Key points:

- Job gains were surprisingly strong, with employers adding 336,000 new jobs in September.

- The unemployment rate held steady at 3.8% with labor force participation moving sideways as well.

- The labor market remains strong, but unlike the pedal-to-the-metal days of 2021 and 2022, today’s strength feels much more sustainable.

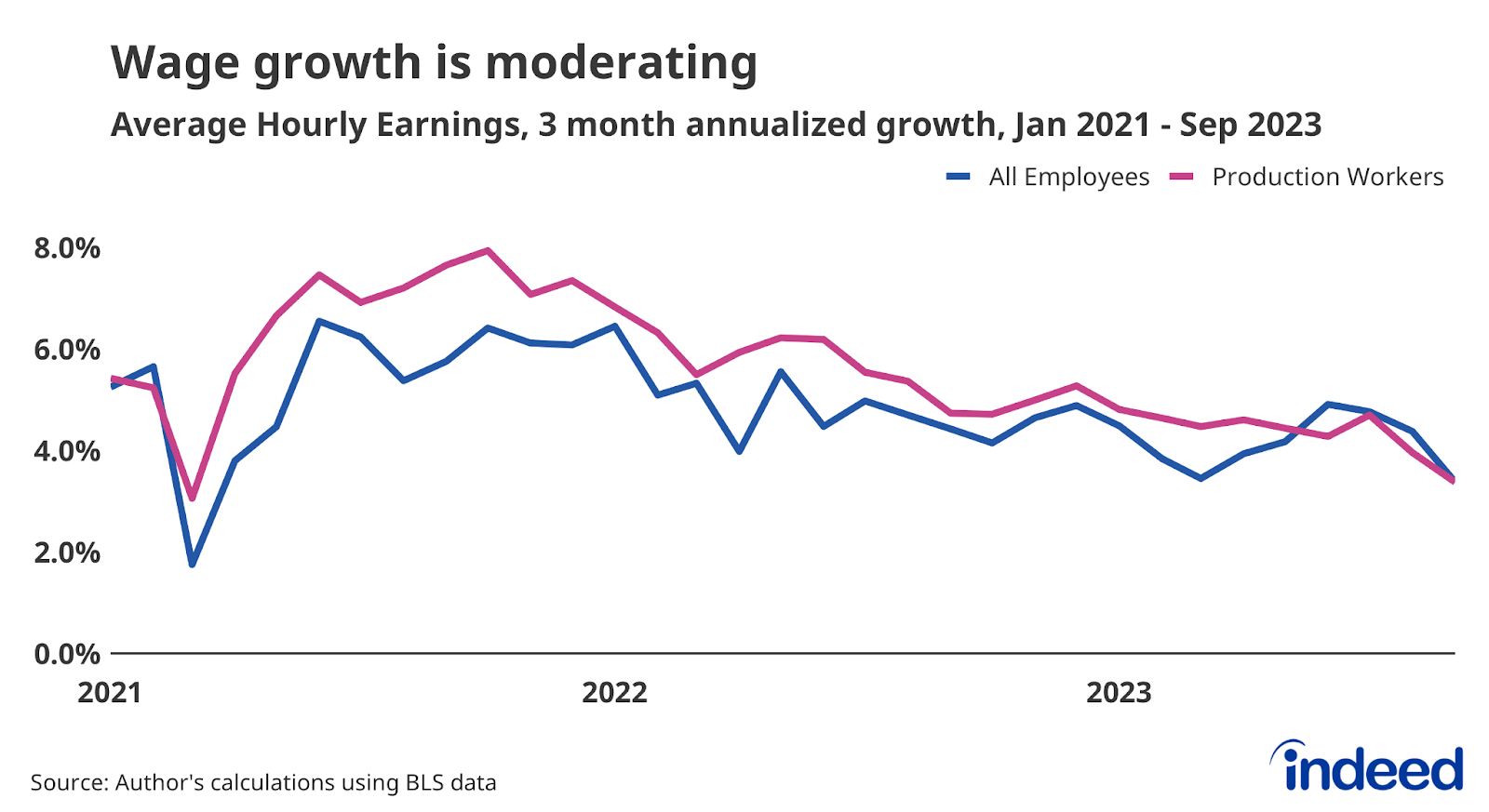

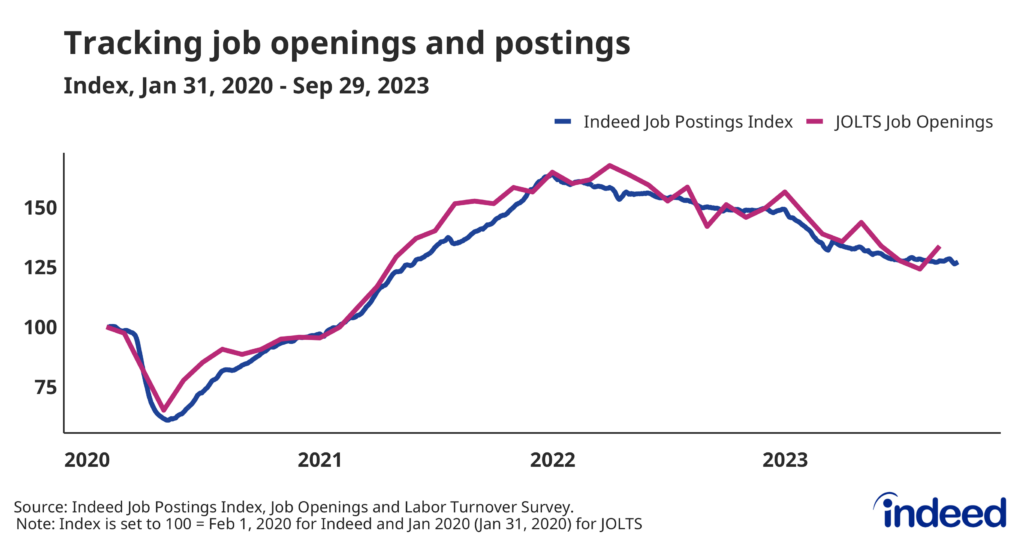

The US labor market clearly still has some gas in the tank. In fact, over the past three months, it’s been cruising at a pace more than twice the rate needed to keep up with population growth. But unlike the pedal-to-the-metal days of 2021 and 2022, today’s strength feels much more sustainable. The labor force participation rate for prime-age workers is high by recent standards but remains below its 1999 peak. Wage growth continues to moderate and is quickly approaching pre-pandemic rates. Despite numbers today that are reminiscent of the immediate post-pandemic boom days, the frenetic days of the past few years are behind us and the path toward a more balanced market is widening.

The continued slowdown in wage growth is the key trend in this report. If job gains continued to be so strong without wages slowing, that would be a problem for the Federal Reserve. But the deceleration of wages, even as demand for workers stays high, points toward a reserve of labor supply willing to be tapped. The recent wage data should reduce concerns about wage growth defying gravity; on a 3-month annualized basis, wages are growing at a 3.4% rate, which is near what we saw in 2019.

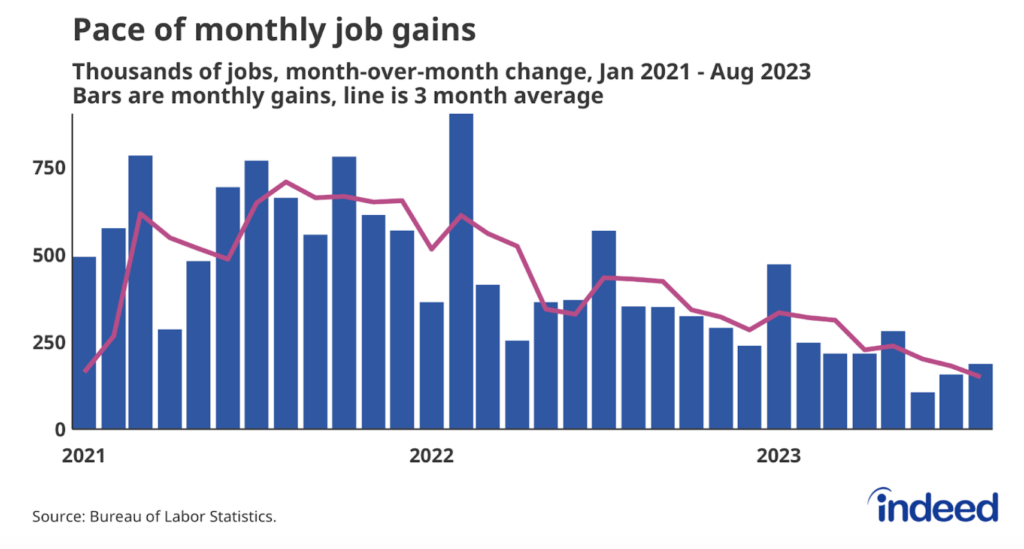

After a stretch of slowing job growth, payroll gains surprised to the upside in September. Not only did employers add more jobs than expected last month, but the past two months of data were revised up. Employers have added an average of 266,000 jobs per month over the past three months, similar to what we saw back in the spring. Another encouraging sign was the breadth of the hiring, with the diffusion index rising to 64.2 in September, similar to readings this spring.

Job gains of these magnitudes are large enough to pull more workers into the labor force. While both the overall labor force participation rate and the rate for prime-age workers were flat in September, continued strong demand should entice more people into finding a job. The prime-age labor force participation rate is still 1.1 percentage points below its 1999 peak, while the high job-finding rate among unemployed workers also indicates increased participation in the future.

On its face, the strong payroll gains in September might spook some people into thinking the current labor market strength is untenable. Some people have adopted the slogan “good news is bad news” as continued strength might provoke the Federal Reserve to hike rates further and/or keep them elevated for longer. But step back and look at the underlying trends. Hiring has moderated from recent highs, and there’s capacity to pull more workers into the labor force while wage growth is moderating.

This is good news. Take it as such.