Key points:

- Singapore job postings fell further in October, continuing a three-year downward trend.

- Postings for retail, hospitality & tourism and physicians & surgeons rose the most over the past three months.

- Remote job postings are more common in Singapore than a year ago, led by gains in marketing, medical information and legal.

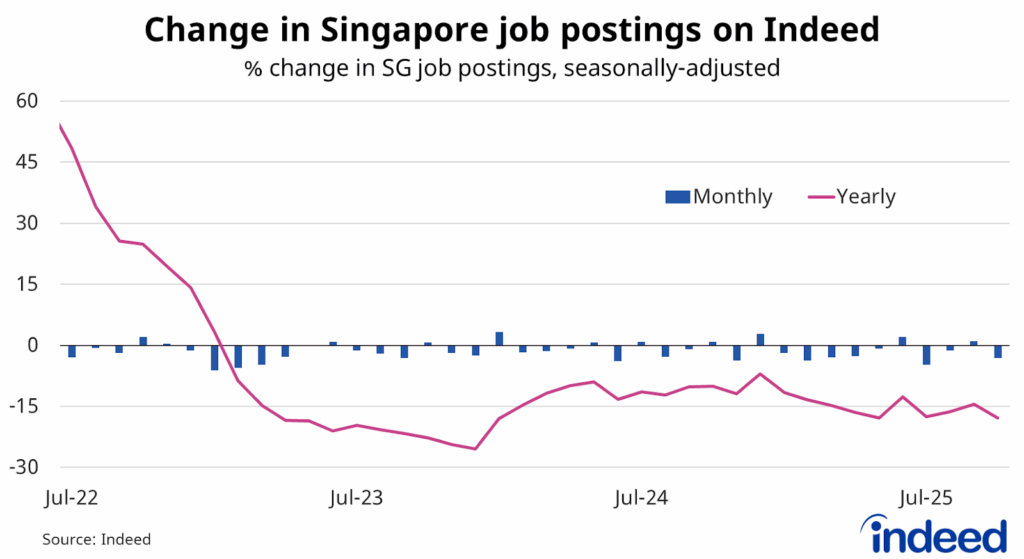

In October, Singapore job postings fell 3.1% – the eighth monthly decline this year – to be 17.9% lower than a year ago. Singapore job postings have been on a downward trend over the past three years.

Despite this, Singapore’s job market remains incredibly tight. The post-pandemic job boom in Singapore was so large that even though job postings have fallen for the past three years, it’s still sufficiently high to keep the unemployment rate low. At the end of October, job postings were still 32% above pre-pandemic levels.

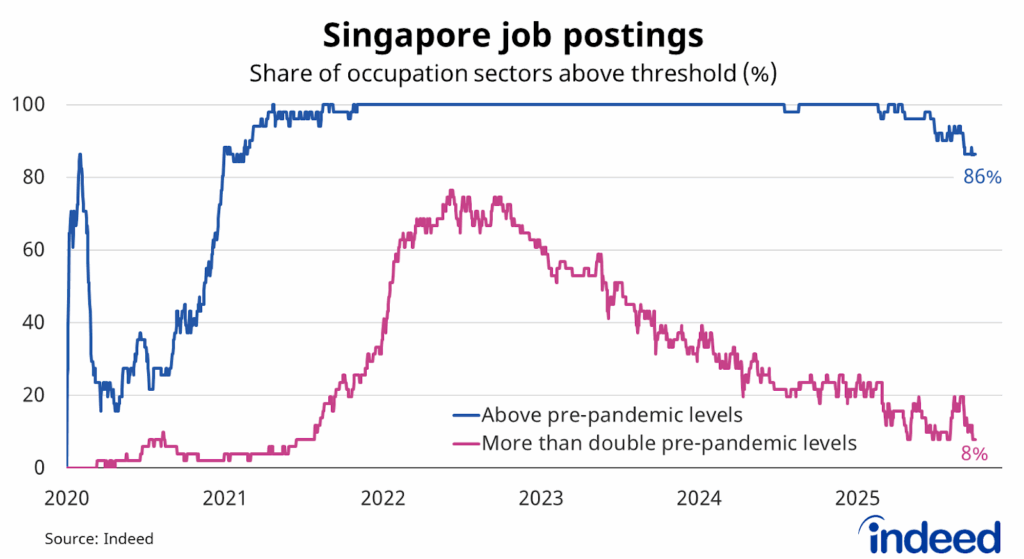

Job postings in 86% of occupations are above their pre-pandemic baseline from 1 February 2020, with 8% more than double pre-pandemic levels. Both figures have declined over the past month and are now near post-pandemic lows.

Demand is highest in pharmacy (+181% compared to pre-pandemic levels), sport (+122%) and hospitality & tourism (+119%), where postings are more than double pre-pandemic levels. Veterinary (+98%), education & training (+94%) and physicians & surgeons (+93%) are also strong performers. By comparison, job postings are below pre-pandemic levels in driving (-27%), childcare (-26%), arts & entertainment (-9.0%) and beauty & wellness (-8.2%).

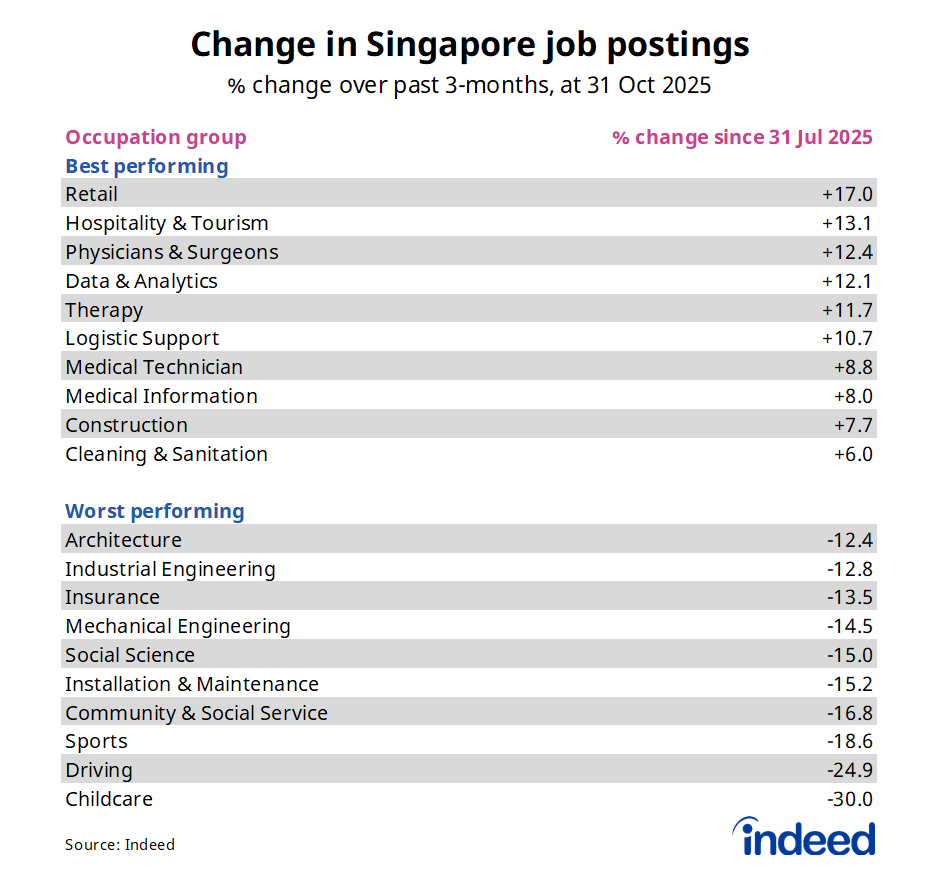

Posting growth mixed across occupations

Job postings rose in around one-third of occupational categories over the past three months, led by gains in retail (+17%) and hospitality & tourism (+13.1%). Healthcare has been a stronger performer recently, with postings for physicians & surgeons (+12.4%), therapy (+11.7%), medical technician (+8.8%) and medical information (+8.0%) all climbing in recent months.

Offsetting those gains, however, were large declines in childcare (-30.0%), driving (-24.9%), sports (-18.6%), community & social service (-16.8%), installation & maintenance and (-15.2%) insurance (-17.6%).

Singapore’s latest remote work trends

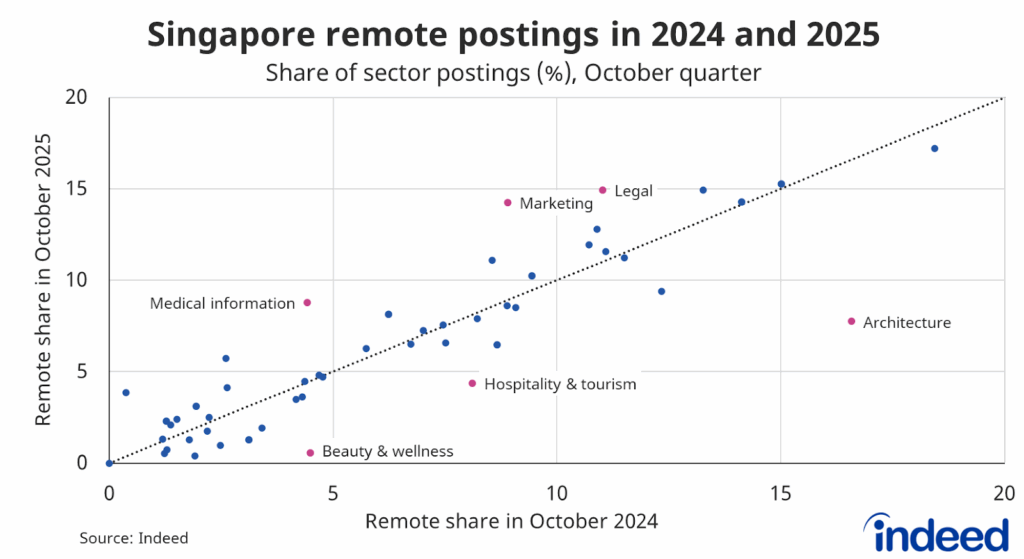

In October, 8.2% of Singapore job postings explicitly mentioned phrases such as ‘work from home’ or ‘work remotely’ in their job descriptions. That’s up from 7.7% a year ago.

Remote opportunities are most common in IT infrastructure, operations & support at 17.2% of postings in the October quarter 2025, ahead of insurance (15.3%) and sales (14.9%). However, they are typically quite low in most occupations, with the share below 5% in around half of occupational categories.

The remote share can also vary considerably from year to year. Over the past year, the share has increased the most in marketing (+5.3 percentage points), medical information (+4.4 percentage points) and legal (+3.9 percentage points). By comparison, large declines were observed for architecture (-8.8 percentage points), beauty & wellness (-3.9 percentage points) and hospitality & tourism (-3.8 percentage points).

Changes in remote share can reflect changing attitudes among employers, particularly regarding work-from-the-office mandates. It may also reflect employers’ attempts to attract more candidates.

Conclusion

Singapore job postings fell further in October and we expect this downward trend to continue in the near term. There are no signs yet that job posting volumes will stabilise. Despite this, the Singapore labour market remains tight, with the unemployment rate low at 2.0% and skill shortages still common.