Key points:

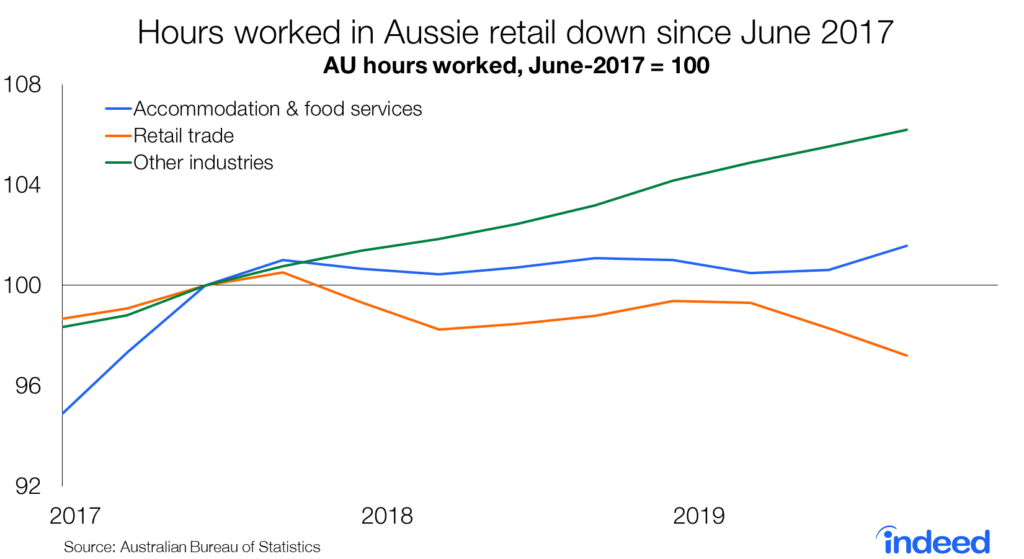

- Hours worked in retail have declined since penalty rates were cut and are unchanged in hospitality, defying broader market trends.

- Job postings featuring phrases such as ‘penalty rates’ have recently picked up following subdued use in 2017-18 and 2018-19 after penalty rates were first cut.

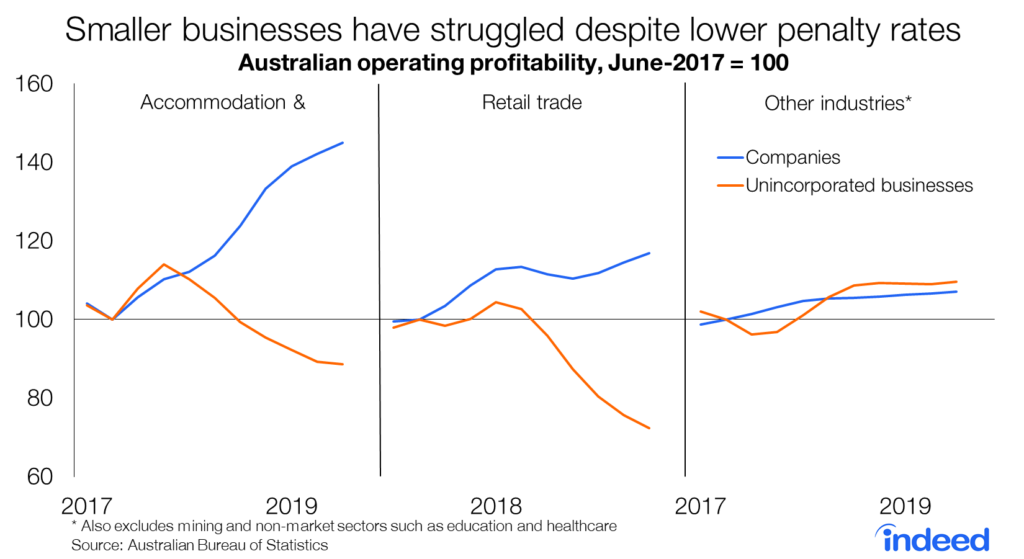

- Cutting penalty rates may have been necessary to save jobs among smaller businesses that have struggled under tough economic conditions, but less so for larger businesses.

In 2017, Australia’s Fair Work Commission (FWC) cut penalty rates paid to retail and hospitality workers for work performed outside normal hours, such as working on Sundays or public holidays. The decision was justified on the basis of job creation — the idea that lower wages would encourage employers to hire more people and stay open longer.

For two years, that promise went unfulfilled. Retail and hospitality underperformed relative to other sectors, suggesting the penalty rate cuts failed to provide the results promised. From a business perspective, these cuts may have been offset by a sizable minimum wage increase. Australia’s economic environment undoubtedly played a role, with difficult conditions apparently weighing on hiring. This was particularly evident among smaller retail and hospitality businesses, whose profitability has tumbled. Larger businesses have been less affected.

In recent months, job creation has picked up and job postings mentioning penalty rates have jumped above their pre-cut levels despite a retail environment and broader economy that have continued to struggle.

What are penalty rates?

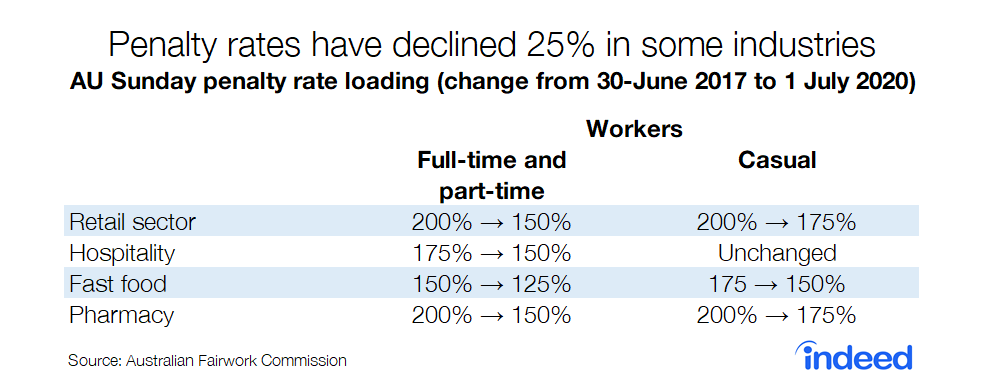

Penalty rates can have a large impact on a worker’s pay packet. Before 1 July 2017, a part-time retail worker normally earning $25 an hour collected $50 an hour on a Sunday thanks to 200% loading, colloquially referred to as ‘double time’. By 1 July 2020, penalty rates for such a worker will be cut to 150%, or ‘time-and-a-half’, reducing Sunday hourly pay 25%. Currently, the penalty rate for this worker is 165%, with the rate falling gradually at the beginning of each financial year since 1 July 2017.

Penalty rates differ by industry and whether employees are full- or part-time, or casual. Casual workers have typically experienced less change than full-time or part-time workers, with awards for casual hospitality workers unchanged. But for most retail and hospitality workers, the drop has been considerable.

Cutting penalty rates hasn’t boosted jobs or hours

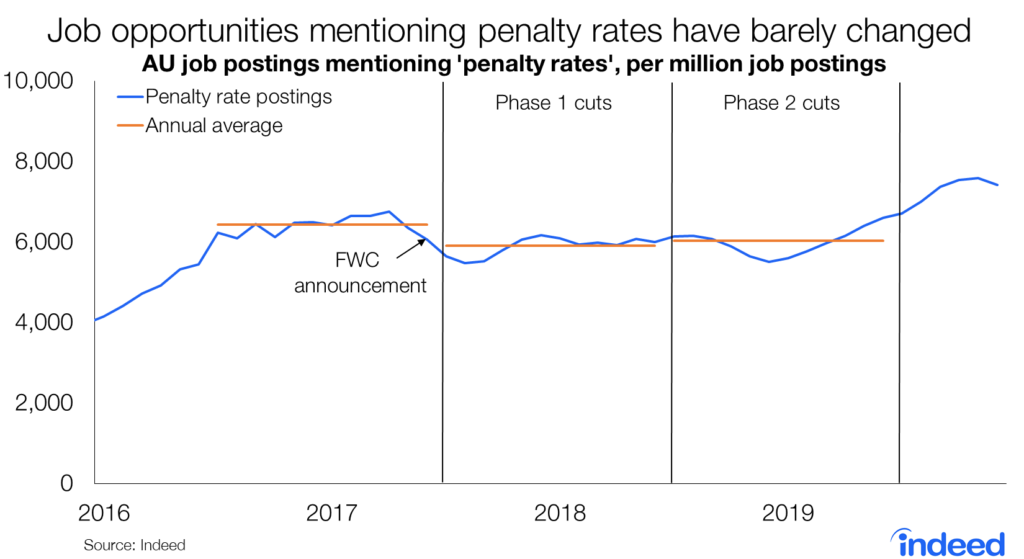

Using Indeed data, we’ve tracked usage of ‘penalty rates’ and related terms in job descriptions across Australia. Since the penalty rate cuts were justified on the basis that they would create jobs in the affected sectors, we would expect job postings to rise. And since penalty rates are generally a desirable perk for job seekers, boosting wages on Sundays and public holidays, the use of the phrase ‘penalty rates’ in job descriptions could be used to attract applicants.

To be clear, there are limitations to this method of tracking penalty rates. Job descriptions are not always well designed. Employers frequently omit important information and some may not be aware of how attractive penalty rates may be to job seekers.

Nevertheless, from the time the cuts went into effect until recently, there has been no evidence of greater usage of the term in job postings. In 2018-19, fewer postings mentioned penalty rates than in 2016-17, before the cuts were introduced. In recent months though, that has started to change. Job postings noting penalty rates were around 15% higher in the December quarter than the 2016-17 average.

Indeed data is broadly consistent with other measures of hiring and business activity in the affected sectors. Retail hours worked have fallen 2.8% since June 2017, while they rose modestly in accommodation and food services. Both sectors are underperformers. Across other industries, hours worked rose 6.2% over the same period. Employment in both industries is up slightly compared with June 2017, but has underperformed the broader economy. That creates a double whammy for many workers — fewer hours per person and reduced penalty rates.

To some degree, the impact of reduced penalty rates has been offset by a big minimum wage increase. The minimum wage rose 3.5% in 2018-19 and a further 3% in 2019-20, well above overall wage growth in both years. Taking into account both the minimum wage hike and reduced penalty rates, just how much workers are better or worse off depends on the share of work they do outside normal hours.

Greed or tough economy?

Australia’s economic situation has complicated the effects of penalty rate cuts. A tough economy, particularly in retail, may have curtailed hiring independently of cuts in penalty rates. One way to explore this possibility is to examine Australian business profitability.

Since penalty rates were introduced, profitability is up for corporations in retail and accommodation and food services, much more than for comparable businesses in other industries.

Yet for larger businesses, the wage bill and corporate earnings have grown at a similar pace. Historically the two tend to move in tandem. Higher profitability of larger businesses has been achieved by cost-cutting in areas other than wages rather than by taking advantage of penalty rate cuts.

The story is much different for unincorporated businesses, such as sole proprietorships and partnerships. Since June 2017, profitability of such businesses is down almost 28% in retail and 11% in accommodation and food services, defying the broader national trend.

Whether assessing employment, income or profitability, smaller retail and hospitality businesses have been in a tough spot. With economic conditions in these businesses the toughest in a quarter-century, penalty rate reductions may have saved jobs.

In recent months, the share of job postings including penalty rates has grown. That’s a welcome development despite the long time it took to get there. It is impossible to separate the impact of changes to penalty rates from the broader economic conditions that have shaped the retail and hospitality sectors in recent years. But given the dire situation faced by small businesses, it is possible that cutting penalty rates saved some jobs even if the reductions didn’t create many new ones.

Methodology

To identify job postings that mention penalty rates, we queried job descriptions that included one or more of the following phrases: ‘penalty rates’, ‘penalties’ and ‘shift allowances’. We tracked the usage of these phrases over time. Penalty rate job postings are presented per one million Australian job postings.