Key points:

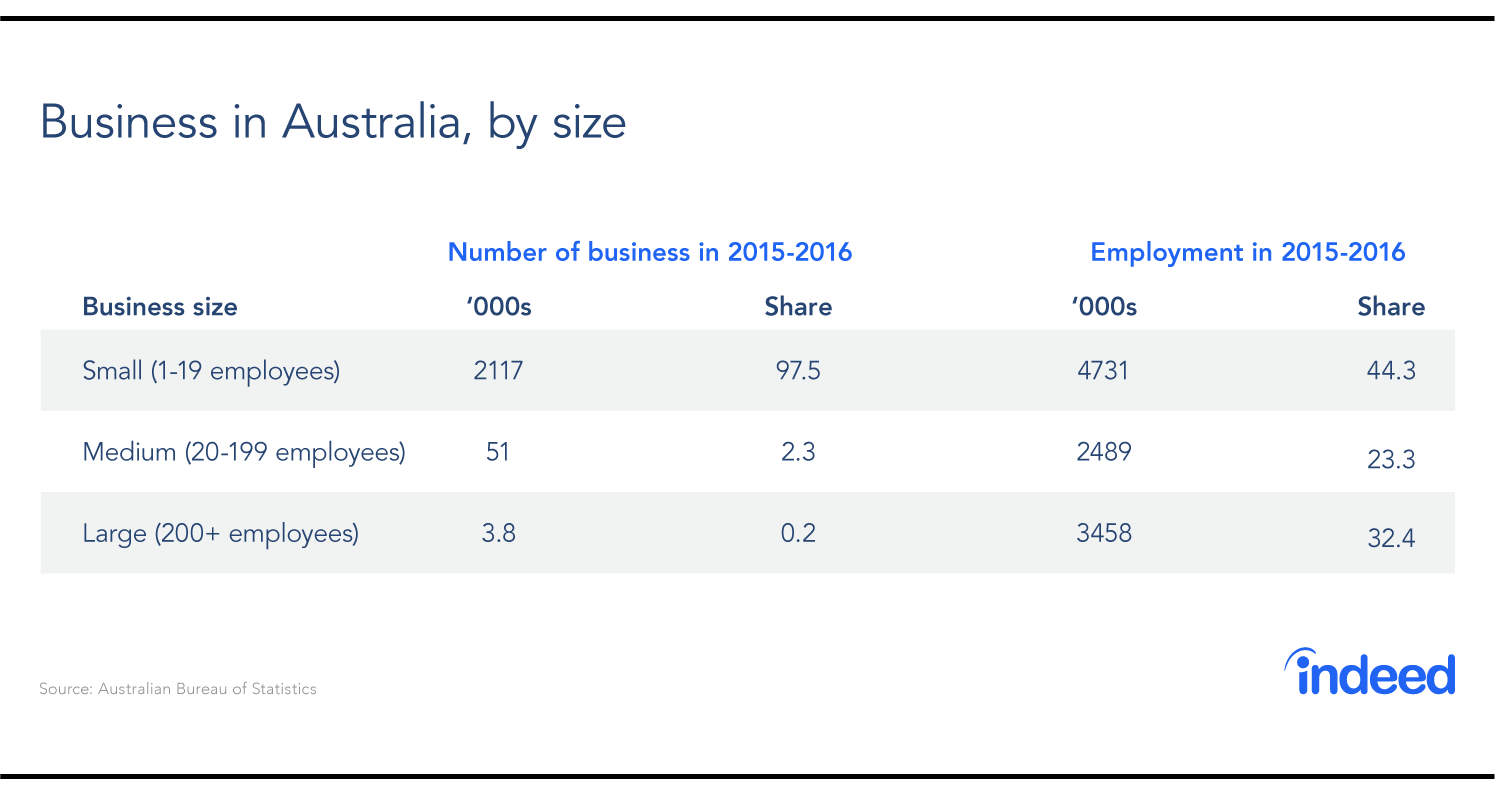

- Australia’s 2.1 million small businesses are important contributors to the economy, creating 4.7 million jobs.

- Small businesses face a number of challenges, including high costs, volatile revenue and financing difficulties, which frequently result in failure.

- The ability of small businesses to expand is low, and every year more of them shrink than grow.

- Small businesses drive innovation by virtue of sheer numbers, but the average small business lags behind bigger enterprises when it comes to adopting new methods.

Australia is home to 2.1 million small businesses, accounting for 97% of all businesses registered in the country. A new small business is created every 100 seconds. Yet, remarkably little is known about small businesses and the environment in which they operate.

What exactly is a small business? Different organisations use different definitions. The Australian Tax Office (ATO) defines small businesses as those with annual revenue under $2 million, while the Australian Bureau of Statistics (ABS) defines them as businesses with fewer than 20 employees. Others, like the Australian Prudential Regulation Authority (APRA), use a combination of definitions based on revenue and loan size.

These definitions cross over—businesses with few employees tend to have low revenue and borrowing capacity. Nevertheless, on occasion, a business fits one criterion, but not others. So when the ATO refers to small business, it could be talking about a different set of businesses than the ABS.

In this analysis, we use the ABS definition of small business based on the number of employees. Here is some of what we discovered:

- Small businesses employ around 4.7 million people—far more than those who work for companies on the ASX 200.

- During the 2015–16 financial year, small businesses accounted for around a third of industry value added across the economy.

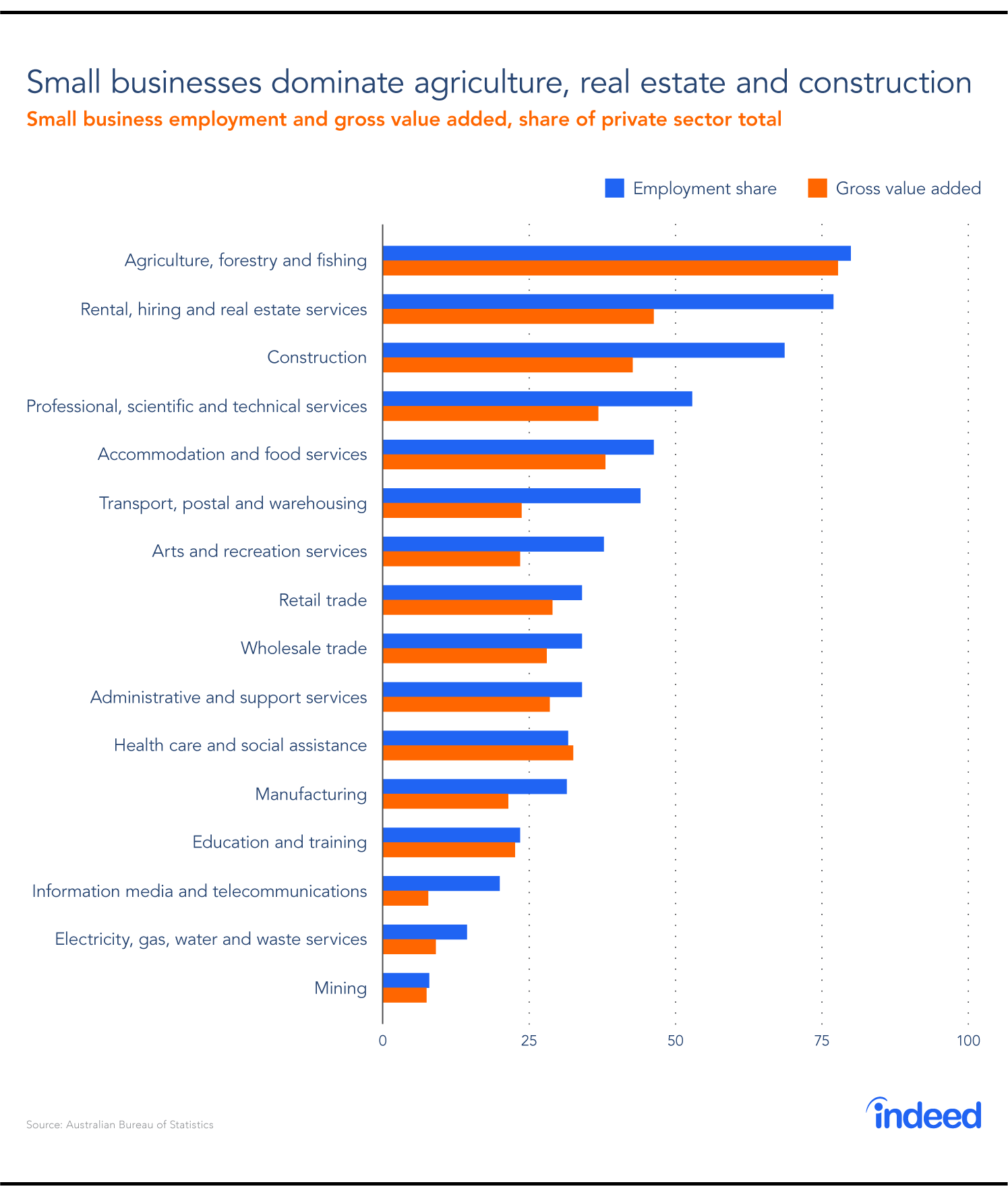

- Small businesses account for more than half of all workers in industries such as agriculture, construction and real estate services.

- Small businesses are more likely than larger businesses to operate in limited areas, providing goods and services that may not be cost effective for bigger businesses.

- Small business owners face a number of challenges, including financing difficulties, higher costs, volatile cash flow and vulnerability to local economic conditions.

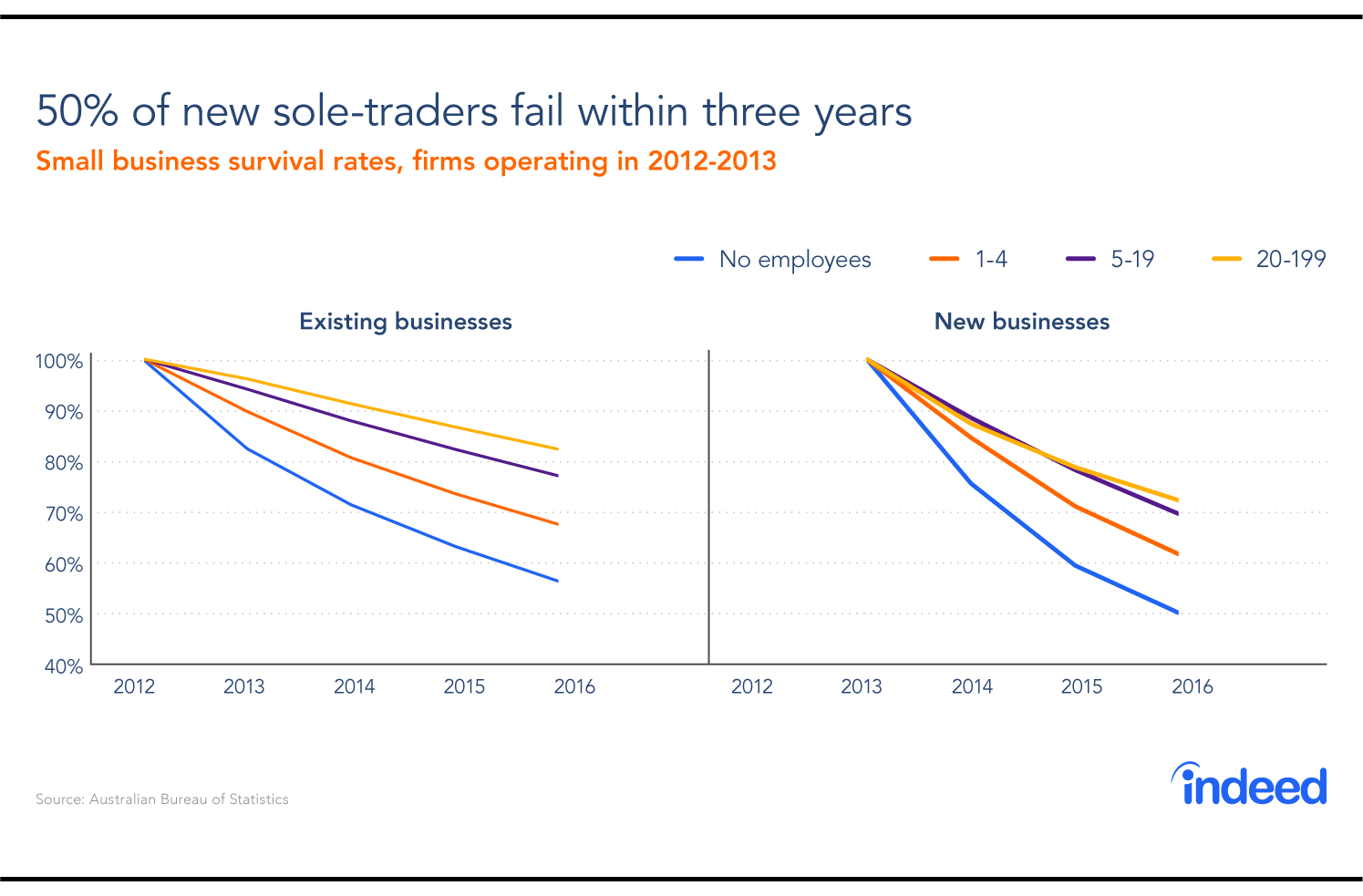

- Half of new one-person businesses and 30–40% of other small businesses fail within their first three years, and even existing small businesses face high probabilities of going under.

Overview of small business in Australia

Dig down into Australia’s 2.1 million small businesses and it turns out that almost two-thirds are one-person operations, while around a quarter employ between one and four people.

All those small businesses add up. The 4.7 million people they employ represent 44% of all those working in the private nonfinancial sector. By comparison, big businesses—those with more than 200 employees—account for around a third of all private nonfinancial employment.

Being your own boss or working for a small business isn’t for everyone. For starters, wages tend to be much lower—around $32,000 a year compared with $58,000 at a medium-sized corporation and $70,000 at a big business. Some small business owners don’t even collect a wage.

Small businesses dominate agriculture, real estate and construction. They also have a big presence in professional, scientific and technical services; hospitality; and retail trade, as demonstrated by the abundance of shops and restaurants in shopping centres and along busy streets. As a general rule, small businesses tend to be most prominent in labour-intensive industries that require relatively little capital to get off the ground. That’s why you don’t find many small businesses in the mining or utilities sectors.

Survival and expansion

Succeeding as a small business owner is tough and there is no shortage of pitfalls on the way to success. Around half of all new one-person businesses fail in their first three years, compared with around a quarter of medium-sized corporations. And that threat never goes away: 43% of one-person businesses that existed in 2011–12 were gone by 2015–16.

The graph below compares survival rates for existing and new small businesses. Although there is a relationship between business size and probability of survival, new businesses face an uphill battle regardless of how big they are.

In general, small businesses are more susceptible to fluctuations in the business cycle and show greater volatility in revenue and profitability. Small businesses tend to operate in a narrow geographical region, which forces them to rely on a small customer base and makes them vulnerable to local economic conditions.

The competition between small and large businesses is a David-and-Goliath battle in which Goliath has the advantage. Smaller enterprises are hampered because they have higher fixed costs and can’t take advantage of economies of scale. Fixed costs, including regulatory compliance and hiring expenses, can be a real burden for some enterprises. And, because of their limited capacity to buy in bulk, small businesses are less likely to receive favourable deals from suppliers.

Finally, obtaining financing and managing cash flow can be huge obstacles. Getting a loan from a bank can be costly—the interest rate spread on loans for small and large business is 2.15 percentage points. And delays in receiving payment from customers can lead to unpredictable cash flow and angry creditors.

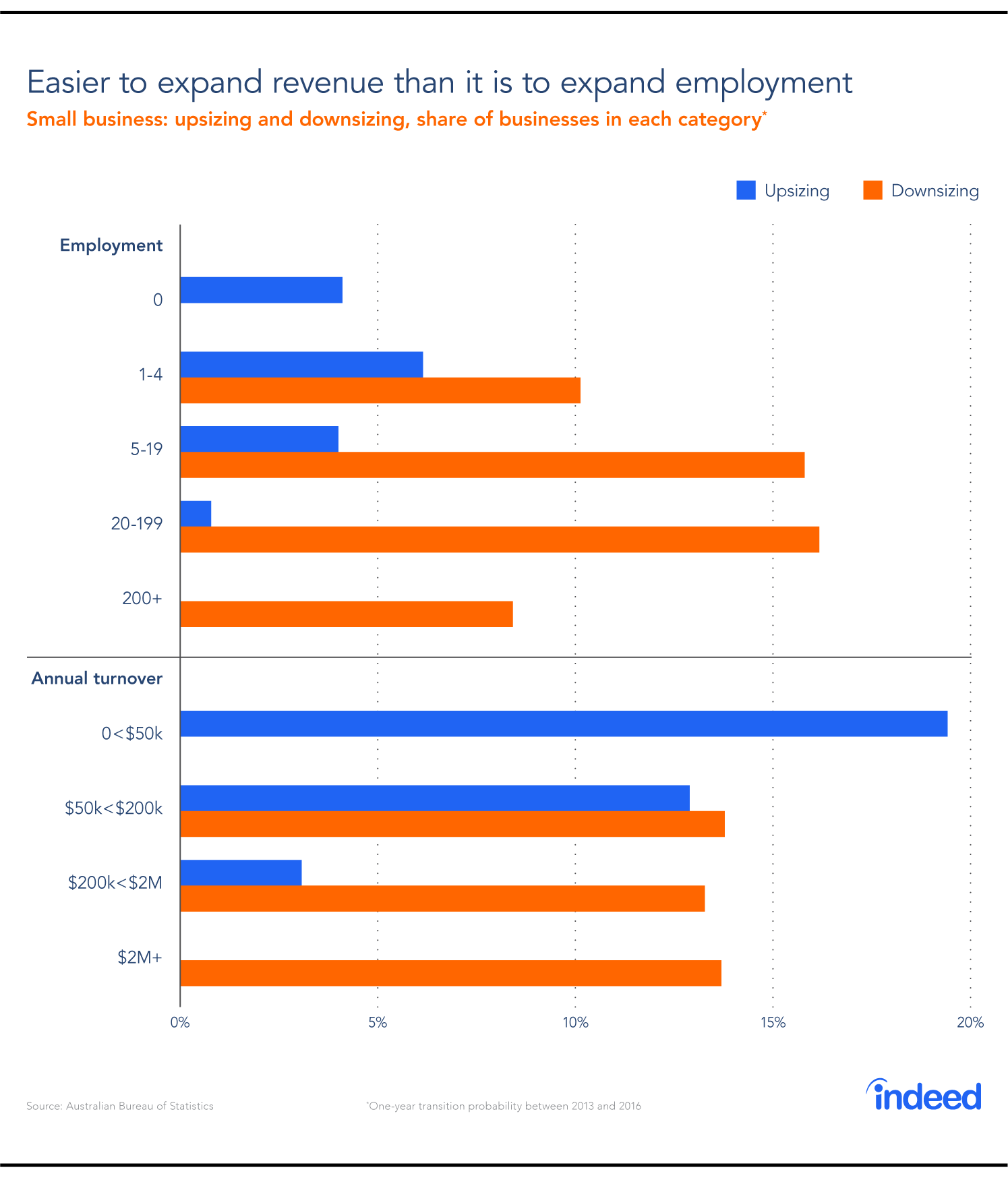

These hurdles represent a survival threat for smaller businesses—a small business fails in Australia every two minutes. Moreover, they are a barrier to expansion. Corporate mobility—the probability of a small business becoming a medium or large business—is relatively low. Smaller businesses typically are reluctant to take on more staff. In fact, they are more likely to shrink than expand payrolls, even as their turnover rises. To be sure, this may be because many sole traders won’t hire regardless of how well their business does.

Innovation

Small businesses account for 96% of enterprises actively innovating in the sale of goods or services, very close to their 97% share of registered Australian businesses. Nevertheless, there is an important distinction between small businesses in general and startups. The latter are often portrayed as the engine of innovation and disruptive ideas. However, survey data show that most small businesses are not startups and are not seeking to shake up their market segment.

Only 20% of small businesses innovated in methods of selling goods or services in the 2015–16 financial year compared with 30% of medium and large corporations. Small businesses are also less likely to innovate in operational or managerial processes. And they trail bigger businesses in developing business websites or social media presence.

Of course, innovation may not be necessary for many small businesses. But the data reveal a harsh truth: Innovation is not a priority for most Australian businesses. Australia ranked 23rd globally in the United Nations 2017 Global Innovation Index—behind the United States (4th), United Kingdom (5th) and Canada (18th)—and our ranking fell from 17th place two years ago.

We may have a healthy small business sector, providing employment for millions of Australians, but our approach to startups needs work.