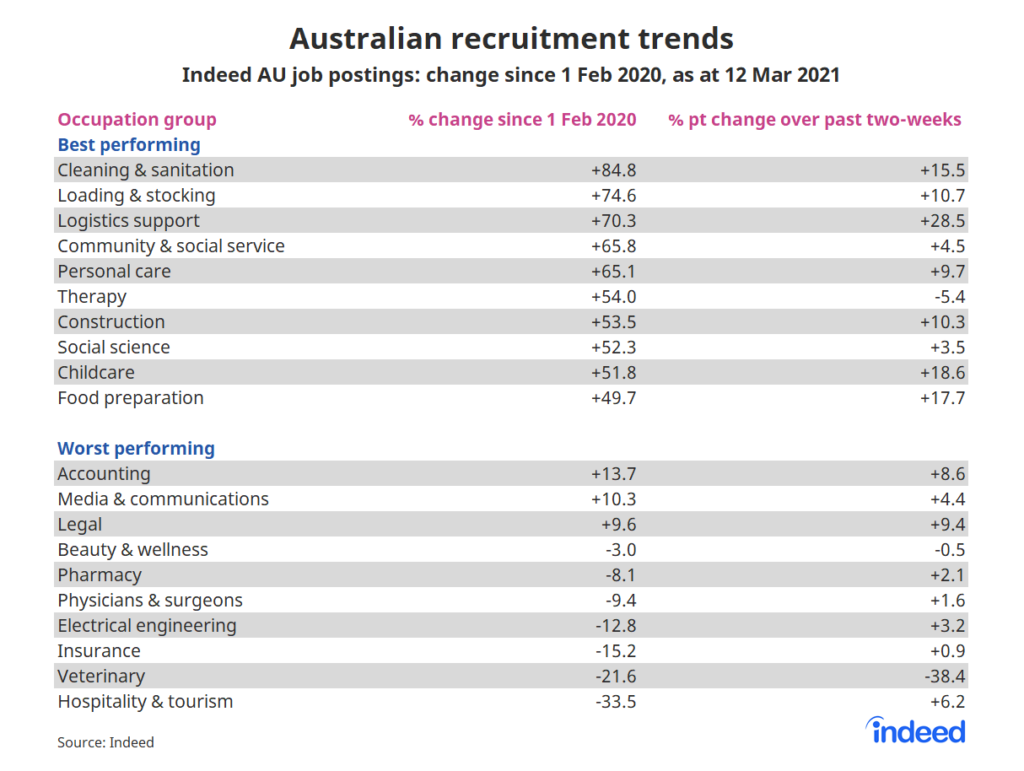

Hiring continues to improve in most occupational groups

Australia’s hiring recovery has been impressive and, although there are some occupations lagging behind, most are heading in the right direction.

Job postings for cleaning & sanitation roles are up 85% compared with their baseline on February 1 last year. Postings for loading & stocking and logistics support are up 75% and 70%, respectively. All three occupations have experienced strong postings growth over the past two-weeks.

We continue to see strong hiring in construction, up 54% against last year’s baseline and up 10.3% points compared with two weeks ago. That’s being supported by rising building approvals and federal government support.

It’s also great to see postings for food preparation workers continue to rise steadily. They are now up 50% against their baseline, having increased 17.7% points in just the past two-weeks.

The hiring recovery remains slowest in hospitality & tourism, despite that improvement in job opportunities for frontline kitchen staff. Hospitality postings are down 34% against their baseline, although they have improved 6.2% points compared with a fortnight ago.

There was also a large fortnightly decline in veterinary postings. However, veterinary postings can be highly volatile due to being a relatively small category.

The good news is that job postings have improved, against their baseline, for most of the ‘worst performed’ occupations over the past two weeks. Many of the ‘worst performing’ occupation groups also have job postings that are higher than their level pre-crisis, while others are only slightly down.

Australia’s hiring recovery continued to impress throughout early March, building on the gains from earlier this year. The next major obstacle on the road to recovery is the end of the JobKeeper wage subsidy at the end of March. That will coincide with Easter, which could create an uncertain period for job postings and labour market conditions more broadly.

Methodology

All figures in this blogpost are the percentage change in seasonally-adjusted job postings since February 1, 2020, using a seven-day trailing average. February 1 last year is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately.

We adopted this new methodology in January 2021 and now use it to report all historical data. Historical numbers have been revised and may differ significantly from originally reported values. The new methodology applies a detrended seasonal adjustment factor to the percentage change in job postings. In contrast, our previous methodology used the 2019 change between February 1 and the reported date as the adjustment factor, which implicitly included both a seasonality component and the underlying trend.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.