We regularly update this report to track the pandemic’s effects on the labour market. Our methodology changed at the start of 2021, as explained in the methodology note at the end of the post.

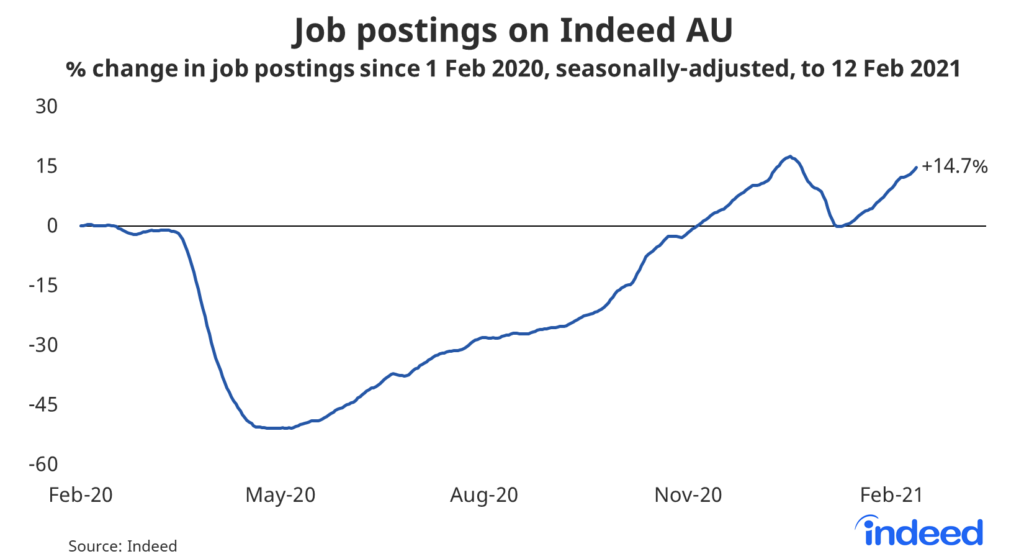

Job postings on Indeed are a real-time measure of labour market activity. On February 13 they were tracking 14.7% ahead of their level on February 1 last year, our pre-pandemic baseline, after adjusting for seasonal trends.

The measure is slightly down on its mid-December high, which was driven by stronger than normal Christmas hiring, but is consistent with the broad improvement in labour market outcomes.

In 2020, job postings plunged from mid-March until late April, falling by half, and then gradually improved over the remainder of the year. Victoria’s lengthy second lockdown slowed the recovery, creating a temporary divergence between Victoria and the rest of Australia. Recent short-term lockdowns in Western Australia and New South Wales do not appear to have impacted hiring noticeably.

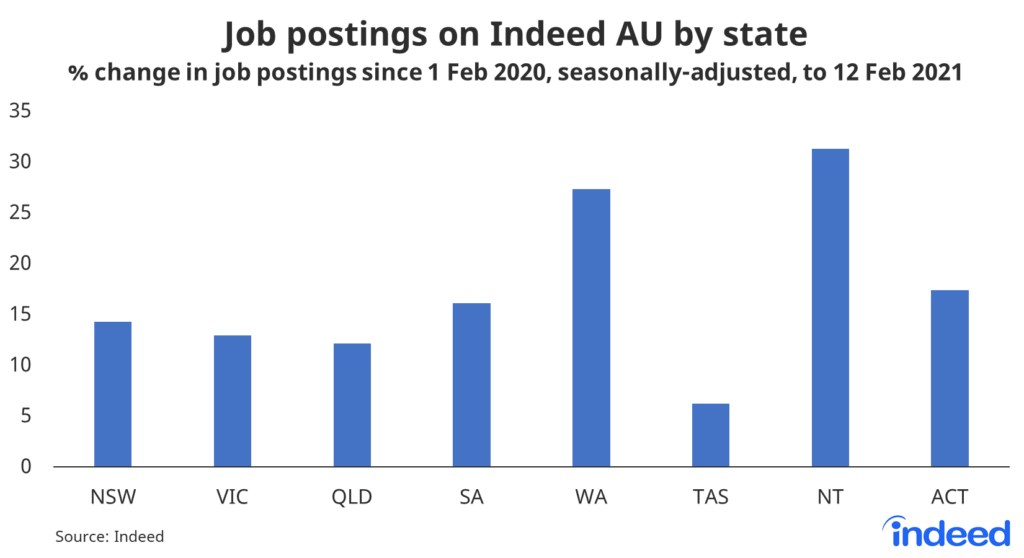

Job postings vary considerably by state. Compared with last year’s baseline, postings are up 27% in Western Australia and 31% in the Northern Territory. Australia’s three most populous states – New South Wales, Victoria and Queensland – are up 14%, 13% and 12%, respectively.

Australia’s hiring recovery is still uneven

While Australia’s hiring recovery has been impressive, outpacing other countries, it is also uneven. Some occupation groups are thriving, while others continue to suffer.

The best performing occupations include cleaning & sanitation, therapy, loading & stocking, personal care and community & social service. All of these occupation groups have gains of 50% or more compared with February 1 last year. We are also seeing strong gains for construction roles, on the back of fiscal support and a sharp rise in building approvals.

Most of the sectors where job postings are down, relative to February 1 last year, are not down considerably. However, there was one key exception.

Job postings for hospitality & tourism roles, a sector targeted repeatedly by lockdowns, is still down 46%. Many restaurants continue to operate below capacity, while travel, both domestic and international, remains greatly diminished.

Australia’s hiring recovery continued during February, with gains solid across all regions and most occupational groups. Some sectors, led by hospitality & tourism, continue to suffer from the impact of COVID-19 but there appears to be a degree of hiring catch-up among other impacted occupations, such as in dental and sports.

Methodology

All figures in this blogpost are the percentage change in seasonally-adjusted job postings since February 1, 2020, using a seven-day trailing average. February 1 last year is our pre-pandemic baseline. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Each series, including the national trend, occupational sectors, and sub-national geographies, is seasonally adjusted separately.

We adopted this new methodology in January 2021 and now use it to report all historical data. Historical numbers have been revised and may differ significantly from originally reported values. The new methodology applies a detrended seasonal adjustment factor to the percentage change in job postings. In contrast, our previous methodology used the 2019 change between February 1 and the reported date as the adjustment factor, which implicitly included both a seasonality component and the underlying trend.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.