Key points:

- Australian job postings are 54% lower than their trend at the same point last year, with the gap widening by the day.

- Job postings for drivers, industrial engineers and nurses are holding up much better than the national average. Hiring activity in childcare, beauty & wellness, sports and hospitality & tourism is tracking well below the national average.

- Australia and New Zealand have experienced a sharper fall in job postings relative to other similar countries.

Australia has few timely measures that help to identify the impact of COVID-19 on labour market conditions. Job postings from Indeed is one of the few, with data updated daily and never more than a few days old.

As this crisis unfolds, we will be updating our data on job postings regularly. So feel free to return for the latest snapshot on Australian hiring.

Australia job postings

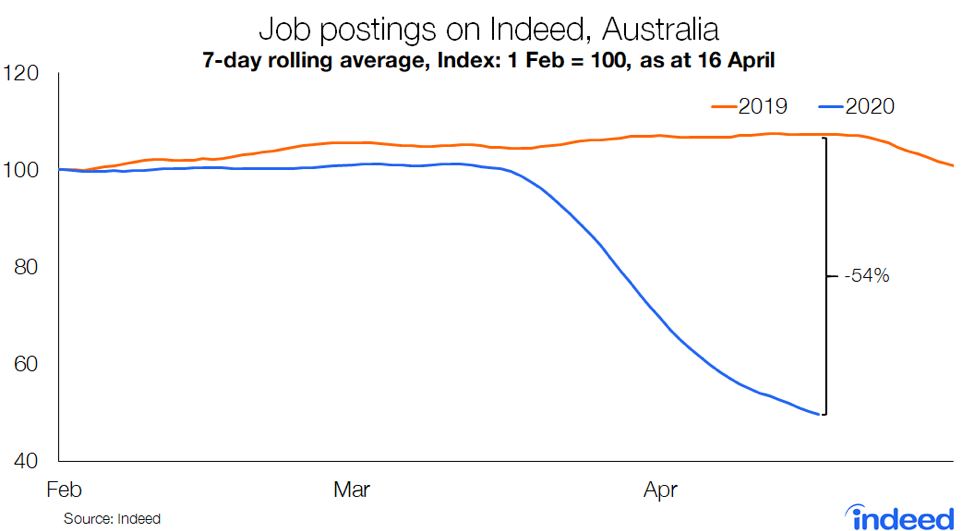

As of 16 April, Australian job postings on Indeed AU were tracking 54% lower than their trend at the same stage last year. Hiring activity has deviated sharply from trend following widespread shutdown of economic activity to contain the spread of COVID-19.

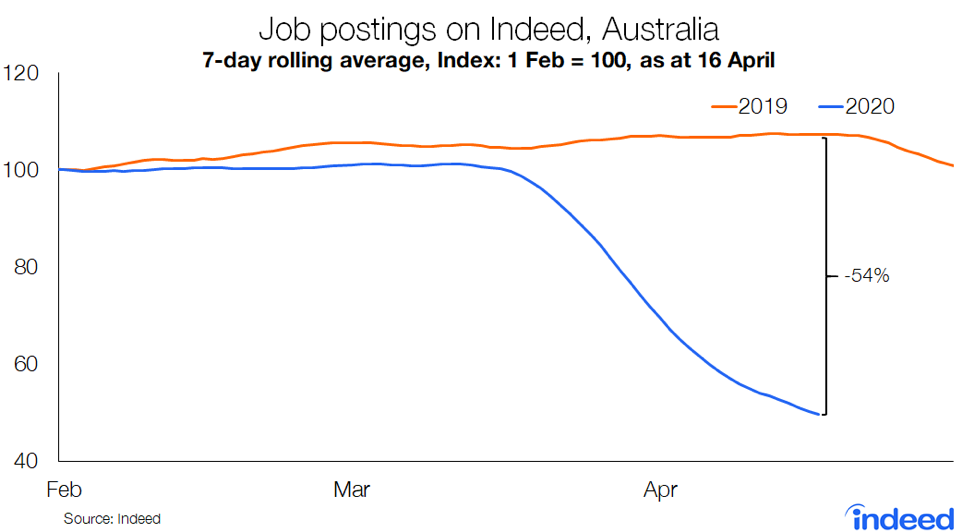

Some sectors are holding up better than others

As the COVID-19 crisis has continued, hiring activity for every sector has declined. Some performed reasonably well early in the crisis, such as nursing and drivers, but job postings have now fallen across the board.

Drivers have become increasingly important to the functioning of the Australian economy, connecting restaurants or shops with customers. Job postings for drivers are tracking 23% below trend.

Industrial engineering roles, nursing, personal care & health and software development are also doing better than the national average. Job postings for these sectors are tracking between 35% and 46% below their trend at the same stage last year.

Sectors such as pharmacy, IT operations & helpdesk, installation & maintenance, information design and retail are tracking in line with the national average. A sector such as retail, which is obviously struggling, has been held up by hiring across major supermarkets.

Larger than average declines are apparent in childcare, beauty & wellness, sports, hospitality & tourism and education. Many of these sectors have been directly impacted by COVID-19 restrictions, with borders closed, sport competitions shutdown and parents pulling children out of school or childcare.

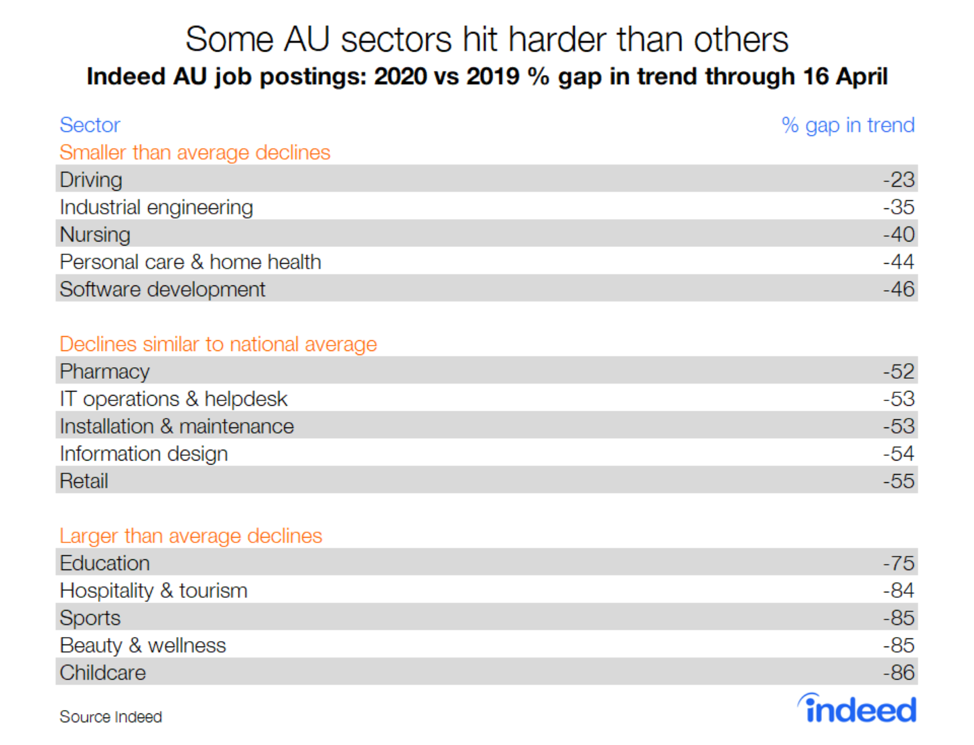

Decline larger in Australia than most other countries

The slowdown in hiring is evident across a range of countries. Australia and New Zealand are experiencing the most severe declines, down 54% and 63%, respectively, against last year’s trend.

Despite having the highest number of cases, job postings in the United States are holding up better than most other markets. In the United Kingdom, not so much. Job postings in Singapore and Germany are holding up well, down just 17% compared with their trend at the same time last year.

Methodology

To measure the trends in job postings, we calculated the 7-day moving average of the number of AU job postings on Indeed. We index each day’s 7-day moving average to 1 Feb for that year (1 Feb, 2020 = 100 for 2020 data, and so on), or another date if specified on the chart.

We report how the trend in job postings this year differs from last year, in order to focus on the recent changes in labour market conditions due to COVID-19. For example: if job postings for a country increased 5% from 1 February, 2019, to 28 March, 2019, but fell 25% from 1 February, 2020, to 28 March, 2020, then the index would have risen from 100 to 105 in 2019 and fallen 100 to 75 in 2020. The year-to-date trend in job postings would therefore be down 29% on 28 March (75 is 29% below 105) in 2020 relative to 2019.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.